Table of Contents

Raisa Energy is selling a package of oil and gas wells across numerous U.S. shale basins that may fetch around $1.5 billion, according to people familiar with the matter. The sale is currently in its early stages and is not guaranteed, with the final price subject to fluctuation depending on market conditions and other factors.

The sources requested anonymity because the process is confidential. TPH, the energy-focused investment banking arm of boutique advisor Perella Weinberg Partners, is advising Raisa on the effort.

Asset Details and Production Capacity

The assets being marketed by Raisa are classified as "non-op" positions in the oil and gas industry. Under this arrangement, the owner contributes a portion of the drilling costs and other expenses and receives a share of the revenue from the sale of hydrocarbons in return. Meanwhile, another producer takes charge of the wells' day-to-day operation.

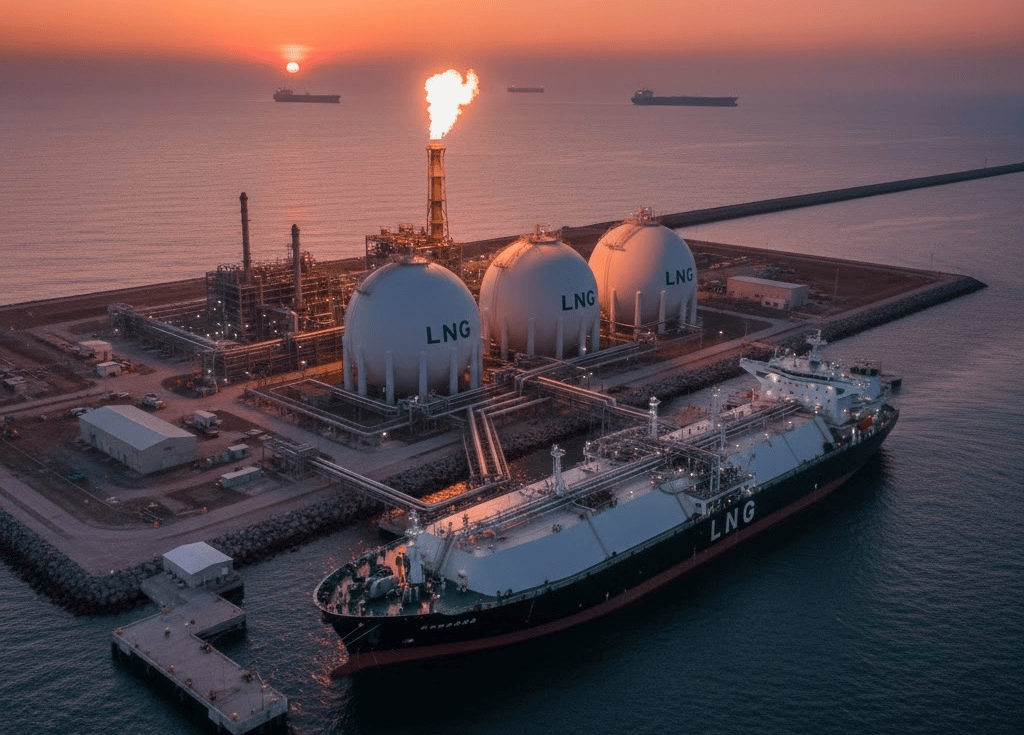

The Raisa assets produce roughly half natural gas, with total net production around 63,000 barrels of oil equivalent per day, according to one of the sources. The wells are spread across numerous U.S. shale basins, though specific locations were not detailed in the available information.

Market Appeal and Investment Structure

Non-op positions are considered attractive to energy producers that specialize in such assets, as well as financial investors who can generate steady returns without requiring operating knowledge. This investment structure allows owners to participate in oil and gas production while avoiding the complexities of day-to-day operational management.

The arrangement provides a way for investors to gain exposure to energy production with reduced operational responsibilities, making these assets appealing to a broader range of potential buyers including both industry specialists and financial investment firms.

Transaction Advisory and Company Response

Perella Weinberg Partners, trading under the symbol PWP.O, is providing advisory services through its energy-focused investment banking arm TPH. The boutique advisory firm is guiding Raisa through the sale process. When contacted for comment, Raisa Energy did not respond to requests.

Perella Weinberg Partners declined to provide comment on the transaction. The confidential nature of the sale process has limited the availability of additional details about potential buyers, timeline for completion, or specific terms being negotiated. The early stage of the sale means that various aspects of the transaction remain subject to change as market conditions and buyer interest develop.

40+ reviews

Find the Latest Oil & Gas Production Projects Around the World with Ease.

Gain exclusive access to our industry-leading database of oil and gas opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.