Table of Contents

Energy Vault Holdings, Inc. has announced the acquisition of SOSA Energy Center, a 150 MW/300 MWh battery energy storage system located in Madison County, Texas. The project was initially developed by Savion, a subsidiary of Shell plc, and represents the first energy storage asset formally acquired under Energy Vault's recently launched Asset Vault energy asset management platform.

The battery energy storage system is positioned within the ERCOT North market and is expected to receive Notice to Proceed in Q4 2025, with commercial operation expected in Q1 2027. Energy Vault will provide a safe harbor for the asset, with construction beginning on-site in Q4 2025. Upon completion, the project will deliver critical grid support and renewable integration capacity to Texas's energy landscape.

Financial Projections and Revenue Structure

The SOSA project is expected to deliver USD 17-20 million in annual revenue over the technical life of the project, totaling approximately USD 350 million or more, with predictable, recurring, high-margin cash streams. Energy Vault is in advanced negotiations with a counterparty for an 8-year offtake agreement, with the offtake structure expected to be underwritten by an investment-grade counterparty.

The acquisition will be supported by the recently announced USD 300 million preferred equity investment from Orion Infrastructure Capital, as well as the monetization of Federal Investment Tax Credit-related funds. The offtake structure is expected to deliver bankable, frontloaded revenue streams, enhancing returns and de-risking project cash flows.

Asset Vault Platform Expansion

The SOSA acquisition brings Asset Vault's total MWs acquired and in operation to approximately 340 MW globally between US- and Australia-based projects, with a funnel of 3.5 GW in active development. Asset Vault is a fully consolidated subsidiary of Energy Vault, dedicated to developing, building, owning, and operating energy storage assets globally.

Current US projects managed under the Asset Vault platform include the 57 MW/114 MWh Cross Trails BESS and the 8.5 MW/293 MWh Calistoga Resiliency Center, a hybrid energy storage system combining clean hydrogen with battery cells. Also managed under the Asset Vault platform is the recently-acquired 125 MW/1.0 GWh Stoney Creek BESS, located in New South Wales, Australia.

40+ reviews

Find the Latest Battery Energy Storage System (BESS) Projects in United States

Gain exclusive access to our industry-leading database of Battery Energy Storage System opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

Technology and Project Development

The BESS will leverage Energy Vault's third-generation B-VAULT AC product, enabling Energy Vault to deliver the system quickly and at low cost while providing higher levels of system availability in the ERCOT region. The company's global B-VAULT portfolio now exceeds 2 GWh of deployed or contracted systems spanning Europe, North America, and Asia, and is complemented by Energy Vault's gravity and hydrogen-based storage platforms for multi-duration energy applications.

The SOSA project benefits from fully secured site control, clean title, and completed environmental and interconnection milestones, ensuring a streamlined path to construction. Asset Vault creates a vertically integrated ecosystem that captures value across the entire energy storage lifecycle, combining Energy Vault's proven operational expertise with long-term asset ownership to generate predictable, recurring cash flows.

Executive Commentary and Strategic Vision

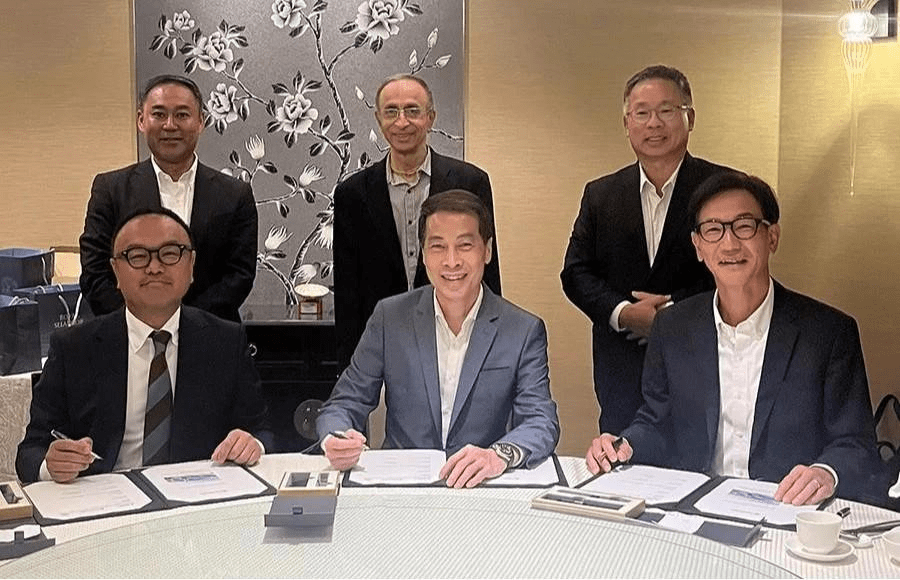

Robert Piconi, Chairman and Chief Executive Officer of Energy Vault, stated that the SOSA BESS is a substantial addition to Energy Vault's growing global portfolio of energy storage deployments, with top-quartile project performance attributes consistent with all projects acquired and developed under the Asset Vault platform. He emphasized that this project acquisition demonstrates the company's commitment to execution speed, rapidly deploying capital to build high-return, bankable energy infrastructure at scale.

Chris Leary, Head of Infra Equity at Orion Infrastructure Capital, described SOSA as representing the caliber of bankable, cash-flow generating assets that Asset Vault was designed to capture. He noted that Energy Vault's proven ability to execute on projects with strong fundamentals and long-term revenue visibility reinforces OIC's commitment to supporting its growth as it builds a portfolio of owned and operated energy storage assets that deliver predictable returns.

Under Asset Vault, Energy Vault self-performs engineering, procurement, and construction, and enters into long-term service agreements for projects, creating multiple cash flow streams while maintaining the flexibility to optimize returns through strategic capital deployment.

The company develops, deploys, and operates utility-scale energy storage solutions designed to transform the world's approach to sustainable energy storage, with comprehensive offerings including proprietary battery, gravity, and green hydrogen energy storage technologies.

Also Read: Austin Energy Signs $288 Million Battery Storage Deal with Jupiter Power for 100-Megawatt Facility

Connect with Decision-makers about the Latest Battery Energy Storage System (BESS) Projects in United States for business Opportunities.

Subscribe to our database on BESS Projects and Tenders in US to get access to reliable and high-quality insights on upcoming, under-construction, and completed BESS Projects across the world or in your desired geographical location.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.