Table of Contents

A Power Purchase Agreement (PPA) is a long term contract for electricity supply between a power seller and buyer. The contract is between public and private sector parties, which makes it a power sector PPP (Public-private partnerships) contract. Depending on the terms of the contract, PPA contracts are either for a pre-defined quantity of electricity or for a fixed price per kilowatt-hour.

The seller (generator) can be a utility company, a renewable energy producer (solar farm, wind farm), or any entity that generates electricity. The corporate buyer (off-taker) can be another utility company, a large commercial or industrial customer, or even a government entity. The structure and risk allocation rest in the offtakers’ ability to raise capital for the project, recover the invested money, and earn a return on equity.

PAA includes conditions for the agreement, such as the amount of electricity to be supplied, negotiated prices, accounting, and penalties for non-compliance over 5 to 10 years. A PPA contract is mainly used to reduce volatile market price risks and will help large electricity consumers reduce investment costs associated with planning or operating renewable energy plants.

As we know, PPA is a bilateral agreement. Different types of PPA agreements are tailored to specific needs. The difference in a PPA agreement is reflected in the range of plants (mid-range or peak) or the different generation technology used. PPA agreements for a wind power plant and solar power plant will be different based on the structure of the agreement, capacity, and technology.

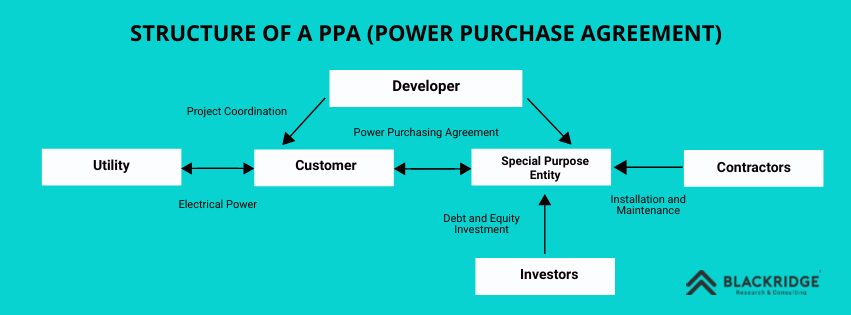

Structure of a PPA

A PPA structure involves the developer, financiers, a utility (depending on the market), and the customer. The agreements in a PPA include the project development plan, the electricity price and terms, and the interconnection agreement to connect the plant to the grid. Financing comes from a mix of debt and equity investment. This structure allocates risks and responsibilities for all involved parties throughout the project lifecycle.

How does PPA Work?

Let's explore how PPAs work:

Eligibility and Location

A PPA agreement is only eligible for a project in a state where ownership of energy production is allowed. Certain states have policies and regulations restricting non-utility providers in regulated markets from selling electric power.

The PPA Agreement

In a PPA agreement, the offtaker signs a contract with a third-party developer to purchase the power generated. The offtaker provides the physical space to host the system for wind farms, solar panels, combined heat and power equipment, etc. Sometimes, the host and offtaker may be separate entities in leased spaces. In this agreement, the customer or offtaker purchases the power, and the developer and investors own the equipment for energy production for the duration of the PPA.

Find Renewable Energy Project And Tender Leads Around the World. Claim Your Free Leads Now!

Initial Project Coordination

The developer provides the initial project coordination services, such as financing, design, and permitting. Equipment installation is completed in-house by the developer or by a contracted installer.

Cost Savings and Price Escalation

The customer purchases the power generated at a lower rate than the utility’s retail rate, this helps to cost savings. The PPA rate usually increases by 1-5% each year for the contract term. This is to account for gradual decreases in system energy efficiency, operating and maintenance costs, and increases in the retail electricity rate. At the end of the contract term, the customer may extend the term, purchase the system from the developer, or remove the equipment from the property.

Interconnection and Net Metering

If the power generation is insufficient to meet the customer’s electric needs, the utility serving the customer will provide an interconnection from the energy system. Excess power is sold to the utility at a retail electricity rate, and this process is called metering.

Special Purpose Entity (SPE)

A special purpose entity (SPE) for each project is created as the legal owner of the energy system. The SPE raises debt and equity investment in the project, resulting in the developer and investors' mutual ownership of the SPE. The SPE helps investors avoid the risk of the developer’s other projects.

Tax Credits and Incentives

There are also tax credits and incentives for renewable energy projects, which developers use to attract more investments. The US has the Solar Investment Tax Credit and the Production Tax Credit for wind energy at the state and federal levels.

Renewable Energy Certificates (RECs)

RECs are tradable, non-tangible energy commodities issued when one megawatt-hour (MWh) of electricity is generated from a renewable energy source and delivered to the grid. The developer will get environmental benefits through these certificates, which help verify carbon reductions from specific projects.

Types of Power Purchase Agreements

Let's discuss different types of power purchase agreements:

On-Site and Off-Site Power Purchase Agreement

On-site PPA agreement helps the businesses to generate renewable energy at their own facility. This will reduce electricity costs and reliance on the grid. This involves installing solar system panels tailored to the buyer's needs.

Off-site PPA allows businesses to access renewable sources of energy from external projects like solar or wind farms. These agreements offer flexibility and scalability without requiring on-site infrastructure. Businesses can enter long-term contracts to purchase electricity at fixed energy prices, reducing upfront costs and maintenance.

Virtual Power Purchase Agreement (VPPA)

VPPAs help organizations to purchase environmental attributes of renewable energy options without physically receiving the electricity. These agreements support sustainability goals and offer environmental benefits. Also, this comes with market and regulatory risks. A thorough risk assessment is crucial before entering a VPPA.

Read: What is Contract for Difference? What is Its Role in Power Purchase Agreements

Sleeved Power Purchase Agreement

A sleeved PPA uses a third-party intermediary to facilitate electricity delivery from a renewable project to the energy buyer. This arrangement simplifies access to renewable energy and reduces administrative burdens.

Physical Delivery Power Purchase Agreement

In a physical delivery PPA, the buyer directly receives electricity from a renewable energy project. This straightforward method integrates renewable energy into the buyer’s portfolio, supporting sustainability and providing clear ownership of the power and its attributes.

Portfolio Power Purchase Agreement

Portfolio PPAs aggregate multiple renewable projects to meet the buyer's energy needs. It also offers diversification and reduced risk. This approach allows access to various energy sources, ensuring reliability and stability in energy supply.

Block Delivery Power Purchase Agreement

Block delivery PPAs enable buyers to purchase energy in predetermined increments. And providing flexibility to meet varying energy demands. This method helps manage costs and budget effectively and supports renewable projects.

Green Tariffs

Green Tariff 1.0 involves purchasing renewable energy certificates (REC) to support projects indirectly. Green Tariff 2.0 allows the direct purchase and renewable electricity consumption from specific projects. This will promote transparency and accountability in renewable power sourcing.

Benefits of PPAs Considering Solar PV

Here are the benefits if a PPA agreement:

Low Upfront Capital Costs

The developer manages the initial costs of sizing, procuring, and installing the solar PV or wind energy system. This allows the host customer to adopt renewable energy and save money when the system becomes operational without any upfront cost in investment.

Reduced Energy Costs

Solar and wind PPAs offer fixed, predictable electricity costs for the duration of the agreement. They are structured in two ways:

Fixed Escalator Plan

Solar electricity prices increase at a predetermined rate, typically between 2% - 5%. This will be lower than projected utility price hikes. The price remains constant throughout the PPA term, saving more as utility prices rise for the solar company. The developer assumes responsibility for system performance and operating risks, reducing the burden on the customer. Developers can also enjoy environmental benefits through Renewable Energy Credits (RECs) and energy attribute certificates, which help verify carbon reductions from specific projects.

Find Renewable Energy Project And Tender Leads Around the World. Claim Your Free Leads Now!

Better Leverage of Available Tax Credits

Developers are usually better positioned to utilize solar incentives, solar loans, and tax credits to reduce system costs. For example, municipal hosts and public entities with no taxable income can benefit from the Section 48 Investment Tax Credit through the developer.

Potential Increase in Property Value

Installing a solar PV system can increase residential property values. The long-term PPAs allow them to be transferred with the property. This helps the customers to invest in their homes at little or no cost.

Disadvantages of PPAs

Long-Term Commitment

PPAs typically involve long-term contracts of 10-25 years, which may not suit all customers. Customers cannot afford the changing energy needs or financial situations due to this long term commitment.

Potential for Higher Costs

PPAs provide cost savings, but also the fixed escalator plan can lead to higher costs. This price outrun happens when predetermined rate increase outpaces the actual rise in utility prices. If utility prices decrease, customers might pay more under the PPA agreement.

Complexity in Contracts

PPA agreements can be complex and require careful negotiation and legal review. Customers need to thoroughly understand the terms, conditions, and potential implications. This may result in time-consuming and may require professional legal and financial advice.

Transfer and Termination Issues

Transferring a corporate PPA when selling a property or terminating the agreement early may involve additional costs. Not all buyers accept the PPA, potentially complicating property sales.

Examples of PPAs

Here are some of the latest PPAs in the wind and solar sectors:

Wind Power Purchase Agreement For Wind

In a Wind PPA, the agreement is to purchase electricity generated from a wind farm. This agreement allows the buyer to secure renewable energy at a fixed rate. And also, providing cost predictability and contributing to sustainability goals without the need for upfront investment in wind energy infrastructure.

On June 24, 2024, RWE entered into two 15-year PPA with Microsoft Corporation. Under these wind project agreements, RWE will supply renewable energy from its new onshore wind projects in Texas, which have a combined capacity of 446 MW, expanding RWE's footprint in Texas to nearly 5 GW.

Power Purchase Agreement For Solar

In solar PPA energy, buyers and a solar developer enter into an agreement. Unlike a lease agreement, the solar installer sets up the solar panel system at the buyer's location. This arrangement allows buyers to reduce their electricity bill by purchasing the generated solar power at a fixed rate. This will be without the upfront solar panel cost typically associated with installing a solar energy system.

Guided by a solar expert, this agreement ensures compliance with industry standards and maximizes the benefits of solar renewable energy credits. It helps mitigate market price volatility, promote sustainability goals, and provide immediate cost savings.

Read: Top 10 List of Solar PV Module Manufacturers in 2024

Solar financing options, such as solar loans, make it easier to afford the solar array and complete the solar installation process. With the increasing integration of EV charging stations and community solar projects, PPAs continue to expand access to renewable energy. This will lower overall energy costs and promote a greener future.

On 24th June 2024, Neoen signed a solar power purchase agreement for 139 MW with SNCF Energie, the electricity sourcing branch for trains in France. Under this 25-year agreement, SNCF Energie will purchase all the electricity produced from Le Couret Agrisolar Park in Haute-Vienne, France, once the park is commissioned.

This solar lease project, operating under Neoen’s develop-to-own model, will be one of the largest solar parks in France. The solar energy project has received the necessary authorizations and secured a grid connection, with construction set to begin in 2026 and commissioning in 2028.

PPA Regulation in Different Countries

| Country | Regulatory Body | Key Points |

| UK | BEIS | Oversees PPA regulations in the UK |

| US | FERC | Determines facilities for PPAs (Energy Policy Act 2005). State & federal regulations apply. |

| Germany | German Energy Agency | PPAs are seen as central to energy transition and advocate for better regulations. |

| India | Multi-level |

|

| South Africa | NERSA |

|

| UAE | DoE & EWEC |

|

Conclusion

Power Purchase Agreement (PPA) is a long-term contract for electricity supply between a power buyer and seller. This agreement mitigates market price volatility and supports large-scale renewable energy projects. Due to the recent challenges such as supply chain disruptions, labor shortages, and regulatory uncertainties, the demand for renewable energy through PPAs remains strong among corporations. Different PPAs offer flexibility to meet diverse energy needs, while various global regulations influence their implementation. PPAs are crucial in promoting sustainable energy solutions and achieving corporate renewable energy targets.

Connect with decision-makers of Renewable Energy projects in the World for business opportunities.

Subscribe to upcoming and ongoing Renewable energy projects and tenders database in the World to get access to reliable and high-quality insights on upcoming, in-progress, and completed renewable energy projects across the World.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Start a free demo to take your business to the next level!

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.