Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 245

About this Report

The global wind turbine market is witnessing continued growth. This growth is majorly driven by factors such as increasing wind power projects, supportive legislation and regulatory frameworks aimed at achieving emission reduction targets and enhancing energy security, and a surge in investments in global offshore wind energy.

Nevertheless, the protracted permitting process, issues associated with land use and land rights, environmental concerns, and limitations in grid infrastructure are some of the major constraints for global wind turbine market growth.

Global Wind Energy Scenario

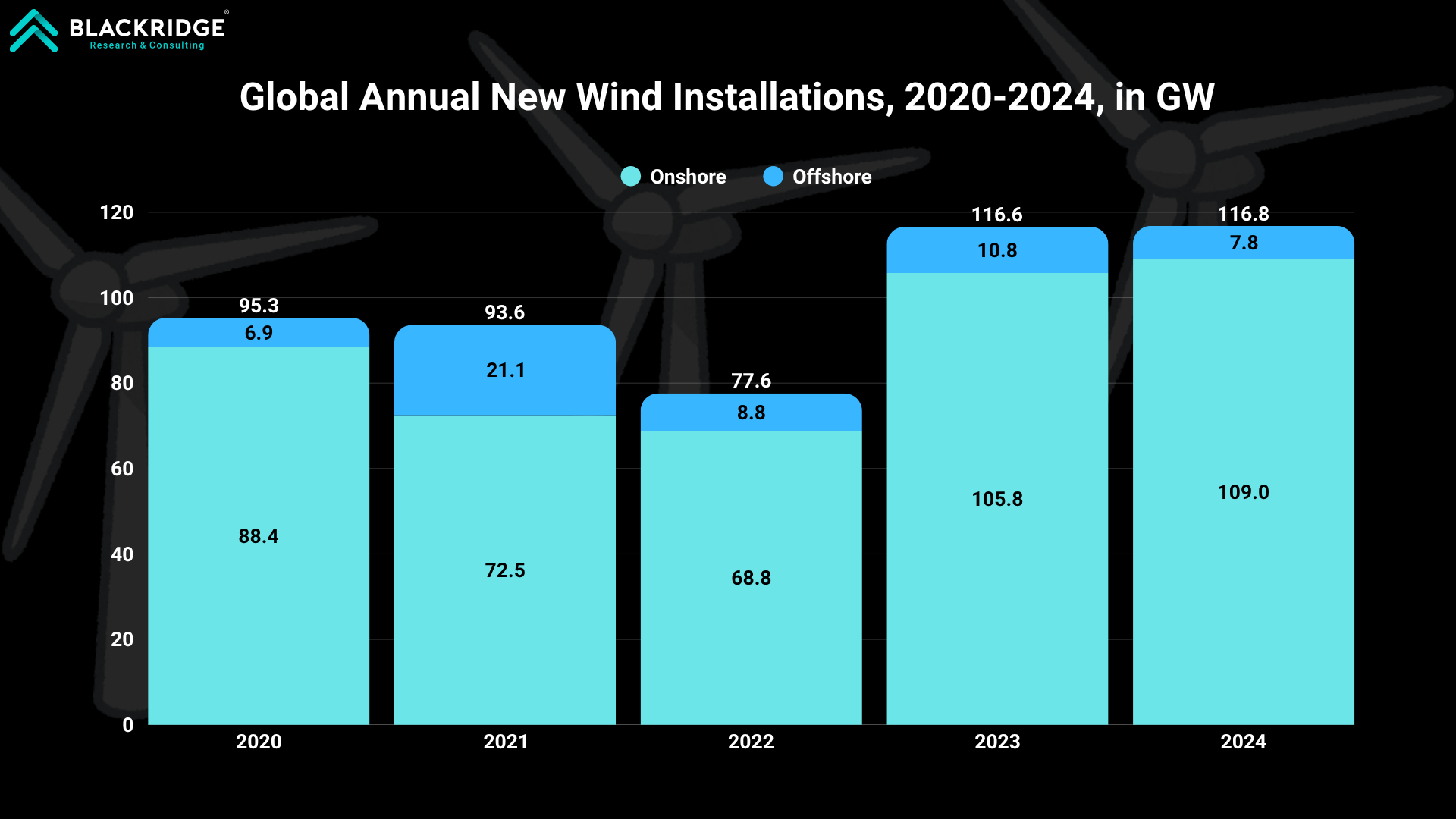

In 2024, the global wind power industry experienced another record year, with 117 GW of new wind energy capacity installed worldwide, bringing the total global cumulative capacity to 1,136 GW. This marked an 11% increase in total installed capacity compared to the previous year. Wind energy accounted for 20% of all expansion in the power sector in 2024, with renewables making up 90% of this growth.

Global Wind Turbine Market Scenario in 2024

In 2024, a total of 23,098 wind turbines were installed worldwide by 29 different manufacturers, comprising 18 from Asia-Pacific, 8 from Europe, 2 from the Americas, and 1 from the Middle East.

The global wind turbine manufacturing market saw record growth in 2024, largely due to a surge in installations in mainland China. Chinese manufacturers are increasingly dominant, holding six of the top ten spots globally and the top four positions for the first time since 2013, led by Goldwind, Envision, Windey, and Mingyang.

However, Chinese manufacturers' success is heavily reliant on their domestic market, which accounted for 70% of global installations. In contrast, European and US suppliers have a more diverse customer base internationally.

European wind turbine manufacturers—such as Vestas, Siemens Gamesa, and Nordex—continue to hold a significant share of the global wind market. While they dominate the European landscape, these companies have also established a significant presence in the United States and maintain a competitive foothold in several international markets. Notably, Vestas alone captured nearly one-third of the global wind turbine market share outside China in 2024, highlighting its strong global competitiveness.

Drivers

Supportive policies by governments around the world continue to be the main driver of global wind turbine installations. A wide range of policy mechanisms is propelling capacity growth, comprising auctions, feed-in tariffs (FiT), contracts for difference (CfD), and renewable energy portfolio standards (RPS).

Some nations have passed legislation to streamline permitting processes, which have been a major factor slowing down wind power additions. For instance, Germany's legal recognition of wind energy as being of "overriding public interest" under the Renewable Energy Sources Act (EEG) has streamlined permitting and reduced legal and administrative hurdles, accelerating project advancement.

In December 2024, the British government proposed to reintroduce large onshore wind projects under the Nationally Significant Infrastructure Project (NSIP) framework in England. This change would permit the state to make the final decision on approving any onshore or offshore wind farm projects that would exceed 100 MW, thus making the entire process more efficient and faster and probably the construction of onshore wind energy sites.

The Philippines has introduced the Energy Virtual One-Stop Shop (EVOSS) to expedite regulatory approvals and a Memorandum of Agreement (MoA) between the Department of Environment and Natural Resources (DENR) and the Department of Energy (DOE) to streamline offshore wind permitting, particularly seabed and foreshore leases.

South Korea's Offshore Wind Power Promotion Act (OSS Bill), passed in February 2025, aims to streamline complex permitting by introducing a centralized approach for site designation and exclusivity.

Stable off-take agreements like Power Purchase Agreements (PPAs) and Contracts for Difference (CfDs) are crucial for de-risking investments and ensuring predictable revenue streams for developers.

The UK's Contracts for Difference (CfD) scheme has secured significant new renewable energy capacity, including floating offshore wind.

India is pushing for 10 GW of annual onshore wind auctions from 2023 to 2027 and has policies supporting procurement. India has also approved a Viability Gap Funding (VGF) scheme of INR 7,453 crore (USD 893 million) for offshore projects and port upgrades to ensure financial viability and attract private investment.

Furthermore, there has been a significant demand for wind energy solutions from countries like Germany, the U.S., and Canada, as well as France. This development has in turn spurred unprecedented demand, resulting in a backlog of orders that the sector is currently experiencing.

The global wind turbine order intake reached new industry highs with 91.2 gigawatts (GW) of activity, a 23 percent increase year-over-year (YOY), and the investment by developers globally totaled USD 42 billion in H1 2024; this emphasizes the future prospects of this industry.

Regional Analysis

Asia-Pacific

The Asia-Pacific region is currently dominating the global wind turbine market, primarily due to China. Following the establishment of a local wind supply chain between 2008 and 2010, China has not only risen to prominence as the world's leading wind turbine manufacturing hub but has also become the largest production center for critical components and raw materials in the wind energy industry.

In 2024, China surpassed the 500,000 MW milestone, reaching a total installed wind power capacity of more than 520 gigawatts (GW) by year-end. The country added 80 GW of new wind capacity in 2024 marking another year of strong growth.

With a developed supply chain and supportive government policies such as the 14th Five-Year Plan for Renewable Energy, which featured ambitious plans towards the use of renewable sources, has pushed wind energy deployment in China to an unparalleled level.

Furthermore, China accounted for 72% of the global new wind turbine market in 2024, a steady rise from 65% in 2023 and 58% in 2022.

The China wind turbine market is currently dominated by key players such as Goldwind, Envision, Windey, MingYang, and SANY which together hold a market share of more than 50%. These companies also secured their positions in the top 15 wind turbine manufacturers, driven by their efforts to connect increasing wind energy capacity.

Europe

In 2024, Europe commissioned 16.4 GW of new wind power capacity, with 12.9 GW coming from the EU-27 countries. While wind power additions across the continent declined by 10% year-over-year (YoY), and Europe’s share in the global wind market fell by 2%, the region continues to hold its position as the second-largest wind power market globally.

Europe has the second largest wind turbine manufacturing capacity in the world after China. It includes Norway, the UK, Germany, France, Spain, and Denmark as major nations having a significant manufacturing capacity in Europe. The region is taking initiatives to strengthen domestic manufacturing and counter China’s domination. For instance, the Wind Power Package introduced in October 2023, includes 15 actions to be urgently undertaken by the key public and private actors involved in the Europe wind power industry.

Segment Analysis

Onshore

The Onshore wind turbines segment has been spearheading the growth of additional wind power capacity. These are gradually preferred as they are built on land that is more readily available, mostly in rural or remote areas. They are generally smaller and less expensive to install than their offshore counterparts.

In comparison to offshore deployment, a bigger margin of standardization of onshore wind turbines includes cheaper installation and lower subsequent upkeep, as well as better connectivity to infrastructure. In 2024, the global onshore wind segment registered installations of 109 gigawatts (GW), contributing to a cumulative capacity surpassing 1 terawatt (TW) with a year-on-year growth of 11%.

Offshore

Offshore wind turbine technology is expanding, though at a slower pace relative to onshore wind. In 2024, 8 GW of new offshore capacity was added, bringing the global offshore wind capacity to 83.2 GW, reflecting significant progress. It is foreseen to increase in the years to come as more countries are in the stage of constructing or planning their first offshore wind farms.

Offshore wind turbines are installed in water bodies, shallow sea borders, or further into the sea. This type of turbine is typically larger than their land-based models, more powerful, and suitable for stronger winds high above the ocean surface.

Recent Developments

In June 2025, Envision Energy India announced that its latest wind turbine model, the EN 182–5.0 MW, has been officially included in the Ministry of New and Renewable Energy’s (MNRE) Revised List of Models and Manufacturers (RLMM)—a crucial regulatory requirement for the deployment of wind turbines in India.

TPG, a global alternative asset management firm, agreed to acquire a majority stake in Siemens Gamesa Renewable Energy’s wind turbine generator businesses in India and Sri Lanka in March 2025.

In December 2024, the Advanced Materials and Manufacturing Technologies Office (AMMTO) of DOE in the United States funded research conducted by Oak Ridge National Laboratory (ORNL), where researchers achieved a milestone building a 6.5-foot turbine blade tip with novel materials, then testing it against simulated lightning.

In October 2024, the Department for Energy Security and Net-Zero announced that wind farms will be able to bid for financial support to undergo repowering while they are still operating. It will come into effect for the next round of the CfD, under which successful projects will be announced in mid-2025.

Germany achieved a record number of approvals for onshore wind turbine installations, with approvals for 10,770 MW granted as of October 2024. This marks the highest number of approvals in the country's history, reflecting a strong commitment to expanding onshore wind capacity.

In September 2024, the Biden-Harris administration approved the Maryland Offshore Wind Project, marking the nation's tenth commercial-scale offshore wind energy project under President Biden's administration. This approval contributes to the nation's goal of deploying 30 GW of offshore wind energy by 2030.

Blackridge Research's global wind turbine market report provides insights into the current global and regional market demand scenario and its outlook.

The new report from Blackridge Research on the global wind turbine market provides comprehensive qualitative and quantitative analyses along with a deep insight into the current and future of the market.

(You can access a comprehensive list of both existing and upcoming wind energy projects, along with their current status, through our extensive Global Wind Projects Database.)

What Do We Cover in the Report?

Wind Turbine Market Drivers & Restraints

The study covers all the major underlying market dynamics that help the market develop and grow, as well as the factors that constrain global market growth over the forecast period.

The report includes a meticulous analysis of each factor, explaining the relevant, qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and will function as a guide for you to analyze the degree of impact.

Wind Turbine Market Analysis

This report discusses the market overview, the latest updates, important commercial developments and structural trends, and government policies and regulations.

Wind Turbine Market Size and Demand Forecast

The report provides the global wind turbine market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Wind Turbine Industry Analysis

The report examines the critical elements of the wind turbine industry supply chain, its structure, and the participants.

Using Porter's five forces framework, the report covers an assessment of the wind turbine industry's state of competition and profitability.

Wind Turbine Market Segmentation & Forecast

The report dissects the global wind turbine market into various segments based on technology type (onshore wind, and offshore wind). A detailed summary of the current scenario, recent developments, and market outlook will be provided for each market segment.

Further, wind turbine market share, size, and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major regions across the world. Each region's analysis covers the current market scenario, market drivers, government policies & regulations, and market outlook.

In addition, market size, demand forecasts, and growth rates will be provided for all regions. The region is segmented geographically into North America, Europe, Asia-Pacific, and the rest of the world (South America, the Middle East, and Africa).

Key Company Profiles

This report presents detailed profiles of key companies in the wind turbine industry, such as Vestas Wind Systems A/S, Xinjiang Goldwind Science & Technology Co., Ltd., Siemens Gamesa Renewable Energy SA, GE Vernova, Nordex SE, Envision Energy, Ming Yang Wind Power Group Limited, etc. In general, each company profile includes an overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

The Executive Summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an executive summary chapter and ends with conclusions and recommendations.

Also, check out our other reports:

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Loading testimonials...

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!