Table of Contents

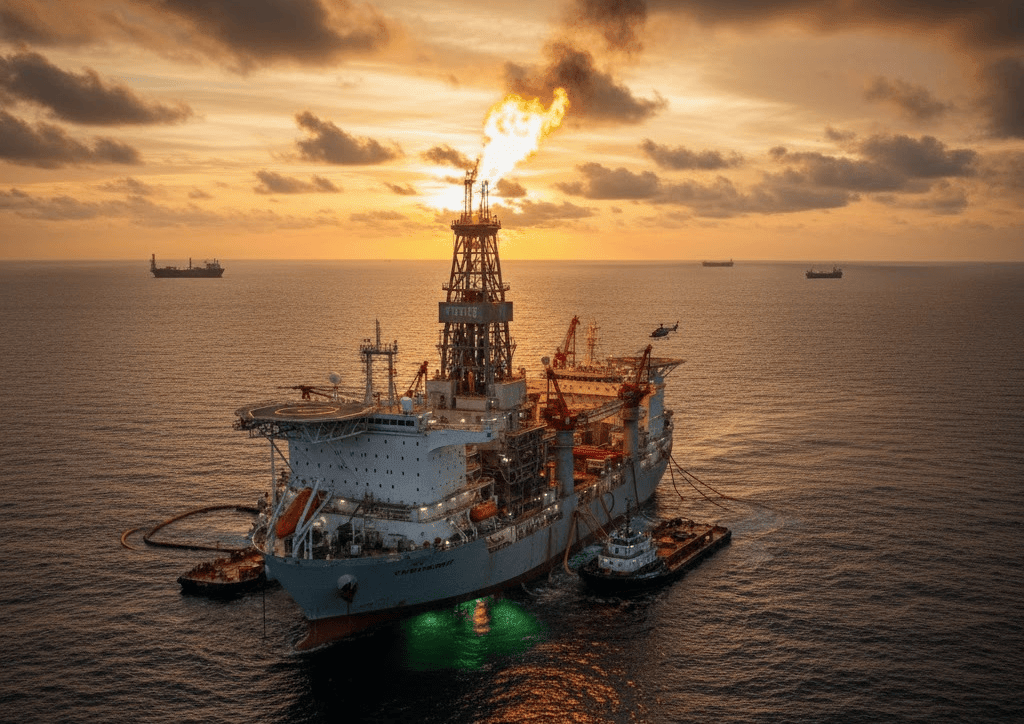

Altera Infrastructure has entered into an agreement to sell its entire floating production, storage, and offloading (FPSO) business to global investment firm Carlyle. The transaction encompasses Altera's full FPSO portfolio, including the floating storage and offloading (FSO) unit Yamoussoukro and the company's 50% ownership in the joint venture Altera&Ocyan.

Asset Portfolio Details

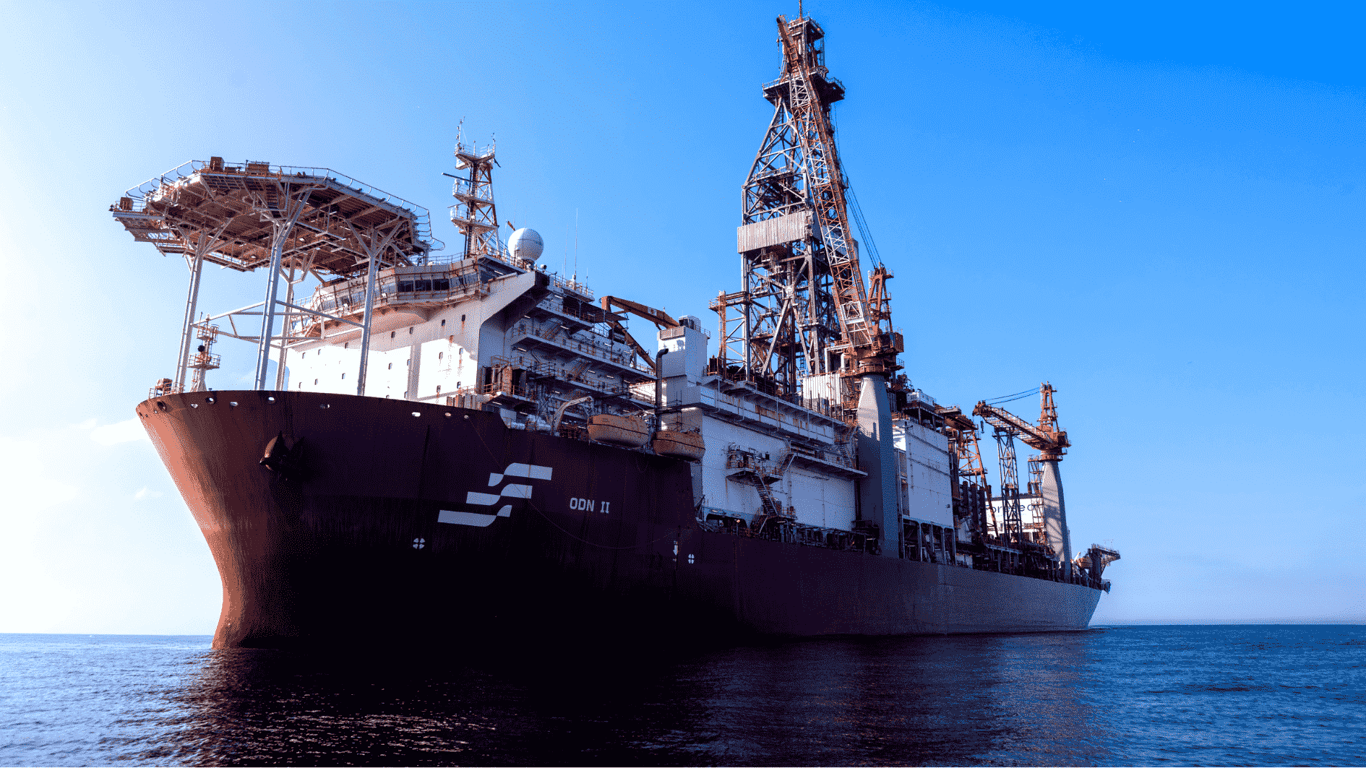

The acquired business includes several key assets currently deployed across multiple regions. The portfolio features the Petrojarl Kong FPSO and FSO Yamoussoukro, both deployed in the Ivory Coast with Eni. Additionally, the transaction includes the Piranema FPSO and 50% of the Altera&Ocyan joint venture's asset, the Pioneiro de Libra FPSO, which is deployed in Brazil with Petrobras.

The FSO Yamoussoukro represents a significant component of the floating storage and offloading operations within the portfolio. The joint venture Altera&Ocyan, in which Altera Infrastructure holds a 50% ownership stake, adds additional operational capacity through the Pioneiro de Libra FPSO unit.

Strategic Investment Rationale

Carlyle's investment will support Altera Infrastructure's FPSO business and continue to build on its track record in redeployments. Bob Maguire, Co-Head of Carlyle International Energy Partners, described the acquisition as “a rare opportunity to acquire an established and high-quality FPSO business with a strong management team, operating track record and long-term cashflows.”

Maguire emphasized that “Altera's portfolio benefits from long-term contracts, strong FPSO market fundamentals, and exposure to world-class operators, which position it well for success.” The investment firm's assessment highlights the strategic value of the existing operational relationships and contract structure within the FPSO business.

40+ reviews

Find the Latest FPSO & FSO (Oil & Gas) Projects Around the World

Gain exclusive access to our industry-leading database of FPSO & FSO (Oil & Gas) opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

Management Perspectives and Future Plans

Altera Infrastructure leadership expressed enthusiasm about the partnership opportunity. Chris Brett, President of Altera Production, and Arne Hygen Tørnkvist, Executive Vice President of Projects, issued a joint statement regarding the transaction. “Partnering with Carlyle marks an important step forward in our journey,” the executives stated.

“Carlyle's deep sector expertise and global network in the energy space, combined with its scale and resources, will allow us to optimize the long-term performance of our assets further, identify efficiencies across the portfolio, and execute on growth initiatives to scale the business.” The leadership team indicated their commitment to maintaining service quality, adding, “We are excited to partner with Carlyle and look forward to delivering for our clients in a rapidly evolving energy landscape.”

Transaction Structure and Approval Process

The transaction value was not disclosed in the announcement of the agreement. The deal is subject to customary closing conditions and regulatory approvals, which represent standard procedure for acquisitions of this scale and complexity in the energy sector. The agreement covers the complete transfer of Altera Infrastructure's FPSO business operations, including all associated assets, contracts, and operational responsibilities.

The 50% ownership stake in the Altera&Ocyan joint venture will also transfer to Carlyle as part of the comprehensive acquisition. The transaction announcement was made on September 2, 2025, marking a significant development in the floating production, storage, and offloading sector. The deal represents Carlyle's continued expansion in energy infrastructure investments and Altera Infrastructure's strategic repositioning of its business portfolio.

The FPSO business being acquired operates across multiple geographic regions, with established relationships with major energy operators, including Eni and Petrobras. These operational partnerships provide the foundation for the long-term contracts that Carlyle identified as a key attraction of the acquisition.

Connect with Decision-makers about the Latest FPSO & FSO (Oil & Gas) Projects Around the World for business Opportunities.

Subscribe to our database on FPSO & FSO (Oil & Gas) Projects and Tenders Around the World to get access to reliable and high-quality insights on upcoming, Under-construction, and completed FPSO & FSO (Oil & Gas) Projects across the world or in your desired geographical location.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.