India Electric Vehicle Market - Share, Size, Growth, Outlook - Industry Trends and Forecast to 2031

Market Research Reports

|Q2 2025

|Report ID: BR05024

|No. of Pages: 111

About this Report

The Indian EV market is expected to continue its growth spree during the forecast period. Several key factors, including government subsidies and policies, rising fossil fuel costs, decreasing costs of EV batteries, expansion of charging infrastructure, increase in domestic EV manufacturing, and growing consumer interest in electric mobility, are driving the Indian electric vehicle market.

However, the limited range and high cost of EVs compared to conventional vehicles and the infantile charging infrastructure market in the country are major hindrances, as they limit the widespread adoption of EVs. The lack of standardization in charging technology also presents challenges to the growth of the market.

Furthermore, India's dependence on imports for key EV components makes it difficult to achieve economies of scale and bring down the cost of EVs on par with conventional vehicles. Consumer skepticism and lack of awareness about EVs are also factors that are hindering their adoption in the Indian market.

Current Scenario of the Electric Vehicle Market in India

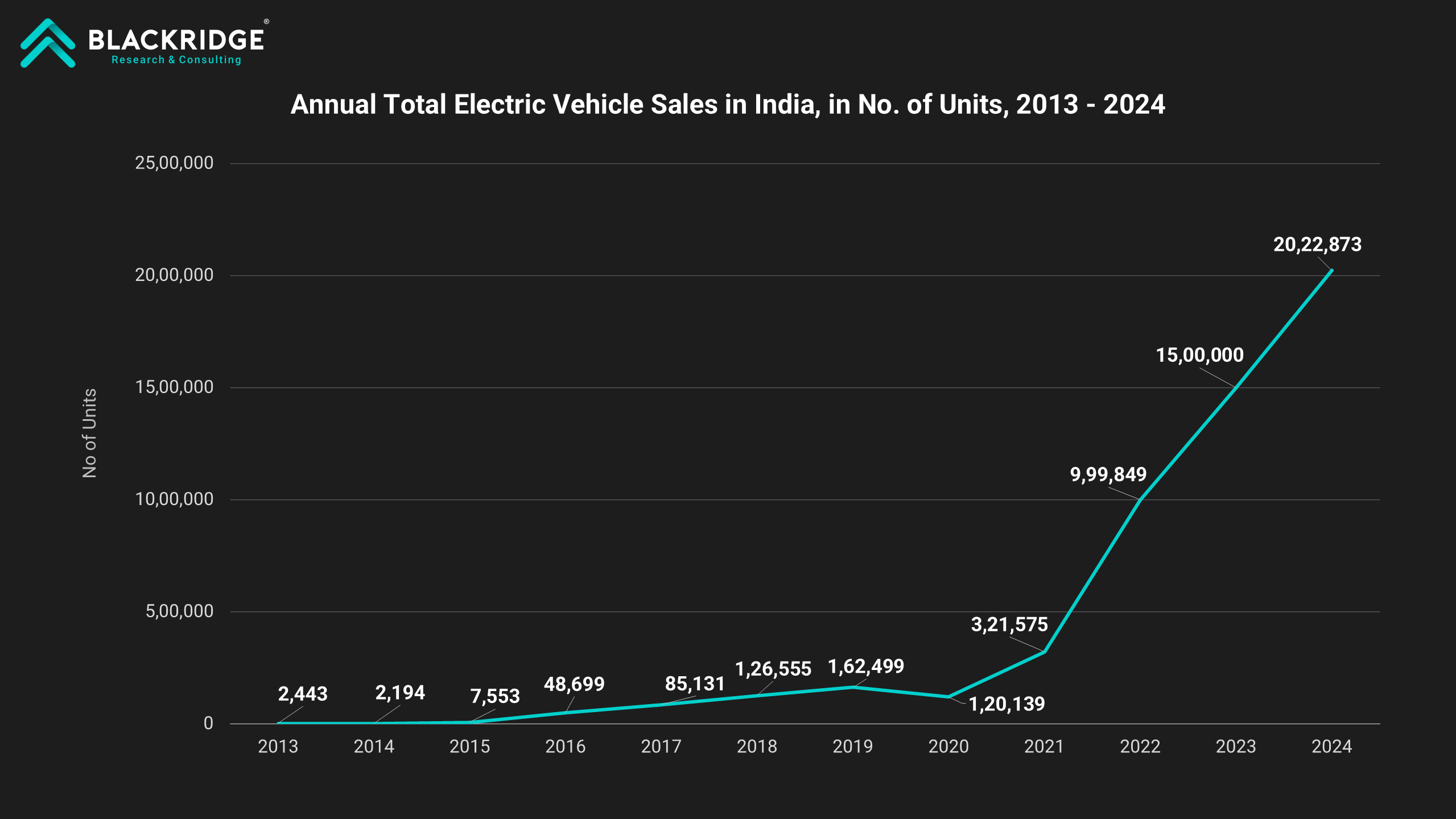

India’s electric vehicle (EV) market experienced impressive growth in 2024, with more than 2.2 million EVs sold during the year. This represents a substantial 37.5% increase compared to 2023, when about 1.6 million units were sold across the country.

For the first time, annual electric vehicle sales crossed the 2 million mark — a major milestone for the industry. As a result, the total number of EVs on Indian roads has now reached 5.6 million.

This surge in sales reflects the growing consumer interest in electric mobility and signals a strong shift toward cleaner, more sustainable transportation solutions.

Drivers

Favorable Government Policies

At COP 26, India made a commitment to reduce its carbon footprint by 45% below 2005 levels by 2031. With road transportation accounting for 80% of consumption, India's transportation sector has become one of the largest oil consumers in the world as a result of the exponential rise in automotive adoption in the nation over the previous decade.

To address this growing challenge and promote clean mobility, the Government of India launched the Faster Adoption and Manufacturing of Electric and Hybrid Vehicles in India (FAME India) scheme in April 2015. This initiative is a key component of the National Electric Mobility Mission Plan, aimed at encouraging the transition to eco-friendly transportation.

The FAME scheme was designed to create market demand through incentives across all vehicle categories—including two-wheelers, three-wheelers, four-wheelers, light commercial vehicles, and electric buses. The core intention was to make electric mobility accessible, affordable, and sustainable for both public and private transportation needs.

Phase I of the FAME scheme was extended multiple times until March 31, 2019, with the total financial outlay increased to ₹895 crore (USD 104 million). Building on the lessons learned in Phase I and feedback from various stakeholders, the government introduced FAME Phase II with an expanded outlay of ₹11,500 crore (USD 1.3 billion).

One of the major accomplishments under FAME II, as of November 25, 2024, includes the registration of 69 Original Equipment Manufacturers (OEMs) spanning 236 EV models:

28 OEMs for e-2Ws (79 models)

37 OEMs for e-3Ws (143 models)

4 OEMs for e-4Ws (14 models)

During this period, over 1.67 million electric vehicles have submitted claims for demand incentives on the FAME-II portal. These include:

14,69,343 electric two-wheelers

1,78,942 electric three-wheelers

23,311 electric four-wheelers

Furthermore, in order to support public EV adoption, the government has also extended permissions for the installation of private charging stations in homes and workplaces in an effort to enhance the number of EV charging stations. As a result, anyone may now easily request the installation of a private charging point from the municipal or state nodal office.

Additionally, the government has given permission for the installation of EV charging stations in shopping centers, apartment buildings, office buildings, restaurants, hotels, and other public locations.

Several Indian state governments have adopted EV-specific policies with the goal of enticing investment and creating jobs in their particular states by offering both supply-side and demand-side incentives. To encourage EV manufacturers, incentives are frequently provided, such as capital interest subsidies, stamp duty reimbursements, tax exemptions, SGST reimbursement, and the supply of interest-free loans.

The electric vehicle industry in India is picking up pace with 100% FDI possible, new manufacturing hubs, and an increased push to improve charging infrastructure. Federal subsidies and policies favoring deeper discounts for Indian-made electric two-wheelers as well as for the localized ACC (advanced chemistry cell) battery storage market are other growth drivers for the Indian EV industry.

Restraints

High Upfront Cost of Electric Vehicles

The high upfront cost of electric vehicles (EVs) remains a key barrier to their widespread adoption in India. On average, EVs are 30% to 50% more expensive than their internal combustion engine (ICE) counterparts. For example, the base variant of the Tata Nexon (petrol) starts at around INR 8 lakhs (USD 9,262), while the Tata Nexon EV is priced from INR 12 lakhs (USD 13,893).

This price gap is largely driven by the high cost of batteries, which are the most expensive component of an EV. India's heavy reliance on battery imports and raw materials not only inflates prices but also exposes the market to global supply chain disruptions and price volatility, further hampering EV affordability and adoption.

Segment Analysis

By Vehicle Type

The electric two wheelers segment dominates the Indian electric vehicle market. Electric two-wheelers represented 60% (~1.2 million units) of total India EV sales in 2024. Ola Electric retained its leading position in the segment with the highest sales, followed by TVS Motor Company, while Ather Energy and Bajaj Auto also emerged as strong performers. Some other notable OEMs are also engaged in a competitive struggle to dominate the growing electric two-wheeler market in India.

Following two-wheelers, the commercial vehicle segment ranks as the next largest in the market, fueled primarily by the widespread adoption of e-rickshaws across the country. This surge highlights the increasing role of electric mobility solutions in public and commercial transportation nationwide.

The electric passenger car segment, though smaller in comparison, continues to show steady progress making up around 5.2% of total electric vehicle sales in India in 2024.

By Vehicle Propulsion Type

Battery Electric Vehicles (BEVs) are currently dominating India’s electric vehicle (EV) market, far ahead of other propulsion types such as plug-in hybrid electric vehicles (PHEVs) and fuel cell electric vehicles (FCEVs).

In fact, BEVs account for the vast majority of EV sales across the country—particularly in the fast-growing two-wheeler, three-wheeler, and commercial fleet segments.

Their dominance is driven by several key factors, such as lower operational and maintenance costs, government incentives and subsidies focused specifically on BEVs (via FAME II and state EV policies), and wider availability of models across vehicle categories.

Meanwhile, plug-in hybrids (PHEVs) occupy a relatively niche space, catering to a small premium market segment. Their uptake remains limited due to higher costs, limited product availability, and lack of policy support compared to BEVs.

Fuel cell vehicles (FCEVs), though promising in the long term, are still at an early stage in India, with negligible market presence due to high costs, lack of hydrogen infrastructure, and limited awareness.

Recent Developments

The Delhi government in July 2025, announced the extension of the state's EV policy until March 2026. The policy was first introduced in 2020, which led to a rise in EV registrations in Delhi, particularly among two-wheelers and e-rickshaws.

In June 2025, the Uttar Pradesh government updated its EV policy to include upstream infrastructure costs—becoming the first Indian state to do so. Eligible charging stations can now claim a 20% capital subsidy (up to INR 10 lakh) on investments of INR 25 lakh or more, excluding land costs. The policy is overseen by Invest UP.

In June 2025, the Indian government rolled out new guidelines for its electric car scheme, aiming to significantly boost domestic manufacturing of electric passenger vehicles. Under these revised rules, companies can now import up to 8,000 electric four-wheeler units annually at a reduced import duty of 15%. This is a substantial cut from the previous rates, which ranged from 70% to 100%. To qualify for this lower duty, companies must commit to investing at least INR 4,150 crore (USD 168 million) in establishing local manufacturing facilities within India.

Ather Energy has signed an MoU with Infineon Technologies Asia Pacific to jointly develop advanced semiconductor technologies for India’s electric vehicle sector. The agreement, signed in May 2025, in Seoul, South Korea aims to support innovation and accelerate growth in the country’s EV ecosystem.

In April 2025, BPCL partnered with Mahindra Electric Automobile Ltd. (MEAL) to expand EV charging infrastructure across India. Under the MoU, both companies will jointly set up fast-charging stations at BPCL outlets.

In February 2025, TATA Motors announced its plans to double the number of available charge points across India to 400,000 by 2027.

The new report from Blackridge Research on the Indian electric vehicle Market comprehensively analyzes the electric vehicle market and provides deep insight into the current and future state of the electric vehicle industry in India.

The study examines the drivers, restraints, and regional trends influencing India electric vehicles Market demand and growth.

The report also addresses present and future market opportunities, market trends, developments, important commercial developments, trends, countries, and segments poised for the fastest growth, and the competitive landscape.

Further, the report will also provide the India Electric vehicles Market size, demand forecast, and growth rates.

What Do We Cover in the Report?

Electric Vehicle Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain the growth.

The report includes a meticulous analysis of each factor, explaining the relevant qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and will function as a guide for you to analyze the degree of impact.

India Electric Vehicle Market Analysis

This report discusses the overview of the market, latest updates, important commercial developments and structural trends, and government policies and regulations in the region.

India Electric Vehicle Market Size and Demand Forecast

The report provides India Electric vehicle Market size and demand forecast until 2031, including year-on-year (YoY) growth rates and CAGR.

Electric Vehicle Market Industry Analysis

The report examines the critical elements of the electric vehicle industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the electric vehicle industry's state of competition and profitability.

India Electric Vehicle Market Segmentation & Forecast

The report dissects the India electric vehicle market into various segments based on vehicle type (two-wheelers, passenger vehicles, and commercial vehicle), and by vehicle propulsion type. A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for a "bespoke" market segmentation to better align the research report with your requirements.

Key Company Profiles

This report presents detailed profiles of Key companies in each segment of the Electric vehicles industry in India, such as Hero electric, OLA electric, Ather Energy, Tata Motors Ltd., MG Motor India, Toyota Motor Corporation, etc. In general, each company profile includes an overview of the company, relevant products and services, a financial overview, revenue growth, market share analysis and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the regional market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the Indian EV sector.

Executive Summary

Executive Summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly. The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of the India electric vehicle market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

1. Executive Summary

2. Research Scope and Methodology

3. Market Analysis

- 3.1 Introduction

- 3.2 Market Dynamics

- 3.2.1. Drivers

- 3.2.2 Restraints

- 3.3 Market Trends & Developments

- 3.4 Market Opportunities

- 3.5 Market Size and Demand Forecast

4. Industry Analysis

- 4.1 Supply Chain Analysis

- 4.2 Porter's Five Forces Analysis

5. Market Segmentation & Forecast

- 5.1 By Vehicle Type

- 5.1.1 Two Wheelers

- 5.1.2 Passenger Vehicles

- 5.1.3 Commercial Vehicles

- 5.2 By Vehicle Propulsion Type

- 5.2.1 Battery Electric Vehicle

- 5.2.2 Plug-in Hybrids

- 5.2.3 Fuel Cell Electric Vehicles

6. Key Company Profiles

- 6.1 Two-Wheeler Companies

- 6.1.1 OLA Electric

- 6.1.2 TVS Motors

- 6.1.3 Hero Electric

- 6.1.4 Ather Energy

- 6.1.5 Okinawa Autotech

- 6.1.6 Ampere Vehicles

- 6.1.7 Bajaj Auto

- 6.1.8 Other Notable Players

- 6.2 Passenger Vehicle Companies

- 6.2.1 Tata Motors

- 6.2.2 MG Motor India

- 6.2.3 Hyundai Motor Company

- 6.2.4 KIA Motors

- 6.2.5 BYD India

- 6.2.6 Mercedes-Benz

- 6.2.7 Other Notable Players

- 6.3 Commercial Vehicle Companies

- 6.3.1 Omega SEIKI

- 6.3.2 Mahindra & Mahindra Ltd

- 6.3.3 Piaggio & C.SpA

- 6.3.7 Other Notable Players

7. Competitive Landscape

- 7.1 List of Notable Players in the Market

- 7.2 M&A, JV, and Agreements

- 7.3 Market Share Analysis

- 7.4 Strategies of Key Players

8. Conclusions and Recommendations

List of Tables & Figures

Abbreviations

Additional Notes

Disclaimer

This report helps to

Gain a deeper understanding of the India Electric Vehicles Market.

Equip yourself with rigorous analysis and forward-looking insights into the India Electric Vehicles Market across multiple regions.

Gain an understanding of uncertainty and discover how the most influential growth drivers and restraints in the regions will impact market development.

Assess market size data and forecasts to understand how the demand across various segments evolves over the next few years.

Gain a comprehensive view of the emerging market trends and developments to assess market opportunities.

Be better informed of your competition by gaining access to detailed information and analysis of key industry players.

Keep on top of M&A developments, JVs, and other agreements to assess the evolving competitive landscape and enhance your competitive position

Who needs this report?

Automotive Manufacturers

EV Component Manufacturers

EV Battery Manufacturers

EV charging station manufacturers

Investor and Financing companies

What's included

Report - India Electric Vehicle Market Outlook to 2030.pdf

Market Data - India Electric Vehicle Market Outlook to 2030.xls

Why buy this report?

Gain a deeper understanding of the India Electric Vehicles Market.

Equip yourself with rigorous analysis and forward-looking insights into the India Electric Vehicles Market across multiple regions.

Gain an understanding of uncertainty and discover how the most influential growth drivers and restraints in the regions will impact market development.

Assess market size data and forecasts to understand how the demand across various segments evolves over the next few years.

Gain a comprehensive view of the emerging market trends and developments to assess market opportunities.

Be better informed of your competition by gaining access to detailed information and analysis of key industry players.

Keep on top of M&A developments, JVs, and other agreements to assess the evolving competitive landscape and enhance your competitive position

Want to know about Current Offers?

Offer 1 - Save with Multiple Purchases - Buy two reports or more and instantly save up to 15% off.

Offer 2 - Introductory offer for new customers - Flat 10% off on your first purchase.

To learn more about the report and our other current offers, contact us here or You can send an email to [email protected]

Analyst access from Blackridge Research

All report purchases come with up to 60 minutes of phone time with an expert analyst who will assist you in connecting the report's key findings to the business issues you're dealing with. This must be used within three months of the report's purchase.

The above telephone time is excluding the post-purchase analyst support for any queries that you may have up to one year.

Free Report Customization

We offer free customization of value USD 1500 for every report that you purchase. Get in touch with us to know more about free customization and our exciting custom research services.

Further Information

If you have any questions about this market research study, please do not hesitate to contact our research team using the top Contact us button, or you may also reach out at [email protected] or call one of our Business Development managers:

AMERICAS (USA): +1 (917) 993 7467

ASIA (India): +91 8500 460 460

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!