Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 216

About this Report

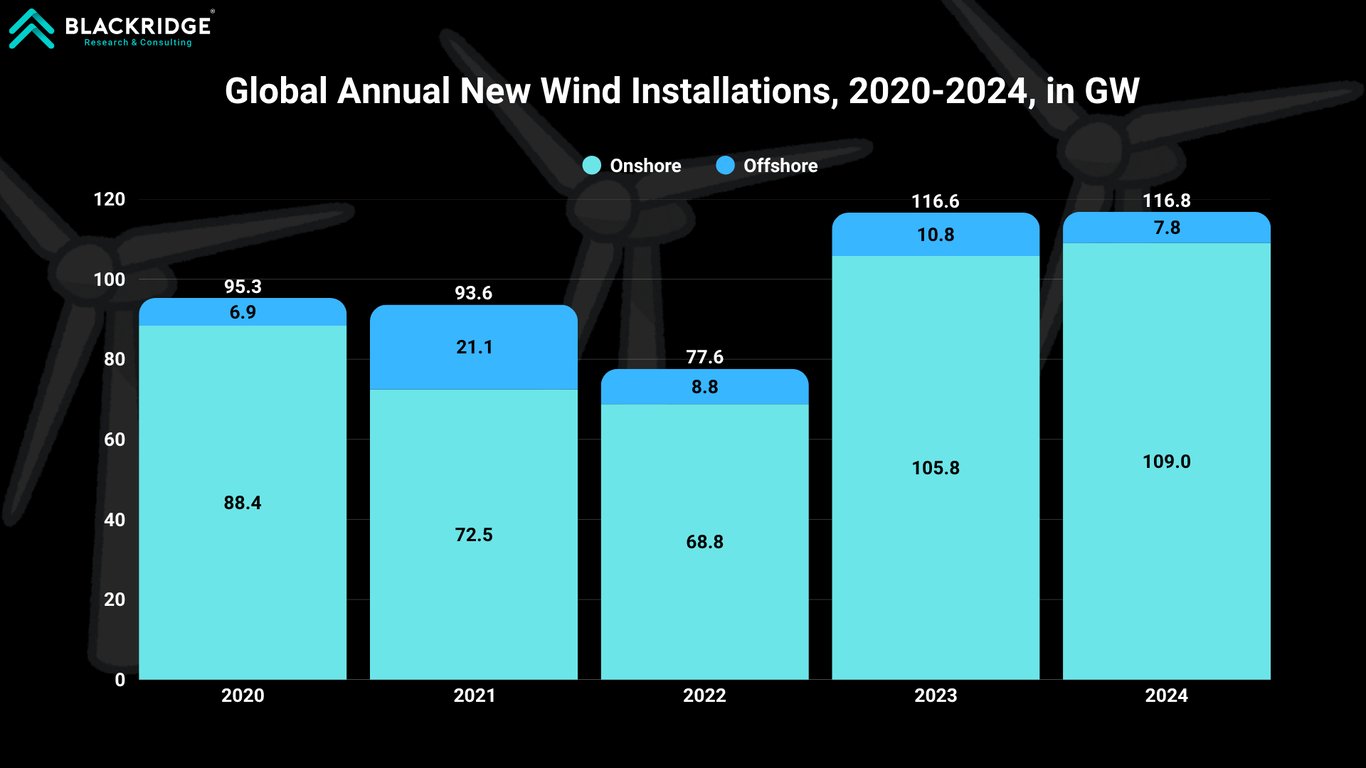

In 2024, Global wind power capacity saw a remarkable boost with the installation of 117 GW, marking a growth rate of 0.86% compared to the previous year, bringing global cumulative installed capacity to 1136 GW.

The Market is expected to continue its significant growth in the coming years owing to factors such as strong policy support, energy security concerns, and economic and climate objectives.

In terms of energy generation, wind power is currently dominating the renewable energy sources. In 2024, wind power generated 2511 TWh of energy, accounting for 25.4% of the global renewable energy generation.

However, the market's growth is being restrained by significant macroeconomic headwinds, policy instability, supply chain disruptions, and grid-related challenges.

Market Dynamics

Drivers

Supportive government policies and national targets are a primary driver for the global expansion of wind power. Governments worldwide are implementing supportive legislative frameworks to meet ambitious climate goals, enhance energy security, and stimulate economic growth, creating a favorable environment for investment and deployment.

Owing to the high-level national commitments in the international forums such as the Conference of Parties and the need to reduce dependence on fossil fuel imports, many nations are enacting a range of targeted policies, from financial incentives and streamlined permitting to dedicated procurement programs, which directly stimulate wind power installations.

For instance, in China, the "grid parity" mechanism, which remunerates wind-generated electricity at the same regulated price as coal power, has been a top market support mechanism since 2021. This policy has driven rapid building of wind power projects, with China approving 92.8 GW of onshore wind under this scheme in 2024 alone. The country also promotes rural wind power plants through the "Thousands of Townships and Villages Embracing Wind Power Initiative".

Similarly, India approved a Viability Gap Funding (VGF) scheme to support its first 1 GW of offshore wind power projects, ensuring financial viability and attracting private investment for future Offshore Wind farm clusters and eventual domestic offshore wind turbine manufacturing.

Germany legally recognized wind energy as being of "overriding public interest," a designation that has significantly streamlined permitting processes and reduced legal hurdles. This deliberate action to remove barriers has led to record-breaking figures in permitting and auction results.

The UK lifted a de facto ban on onshore wind in England in 2024 and reintroduced large projects into a national fast-track infrastructure regime, improving delivery reliability and investor confidence.

Restraints

The cost of capital is a significant macroeconomic factor restraining the growth of the wind power industry globally. As wind farms demand substantial upfront investments (especially in capex‑intensive Offshore Wind farm projects), their project economics are particularly sensitive to financing costs.

This restraint has been intensified in recent years by a combination of fluctuating interest rates, inflation, and increased risk premiums, impacting project viability from Europe and the US to emerging markets.

In 2023 and 2024, several offshore wind projects in the US and Europe defaulted. This was often because revenue-support schemes and offtake contracts were not adapted to handle unhedged costs amid changing market conditions, rendering them economically unviable. The levelized cost of energy (LCOE) for US offshore wind projects, for example, increased by 50% between 2021 and 2023 due to inflation and interest rate hikes.

Persistent high capital costs make long-term investment in the supply chain difficult and less attractive. This threatens to strain financially limited utilities and transmission operators, hindering their ability to invest in necessary grid upgrades to accommodate growing renewable energy capacity.

Segment Analysis

The global wind power market is segmented based on type into onshore wind and offshore wind. Currently, the onshore wind segment is dominating the market, significantly outpacing offshore wind in terms of both new and cumulative installations. While the onshore sector saw another year of record growth, the offshore segment experienced a slowdown in 2024.

The onshore wind market demonstrated significant growth in 2024, continuing its role as the primary driver of the global wind industry. For the second consecutive year, new onshore installations surpassed the 100 GW milestone, reaching a historic peak of 109 GW in 2024. This represents a 3.1% increase from the 105 GW installed in 2023.

Regional Analysis

Asia-Pacific

The Asia-Pacific region is currently dominating the installations, while North America, Europe, and the rest of the regions all experienced declines compared to the previous year.

The Asia-Pacific region was the largest market, accounting for 75% of new global wind power capacity in 2024. The region experienced a 7% year-on-year growth in installations. This performance was driven by explosive growth in China, which accounted for 70% of global onshore installations and over half of global offshore installations (4 GW).

China connected a record 79.8 GW of new wind power capacity to its grid, representing 68.3% of the world's total additions for the year. This growth is part of the country's commitment to its "30-60" carbon goals.

Another major country in the region is India, which added 3.4 GW of new capacity, the highest annual installation since 2017. This growth was attributed to policy reforms and increased investment in domestic manufacturing.

Europe

Europe was the second-largest market but saw its new installations decline by 10% compared to 2023. The region installed 16.4 GW of new capacity, representing 14% of the global total. The EU-27 accounted for 12.9 GW of this total. The decline was primarily due to a slowdown in onshore growth in countries like Sweden and delays in offshore construction and grid connections.

The leading countries for new installations in Europe were Germany (4 GW), the United Kingdom (1.9 GW), France (1.7 GW), and Finland (1.4 GW).

North America

North America is the third largest market but its global market share fell significantly in 2024. New onshore installations in the US dropped to their lowest level since 2013.

The United States installed just under 4.1 GW, a sharp drop from previous years. The slow deployment was caused by transmission congestion, long interconnection queues, inflation, and delayed guidance on tax rules under the Inflation Reduction Act (IRA). The US commissioned its first large-scale offshore project, bringing its total offshore capacity to 174 MW.

Key Market Trends and Developments

In September 2025, Tata Power Renewable Energy Limited (TPREL), a leading player in India’s clean energy sector, entered into a partnership with Suzlon Energy Limited to supply wind turbine generators totaling 838 MW. The wind turbines will be deployed across multiple TPREL projects in various states, with execution phased over the next several years to align with project timelines and commissioning milestones.

In March 2025, TPG (a leading global alternative asset manager) and Siemens Gamesa announced an agreement for TPG to acquire a majority stake in Siemens Gamesa’s onshore wind turbine manufacturing business in India and Sri Lanka, with Siemens Gamesa retaining a minority interest and providing long‑term technology support.

In May 2025, Vestas agreed to acquire LM Wind Power’s blade factory in Goleniów near Szczecin, Poland, integrating the site into its expanding European manufacturing footprint for an undisclosed amount. The facility, which produces blades for Vestas’ onshore turbines, including the V172‑7.2 MW will continue supporting growing wind energy demand in Poland and across Europe.

In May 2025, Poland announced EUR 54 million in state support to construct the world’s largest tower factory dedicated to producing towers for offshore wind turbines. The facility will anchor the country’s emerging offshore supply chain and bolster European manufacturing capacity.

In January 2025, Envision Energy India signed agreements with Juniper Green Energy (JGE) to supply 200 EN 182|5 MW wind turbine generators and a 320 MWh battery energy storage system, marking Envision’s first BESS deployment with JGE. The equipment will support projects across wind‑rich states.

Blackridge Research’s Global Wind Power Market Outlook report provides comprehensive market analysis on the historical development and targets, the current state of wind power installation scenario, and its outlook.

The insights in the research report – market data, policies and regulations, project data, company profiles, and competitive landscape analysis - have been derived primarily from our proprietary databases, and offering - Wind Project Tracker Service.

The new report from Blackridge Research on Global Wind Power Market comprehensively analyses the Wind Power Market and provides deep insight into the current and future state of the industry.

The study examines the drivers, restraints, and regional trends influencing Global Wind Power Market demand and growth.

The report also addresses present and future market opportunities, market trends, developments, and the impact of geopolitics on the Wind Power Market, important commercial developments, trends, regions, and segments poised for fastest growth, competitive landscape, and market share of key players.

Further, the report will also provide Wind Power Market size, demand forecast, and growth rates.

What we cover in the report?

Wind Power Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain the growth.

The report includes a meticulous analysis of each factor, explaining the relevant, qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and functions as a guide for you to analyze the degree of impact.

Wind Power Market Analysis

This report discusses the overview of the market, latest updates, important commercial developments and structural trends, and government policies and regulations.

This section provides an assessment of geopolitics impact on Wind Power Market demand.

Wind Power Market Size and Demand Forecast

The report provides Global Wind Power Market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Wind Power Market Industry Analysis

The report examines the critical elements of Wind Power industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the Wind Power industry's state of competition and profitability.

Wind Power Market Segmentation & Forecast

The report dissects the Global Wind Power Market into various segments. A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for a "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies & regulations, and market outlook.

In addition, market size, demand forecast, and growth rates will be provided for all regions.

Following are the notable countries covered under each region.

North America - United States, Canada, Mexico, and Rest of North America

Europe - Germany, France, United Kingdom (UK), and Rest of Europe

Asia-Pacific - China, India, Japan, South Korea, Australia, Rest of APAC

Rest of the world - Saudi Arabia, Brazil, Nigeria, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of Key companies in the Wind Power industry. In general, each company profile includes - overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

Executive Summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of Global Wind Power Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!