Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 238

About this Report

The Offshore Wind Turbine Installation Vessels (WTIV) market is currently experiencing significant growth, driven by the global shift towards renewable energy sources and the increasing demand for offshore wind farms.

As countries and regions strive to reduce their carbon footprint and meet renewable energy targets, offshore wind power has emerged as a crucial component of their sustainable energy strategies. This has led to a surge in offshore wind projects and, consequently, a rising need for specialized vessels capable of efficiently installing and maintaining offshore wind turbines in challenging environments.

However, the industry also faces challenges, including high initial investments, weather-dependent operations, limited number of vessels, and the associated competition for vessel capacity. Despite these constraints, the future of the WTIV market looks promising as it continues to play a crucial role in the global transition towards a more sustainable energy landscape.

Market Definition

A Wind Turbine Installation Vessel (WTIV) is a specialized marine vessel designed specifically for the transportation, lifting, and installation of offshore wind turbines and their components. These vessels are equipped with heavy-duty cranes, dynamic positioning systems, and—often—jack-up legs that allow the vessel to elevate itself above the sea surface, providing a stable working platform. WTIVs play a crucial role in offshore wind farm construction, enabling the efficient assembly and installation of turbine towers, blades, nacelles, and foundations in challenging marine environments.

Market Drivers

Increasing Offshore Wind Capacity Additions

As countries around the world continue to grapple with energy security issues and the urgent need to address climate change, they are increasingly turning their attention to the potential of the offshore wind power industry to transition away from fossil fuels and achieve carbon neutrality.

These goals are often part of broader commitments outlined in international agreements such as the Paris Agreement.

Governments globally are reinforcing offshore wind as a cornerstone of decarbonization, with plans to incorporate a substantial share of offshore wind into their energy mix. For instance, Germany aims to develop 30 GW of offshore wind capacity by 2030, and the EU's Clean Industrial Deal seeks to reduce greenhouse gas emissions by 90% by 2040, which includes speeding up permitting for offshore wind.

The offshore wind sector has captured the focus of policymakers and energy planners due to its vast potential. Unlike onshore wind farms, which may face limitations in land availability and opposition from local communities, offshore wind farms are typically situated in waters where wind resources are abundant and consistent. This positioning offers several advantages, including stronger and more consistent winds, reduced visual impact, and the potential to build larger, more powerful turbines.

Post-COP 26, there's been a surge in offshore wind ambition worldwide. Many governments are setting new targets or increasing existing ones in response to the energy crisis triggered by the Ukraine-Russia war, particularly in Europe. Offshore wind is seen as a key solution to enhance energy security and combat climate change. Advances in technology and public demand are driving this rapid expansion.

For instance, the European Commission's REPowerEU plan aims to liberate Europe from Russian fossil fuels before 2030. The Esbjerg Declaration, embraced by Denmark, the Netherlands, Belgium, and Germany, sets an ambitious target of achieving 150 GW of offshore wind capacity by 2050.

Additionally, the UK Government has raised its offshore wind target by 10 GW, targeting 50 GW by 2030.

Even beyond Europe, countries like Vietnam are actively pursuing significant offshore wind expansions in their Power Development Plan 8 (PDP8). According to the PDP's latest amendments in April 2025, the country is planning for offshore wind power projects with total capacity ranging from 6,000 MW to 17,032 MW to begin operations between 2030 and 2035, extending slightly beyond the initial planning period of PDP 8.

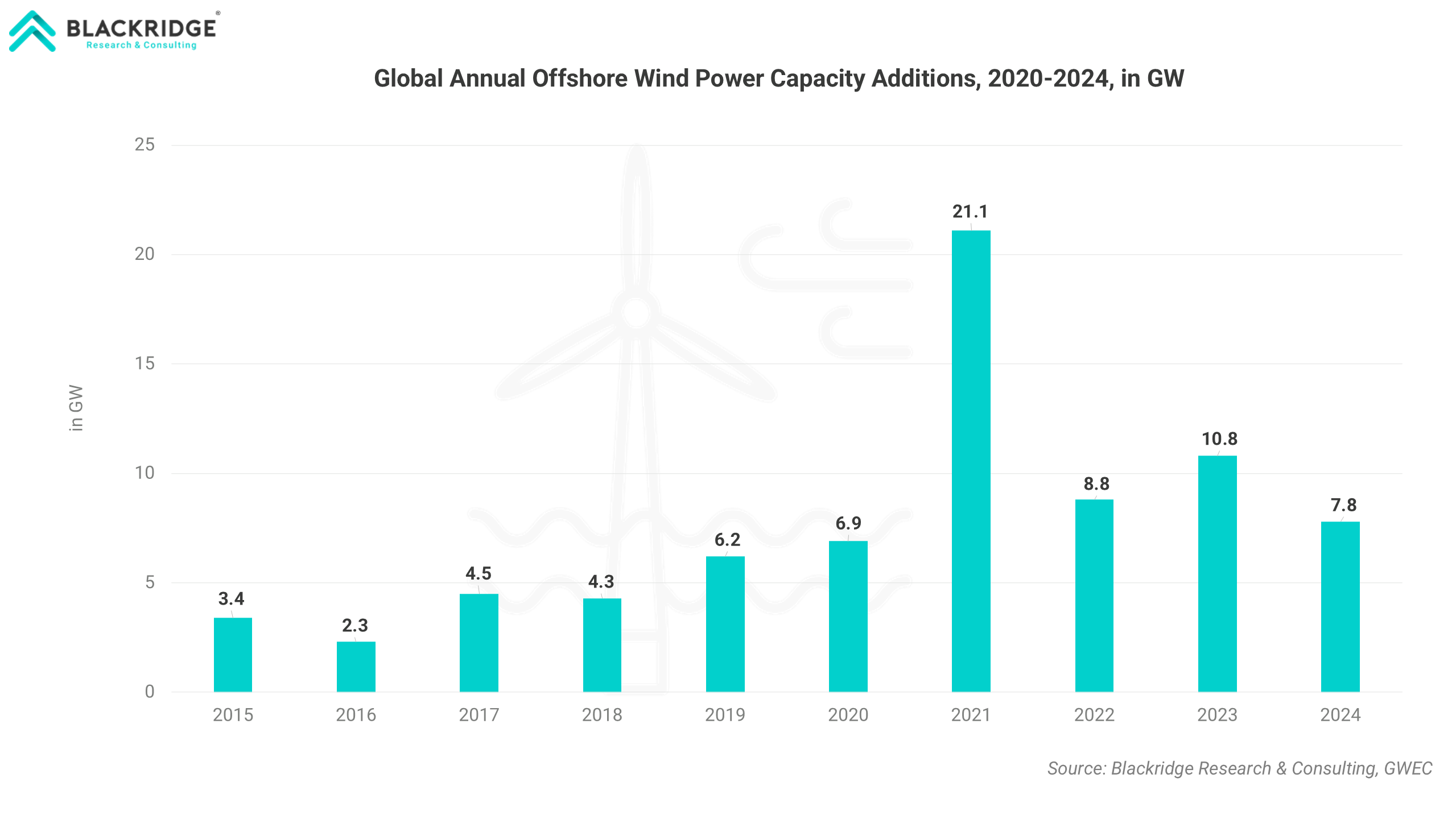

According to the global wind energy council (GWEC) In 2024, global offshore wind capacity witnessed an addition of around 8 GW of wind power, primarily propelled by China's impressive growth of 4 GW. Although the new capacity additions were 26% lower than the previous year, 2024 marked the fourth-highest year in offshore wind history to date.

To foster the growth of the offshore wind sector, governments are implementing supportive policies, offering incentives, and streamlining regulatory processes. They are also investing in research and development to drive technological advancements and make offshore wind energy even more cost-effective and efficient.

For instance, The Philippines government has introduced the Energy Virtual One-Stop Shop (EVOSS) to expedite regulatory approvals and a Memorandum of Agreement (MoA) between the Department of Environment and Natural Resources (DENR) and the Department of Energy (DOE) to streamline offshore wind permitting, particularly seabed and foreshore leases.

Similarly, South Korea's Offshore Wind Power Promotion Act (OSS Bill), passed in February 2025, aims to streamline complex permitting by introducing a centralized approach for site designation and exclusivity.

Furthermore, there has been a significant demand for wind energy solutions from countries like Germany, the U.S., and Canada, as well as France. This development has in turn spurred unprecedented demand, resulting in a backlog of wind turbine orders that the sector is currently experiencing.

The global wind turbine order intake reached new industry highs with 91.2 gigawatts (GW) of activity, a 23 percent increase year-over-year (YOY), and the investment by developers globally totaled USD 42 billion in H1 2024; this emphasizes the future prospects of this industry.

Market Restraints

Vessel Obsolescence

The rapid evolution in offshore wind turbine technology, particularly the sharp increase in the offshore wind turbine size and weight, poses a significant challenge to the Wind Turbine Installation Vessel (WTIV) market. Modern turbines now exceed 15 MW in capacity, with industry trends indicating a move toward 20–25 MW units in the coming years. This escalation in turbine dimensions requires WTIVs with significantly greater lifting heights, deck space, and crane capacities.

For instance, transitioning from 11 MW to 15 MW turbines demands a substantial upgrade in vessel capabilities. WTIVs must be able to lift components approximately 20 meters higher and manage lifting capacities of 1,000 to 1,200 tons—far above the 650 to 700 tons typically required for 11 MW turbines. Moreover, this must be achieved with extreme precision, often within tolerances as tight as 5–8 millimeters.

As a result, there is a growing risk that vessels commissioned or built today could face obsolescence within a few years, as they may be unable to meet the requirements of next-generation turbines. This uncertainty makes it difficult for WTIV owners and operators to accurately forecast future technical specifications, hindering long-term investment decisions and introducing significant financial risk.

Current Scenario of the Global WTIV Market

According to Blackridge Research and Consulting, increasingly large turbine installations are expected to occur during the forecast period, and the offshore wind energy market is expected to experience a shortage of wind turbine installation vessels in the coming years.

Until recently, the need for larger wind turbines has been met by wind turbine installation vessels (WTIVs), heavy lift vessels, and semi-submersibles designed for the oil and gas and port/salvage markets.

However, with the average turbine capacity growing from three megawatts in 2010 to 6.5 megawatts now and offshore wind projects increasingly requiring 15-megawatt turbines, only a few vessels worldwide can presently install turbines over ten megawatts. Hence, there is an urgent need for more advanced new vessels.

Market Opportunities

There is a continuous trend of offshore wind turbines and their foundations growing in size and capacity, necessitating specialized vessels with higher lifting capacities and greater payload capabilities. WTIV contractors possessing a strong fleet of modern, heavy-lift vessels are well-positioned to capitalize on upcoming offshore wind projects, gaining a competitive advantage in meeting the evolving technical and operational requirements of the industry.

The offshore wind sector is undergoing significant worldwide expansion, marked by rapid development and major new projects emerging outside of Europe—especially in the US and Asia. Notable examples include large-scale initiatives such as the Coastal Virginia Offshore Wind project in the United States and the Hai Long and Greater Changhua projects in Taiwan.

These fast-growing, strategically important markets present strong opportunities for WTIV contractors to expand their business footprint, diversify revenues, and establish an early presence in regions set for sustained offshore wind growth.As the offshore wind fleet grows and existing wind farms age, there is a rising demand for Operations and Maintenance (O&M) services. This trend presents valuable opportunities for WTIV contractors to optimize vessel utilization by deploying their fleets for O&M activities during periods between major installation projects.

Recent Development

In July 2025, Hamburg-based Skyborn Renewables, a leading offshore wind developer and operator, signed a Preferred Supplier Agreement (PSA) with Norway’s Fred. Olsen Windcarrier for the transport and installation of wind turbines at the upcoming Gennaker offshore wind farm, located in the German sector of the Baltic Sea. Installation work is scheduled to begin in 2028.

In July 2025, Copenhagen-based Cadeler A/S announced that Ørsted A/S has terminated their long-term agreement for a newbuild A-Class wind turbine installation vessel, originally secured from Q1 2027 to the end of 2030. The termination follows Ørsted’s decision to halt development of the Hornsea 4 offshore wind farm.

Cadeler has taken delivery of its newly built jack-up wind turbine installation vessel (WTIV), Wind Keeper, in July 2025, marking the latest addition to its fleet. The vessel has also secured a long-term contract for its maiden assignment with Vestas, strengthening Cadeler’s operational portfolio in the offshore wind sector.

In May 2025, Lamprell, a major EPCI contracting service provider in the UAE, has signed a memorandum of understanding (MoU) with Dong Fang Offshore (DFO) for a newbuild NG-9000X wind turbine installation and maintenance vessel.

In February 2025, Seatrium officially began sea trials for Charybdis, the first Jones Act-compliant Wind Turbine Installation Vessel (WTIV) built in the United States. Commissioned by Dominion Energy, the vessel recently completed successful jacking trials and main crane load testing, marking a key milestone in its development.

In January 2025, Dutch offshore vessel contractor Van Oord officially took delivery of Boreas, the world's largest wind turbine installation vessel, now entering operational service. At 175 meters long, Boreas features a 155-meter-high lifting boom capable of lifting over 3,000 tons, enabling it to install next-generation offshore wind turbines up to 20 MW in capacity.

In December 2024, Dogger Bank Wind Farm signed a heavy lift vessel reservation agreement with Seaway7, a Subsea7 Group company, to charter a second turbine installation vessel. Beginning in 2026, the Seaway Ventus jack-up vessel will support turbine transport and installation of GE Vernova Haliade-X offshore wind turbines at the Dogger Bank site off the coast of England.

In October 2024, Cadeler A/S finalized firm contracts to deliver installation vessel services for the Bałtyk 2 and Bałtyk 3 offshore wind farm projects in the Polish Baltic Sea. Both projects are jointly owned by Equinor and Polenergia, each holding a 50% stake. The contracts carry a total potential value estimated between EUR 120 million and EUR 144 million. Operations are slated to commence in 2027, marking Cadeler’s continued expansion in the growing Central and Eastern European offshore wind market.

The new report from Blackridge Research on the Global Offshore Wind Turbine Installation Vessel Market comprehensively analyzes the offshore wind turbine installation vessel Market and provides deep insight into the current and future state of the industry.

The study examines the market dynamics and regional trends influencing Global Offshore Wind Turbine Installation Vessel Market demand and growth.

The report also addresses present and future market opportunities, market trends and developments, and the impact of geopolitics on the offshore wind turbine installation vessels market; important commercial developments, trends, regions, and segments poised for fastest growth; the competitive landscape; and the market share of key players.

Further, the report will also provide offshore wind turbine installation vessel market size, demand forecast, and growth rates.

What Do We Cover in the Report?

Offshore Wind Turbine Installation Vessel Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain growth.

The report includes a meticulous analysis of each factor, explaining the relevant qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and will function as a guide for you to analyze the degree of impact.

Offshore Wind Turbine Installation Vessel Market Analysis

This report provides a market overview, latest updates, important commercial developments and structural trends, and government policies and regulations.

Offshore Wind Turbine Installation Vessel Market Size and Demand Forecast

The report provides the Global Offshore Wind Turbine Installation Vessel Market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Offshore Wind Turbine Installation Vessel Market Industry Analysis

The report examines the critical elements of the offshore wind turbine installation vessel industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the Offshore Wind Turbine Installation Vessel industry's state of competition and profitability.

Offshore Wind Turbine Installation Vessel Market Segmentation & Forecast

The report dissects the global wind turbine installation vessel market into various segments based on vessel type: self-propelled, normal jack up vessel, and heavy lift vessel.

A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies and regulations, and market outlook.

In addition, market size, demand forecasts, and growth rates will be provided for all regions and emerging markets.

Following are the notable countries covered under each region.

North America: United States, Canada, Mexico, and the Rest of North America

Europe: Germany, France, the United Kingdom (UK), Russia, and the Rest of Europe

Asia-Pacific: China, India, Japan, South Korea, Australia, and the Rest of APAC

Rest of the world: Middle East, Brazil, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of Key companies in the global wind turbine installation vessel market, such as Deme Group, Jan De Nul Group, Van Oord, Cadeler A/S, Fred. Olsen Windcarrier, Dominion Energy, Inc., etc. In general, each company profile includes - overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the global market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

Executive summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of the Global Offshore Wind Turbine Installation Vessel Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!