Table of Contents

Chevron Completes Hess Acquisition Despite ExxonMobil Objections, Gains 30% Stake in Guyana Oil Block Chevron has completed its acquisition of privately-held rival Hess, securing a 30 percent stake in ExxonMobil's lucrative Stabroek Block developments off Guyana.

The transaction was finalized on Friday morning, just four hours after an International Chamber of Commerce arbitration panel ruled in Chevron's favor against ExxonMobil's attempts to block the deal.

Arbitration Dispute and Resolution

ExxonMobil had filed an arbitration case through the International Chamber of Commerce in an effort to prevent Chevron's acquisition of Hess. The dispute centered on a contractual clause in Hess's ownership agreement for the Stabroek Block lease that provided ExxonMobil with a right of first refusal in the event of a sale of Hess' stake.

ExxonMobil argued that this clause should apply to the sale of Hess itself as a company. Chevron disagreed with ExxonMobil's interpretation of the contract terms. On Friday morning, the arbitration panel ruled against ExxonMobil, allowing Chevron to proceed with the acquisition.

Chevron CEO Mike Wirth celebrated the arbitration victory, thanking the panel for recognizing the "longstanding practice and understanding that asset-level rights of first refusal do not apply in parent company merger and acquisition transactions."

Company Responses

Following the arbitration decision, ExxonMobil acknowledged the outcome despite disagreeing with the panel's interpretation. The company issued a statement saying, "We disagree with the ICC panel's interpretation but respect the arbitration and dispute resolution process.

We welcome Chevron to the venture and look forward to continued industry-leading performance and value creation in Guyana." ExxonMobil has accepted that Chevron will become its new business partner in the Stabroek Block project, despite its previous objections to the acquisition.

Stabroek Block Significance

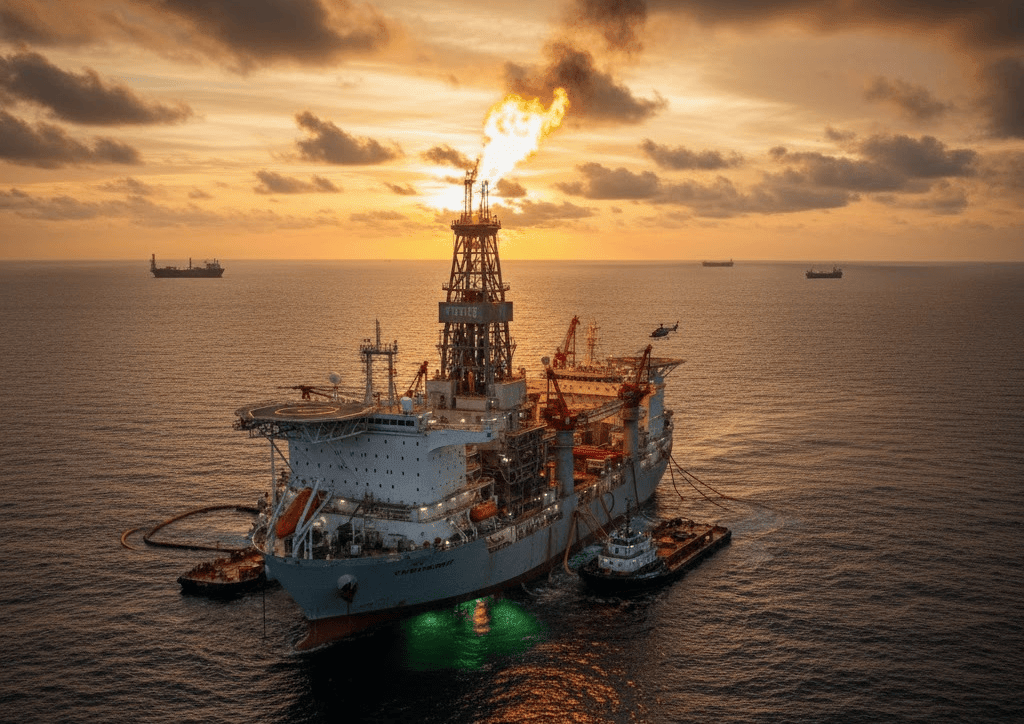

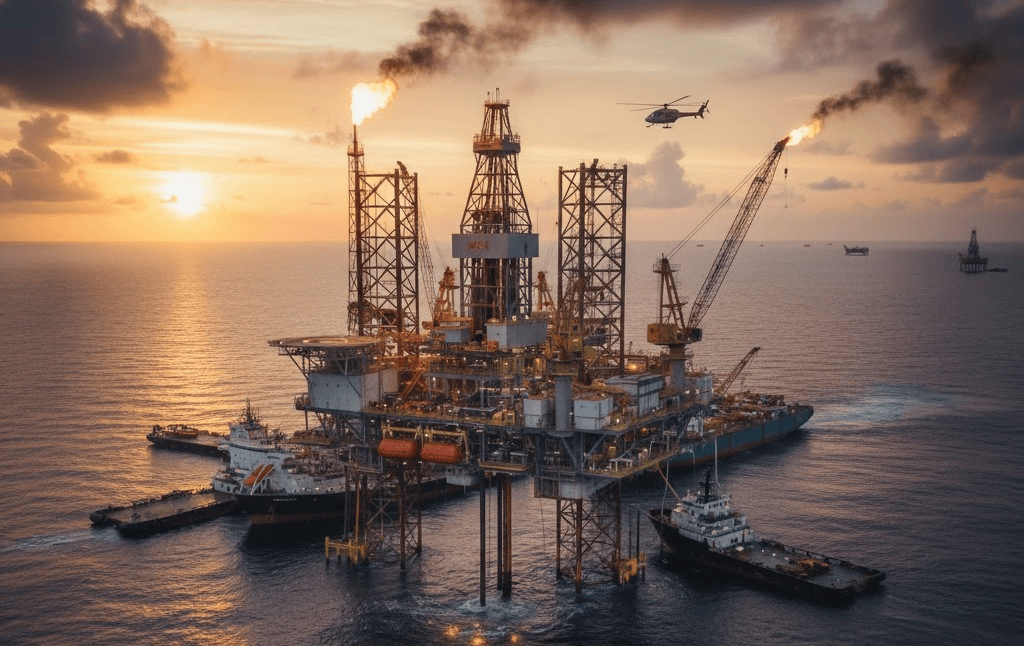

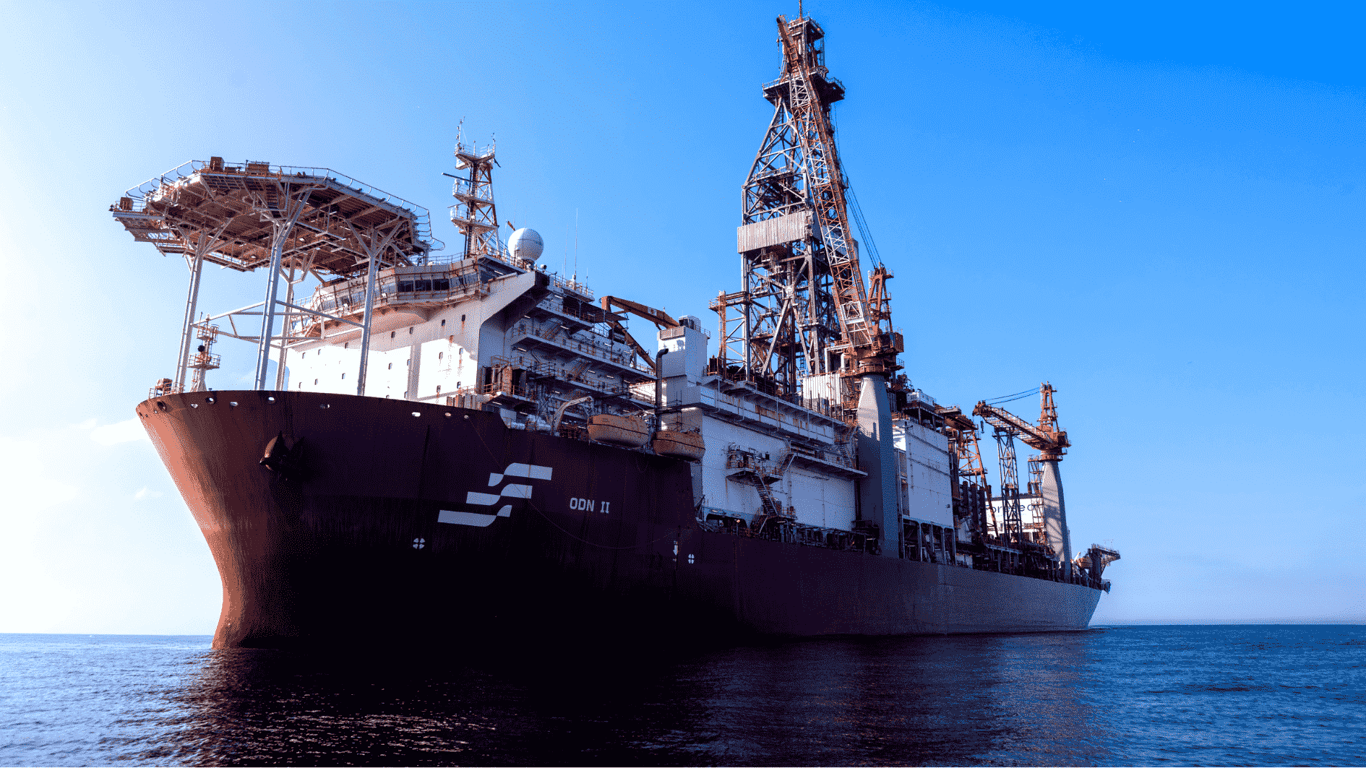

The Stabroek Block represents one of the world's most promising offshore oil discoveries and serves as a powerhouse behind ExxonMobil's profit margins. The International Energy Agency predicts that the Stabroek Block will singlehandedly produce one percent of the world's oil in future years.

The project's economics are particularly attractive even in challenging market conditions. Independent estimates indicate that the first four Stabroek floating production storage and offloading vessels will produce oil at a breakeven cost of less than $35 per barrel. This low breakeven cost means the projects will remain profitable even during periods of low oil prices, despite the typically high costs associated with offshore operations.

ExxonMobil operates the Stabroek Block development, which includes the FPSO One Guyana among its production facilities. With Chevron's completed acquisition of Hess, the company now holds a 30 percent interest in these offshore Guyana operations.

40+ reviews

Find the Latest Pipeline (Oil & Gas) Projects Around the World with Ease

Gain exclusive access to our industry-leading database of Latest Pipeline (Oil & Gas) Projects opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.