Build Your Custom News Feed.

Select the sectors that matter you. Get breaking news alerts as stories develop, plus comprehensive monthly insights across all industries.

Related Contents

Oct 7, 2025

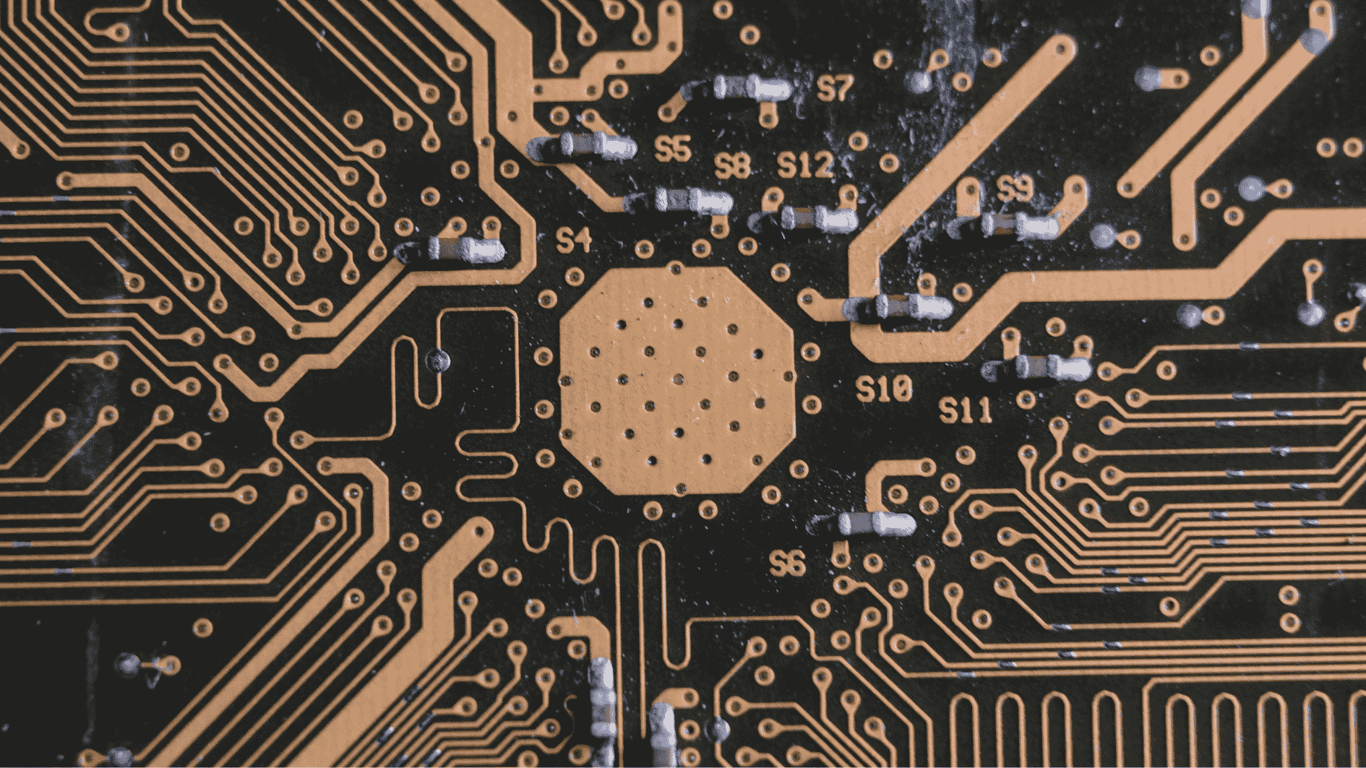

INOX Air Products invests strategically in Dholera to support India's growing semiconductor industry with industrial gas supplies and equipment.

Oct 7, 2025

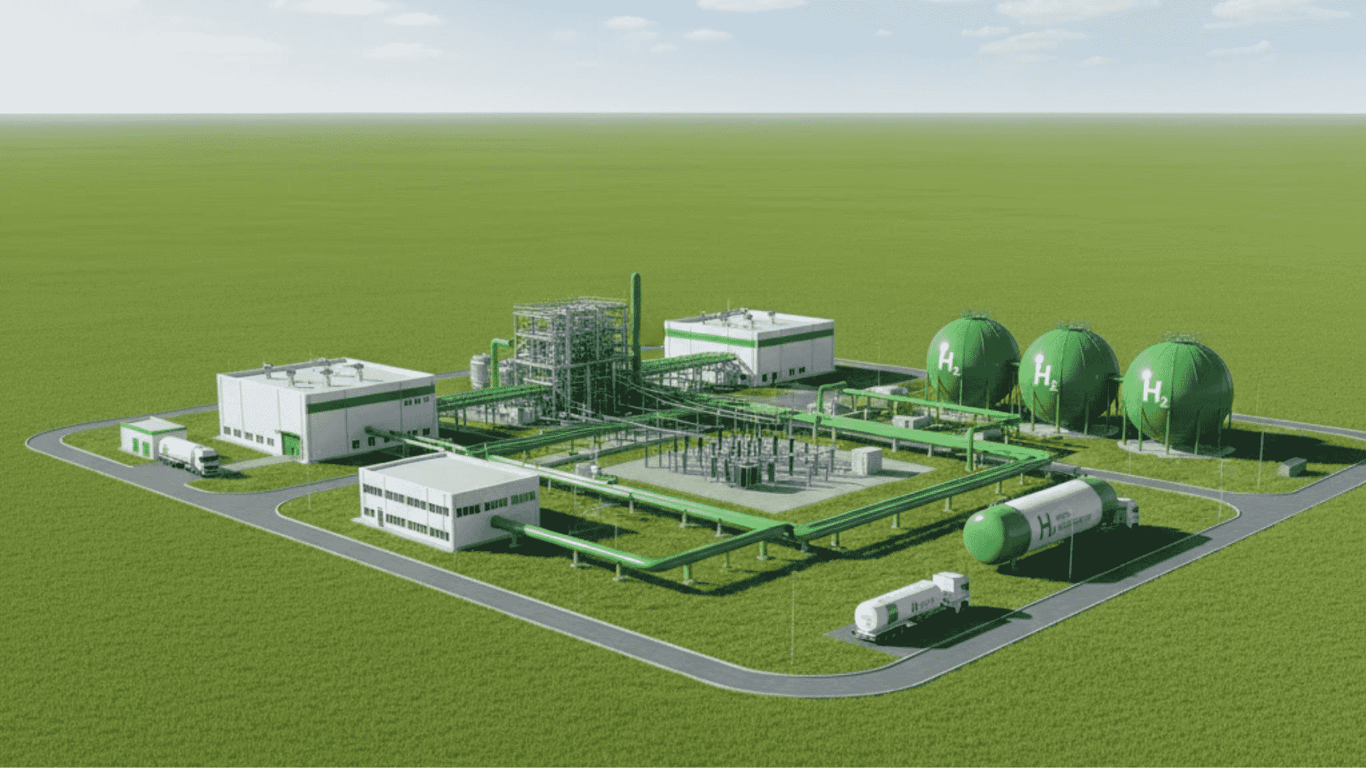

SIAD and Brembo invest in Hydrospark for hydrogen production and storage, advancing a sustainable hydrogen supply chain.

Oct 7, 2025

Stargate Hydrogen launches Aurora electrolyzer system with a record-low footprint and Starbase stacks for efficient green hydrogen production.

Oct 7, 2025

Johnson Controls invests in Accelsius, a data center liquid cooling company, expanding into the strategic data center cooling sector.

Oct 7, 2025

Oman Across Ages Museum partners with BP Oman on a clean energy deal, marking a new collaboration between a cultural institution and an energy company

Oct 7, 2025

Oil India and Mahanagar Gas Limited sign strategic MoU for LNG value chain collaboration and clean energy projects in major partnership deal.

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.