Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 263

About this Report

The global electrolyzer market has witnessed remarkable growth in recent years, driven by several key factors:

Growing support from governments in the form of strategies, policies, initiatives, investments, and deployment targets

Rising adoption of hydrogen as a clean fuel due to its benefits

Growing interest in fuel cell electric vehicles (FCEVs) and hydrogen infrastructure

Increasing demand for hydrogen from industries

Rapidly growing low-carbon hydrogen production projects

However, factors such as high initial investments, a lack of hydrogen infrastructure, including distribution and storage facilities, and competition from other methods such as natural gas reforming are acting as restraints on the growth of the global electrolyzer market.

Introduction

An electrolyzer is a device that employs electricity to facilitate the process of electrolysis, which involves passing an electric current through a substance to induce its decomposition into its fundamental constituent elements. This commonly involves the separation of water or other compounds into their primary components.

Currently, electrolyzers stand as the pivotal technology for generating hydrogen from water through the process of electrolysis. Water electrolysis is an electrochemical process that splits water (H2O) into hydrogen (H2) and oxygen (O2) using electricity. This process takes place in the electrolyzer.

The primary reason for producing hydrogen using an electrolyzer is to solve the intermittence issue caused by renewable energy sources, as hydrogen can be stored for longer durations when compared to any other energy storage method.

Working of an Electrolyzer

An electrolyzer comprises a conductive electrode stack separated by a membrane that is subjected to high voltage and current. This creates an electric current in the water, causing it to disintegrate into its constituents: oxygen and hydrogen.

The whole electrolyzer system includes pumps, power electronics, compressors, a gas separator, and other auxiliary components such as storage tanks. In some situations, the oxygen produced in parallel is discharged into the atmosphere or kept for future use as a medicinal or industrial gas.

Hydrogen is compressed or liquefied and stored to be used in industry or hydrogen fuel cells.

Types of Electrolyzers

There are four main electrolyzer technologies:

Alkaline Electrolyzer

Proton exchange membrane (PEM) / polymer electrolyte membrane electrolyzer

Others (Solid Oxide Electrolyzer Cells and Anion exchange membranes)

Electrolyzers have several major applications across various industries, primarily centered around the production and utilization of hydrogen. The major applications of electrolyzers include hydrogen production, chemical synthesis, space and aerospace applications, etc.

Drivers

Growing Support from Governments

Governments around the world are increasingly recognizing the importance of hydrogen and electrolyzers in achieving their environmental and energy goals. They are enacting policies that incentivize and promote the use of green hydrogen produced via electrolysis. These policies often involve setting emission reduction targets and mandates for the integration of green hydrogen systems into various sectors, driving up demand for electrolyzers.

Prominent nations have taken significant steps by unveiling their hydrogen roadmaps as integral components of their energy transition strategies. For instance, in June 2023, the U.S. Department of Energy unveiled the U.S. National Clean Hydrogen Strategy and Roadmap.

The roadmap not only encapsulates the current landscape of hydrogen production, transportation, storage, and utilization in the United States but also adopts a forward-looking perspective in the development of the green hydrogen market. It offers insights into how clean hydrogen will contribute to national decarbonization objectives and presents future demand scenarios for clean hydrogen. This, in turn, has the potential to catalyze increased demand for electrolyzer technology.

In order to achieve their determined emission reduction targets promised in the international forums, governments are implementing incentive programs that offer financial support to companies and industries investing in electrolyzer technology. These incentives can take the form of grants, subsidies, tax credits, or rebates. Such programs reduce the financial burden on businesses looking to adopt or scale up electrolyzer projects.

For instance, the incentives announced in 2022 by the United States government under the Inflation Reduction Act led to an increase in the number of new electrolyzer manufacturing facilities in the nation, making way for the development of the hydrogen market in the nation.

Similarly, in April 2025, the European Union approved EUR 400 million for Spain's Hydrogen Scheme. This funding is set to support the construction of up to 345 megawatts (MW) of electrolyzer capacity and the production of up to 221,000 tons of renewable hydrogen in Spain.

(You can access a comprehensive list of both existing and upcoming Hydrogen Projects, along with their current status, through our extensive Global Projects Database)

Restraints

Policy and Regulatory Uncertainty

Policy uncertainty remains a significant barrier to the global electrolyzer industry, as it creates an unpredictable environment for investment, project planning, and long-term market growth.

A key example is the U.S. Inflation Reduction Act (IRA), introduced under the Biden administration in 2022, which offered substantial incentives through the 45V production tax credits (PTCs)—up to USD 3/kg—based on the carbon intensity of hydrogen production.

These credits were made available to both green hydrogen projects, powered by renewable electricity and electrolyzers, and blue hydrogen projects, utilizing steam methane reforming with carbon capture, utilization, and storage (CCUS).

However, a shift in political leadership has altered the policy landscape. Under President Trump’s administration, the proposed tax bill titled “One Big Beautiful” advanced the eligibility deadline for 45V tax credits, requiring projects to begin construction by January 1, 2026, instead of the original January 1, 2033 deadline outlined by the IRA. These changes were reaffirmed in a revised bill released by the Senate Finance Committee on June 16, 2025.

This abrupt change poses a serious challenge for the hydrogen industry—especially for green hydrogen projects, which typically require long development timelines, significant upfront capital, and dedicated renewable energy sourcing.

Accelerating construction and achieving financial close within the newly shortened window is widely viewed as unrealistic, leading to growing hesitation among investors and project developers, and threatening to stall momentum in the U.S. electrolyzer market.

Segment Analysis by Type

As of the end of May 2024, approximately 1.75 GW of electrolyzer capacity had been deployed worldwide, while an additional 26 GW had reached Final Investment Decision (FID) globally.

Of the 1.75 GW deployed, around 60% of the capacity has a specified technology. Within this portion, alkaline electrolyzers account for roughly 75%, while proton exchange membrane (PEM) technology makes up the remaining 25%.

Regional preferences for electrolyzer technologies are also emerging. In China, around 90% of installed electrolyzers are alkaline, reflecting a preference for cost-effective, mature solutions.

Conversely, in Europe and North America, PEM technology dominates, comprising approximately 80% of deployed capacity, driven by its higher efficiency and suitability for dynamic operation with renewable energy sources.

(For a much deeper understanding of the market segment analysis, subscribe to the report)

Regional Analysis

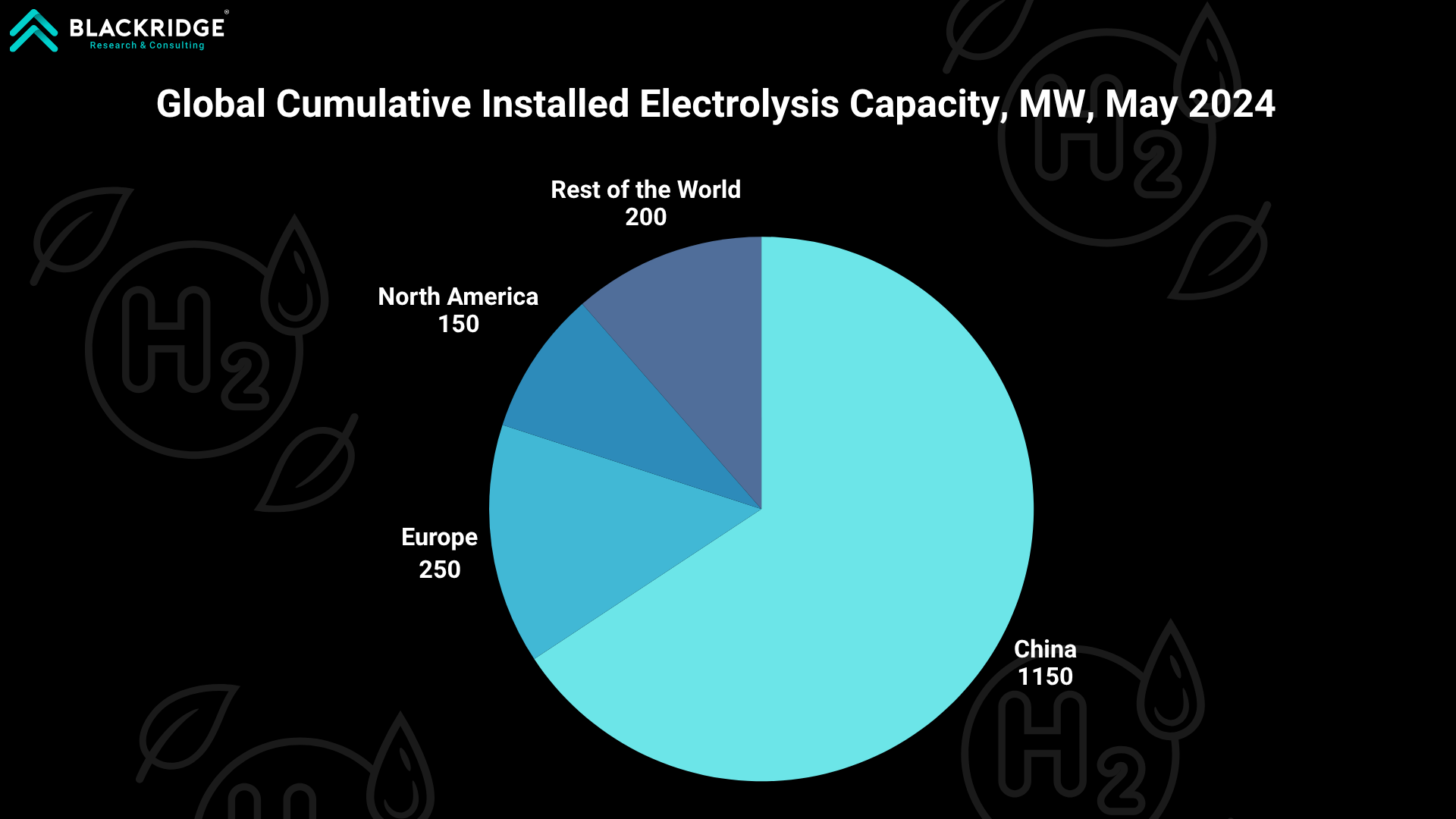

Progress in electrolyzer development spans across various continents, with China taking the lead in installed capacity, while the European Union and the United States have implemented significant policy initiatives.

Countries and regions that are making noteworthy strides in advancing electrolyzer technology include:

China: China continues to lead the global electrolyzer market, both in terms of installed capacity and manufacturing capabilities. As of May 2024, the country had deployed nearly 1,150 MW of cumulative electrolyzer capacity.

China also dominates the project pipeline, with its share of committed electrolyzer volumes steadily increasing—from 40% to 55%, and now reaching 65% of the global total.

Furthermore, China accounts for 60% of the global electrolyzer manufacturing capacity, highlighting its substantial contribution to the industry's growth.

Europe: As of May 2024, the region has a cumulative electrolyzer capacity of 250 MW. Major nations contributing to this capacity are Germany with 80 MW, Spain, and Sweden with 25 MW each. In July 2022, the European Commission approved EUR 5.4 billion in funding to bolster its inaugural hydrogen-related Important Project of Common European Interest (IPCEI), known as Hy2Tech.

This initiative focuses on advancing hydrogen technologies and includes incentives to support electrolyzer manufacturers, further promoting the development of this critical sector.

North America: As of May 2024, the United States led North America in deployed electrolyzer capacity, with approximately 150 MW installed. The country’s momentum in clean hydrogen development has been significantly driven by the Inflation Reduction Act (IRA), which introduced generous tax credits and production incentives for green hydrogen and related manufacturing projects.

These incentives have catalyzed a wave of announcements for new electrolyzer manufacturing facilities, underscoring growing confidence in the hydrogen economy and the country’s intention to localize production and reduce dependence on foreign technologies.

However, as of early 2025, there is growing uncertainty surrounding the future of these incentives, following President Trump’s return to office in January 2025. Potential executive orders or policy reversals have raised concerns about the continuity of support for green hydrogen initiatives, casting a shadow over the long-term investment outlook.

Current Scenario of the Electrolyzer Industry

As of May 2024, the deployment of electrolysis capacity experienced substantial growth, surging by approximately 60% compared to 2022, reaching a total of 1.75 GW, a significant increase from the previous 1.1 GW. This installed capacity translates to approximately 185 kilotons per annum (kt p. a.) of renewable hydrogen supply.

The primary driver behind this growth is the substantial addition of electrolyzer capacity in China. Presently, China holds the lead in deployed electrolyzer capacity, with 1150 MW. Notably, the world's two most significant operational projects, each with capacities of 260 MW and 150 MW, are situated in China.

Following China, the United States and Germany have notable capacities of 110 MW and 80 MW respectively. Additionally, Spain, Taiwan, Sweden, and Canada each contribute approximately 25 MW to the global electrolyzer capacity landscape.

Taking into account the robust pipeline of projects currently under development and their anticipated operational dates, it is anticipated that global electrolysis capacity will experience a swift and substantial expansion in the forecast period.

Recent Developments

In July 2025, Belgian technology company John Cockerill Hydrogen acquired part of the assets of French energy company McPhy to accelerate the development of its new generation of pressurized alkaline electrolyzers.

In July 2025, Hynamics I-JK—a wholly owned subsidiary of EDF Group focused on low-carbon and renewable hydrogen production—and Hy24, a leading low-carbon hydrogen asset manager, signed a Memorandum of Understanding (MoU) to establish an exclusive partnership. The collaboration aims to jointly develop and finance the Fawley Green Hydrogen Project.

Masdar and EnBW signed a strategic MoU in July 2025, to collaborate on energy storage and green hydrogen projects across Europe to support broader energy transition goals in Europe and beyond.

In July 2025, Petronas entered into a strategic partnership with national utility Tenaga Nasional Berhad (TNB) and state-owned investor Terengganu Inc. to launch a floating solar-powered green hydrogen project in eastern Malaysia.

Nel Hydrogen, a Norwegian electrolyzer manufacturing company, has announced its decision to temporarily halt production at the alkaline electrolyzer production facility in Herøya, Norway in January 2025.

In February 2024, India awarded tenders for 1500 MW electrolyzer manufacturing.

Danish catalyst and technology company Topsoe has landed a EUR 94 million grant from the EU's Innovation Fund, supporting its construction of a factory for Solid Oxide Electrolyzer Cells (SOECs) in Herning, Denmark.

Siemens Energy, and Air Liquide officially inaugurated their joint venture gigawatt electrolyzer factory in Berlin, in November 2023.

In June 2023, Ohmium International's Indian subsidiary was chosen as a PEM electrolyzer partner for NTPC Renewable Energy Limited (NTPC REL), a subsidiary of India's NTPC. Ohmium's electrolyzers will be used in up to 400 MW projects across various sectors, with the agreement lasting until May 2025.

Cleantech firm EVoLOH, Inc. in September 2023, revealed its recent move to lease an industrial facility in Lowell, Massachusetts. This facility is currently undergoing preparations to become EVoLOH's Manufacturing Center of Excellence, where the company will manufacture innovative anion exchange membrane (AEM) electrolyzer stacks designed for the production of green hydrogen.

In September 2023, DuPont made a significant announcement regarding its entry into the green hydrogen market. The company introduced its inaugural product tailored specifically for green hydrogen production: the DuPont AmberLite P2X110 Ion Exchange Resin. This specialized ion exchange resin has been designed to facilitate hydrogen generation from water, catering to the distinctive chemistry of electrolyzer systems.

Nel Hydrogen announced its plans to build its Gigafactory in Plymouth Township which will be among the world’s largest electrode plants.

Fusion Fuel, a pioneer in innovative green hydrogen solutions, has secured a significant purchase order for a 300 kW hydrogen electrolyzer and balance of plant system from a prominent global provider of building solutions.

In June 2023, India's Ministry of New and Renewable Energy (MNRE) unveiled guidelines for the implementation of incentive schemes targeting green hydrogen and electrolyzer production. These schemes collectively offer substantial incentives amounting to INR 17,490 crore (USD 2 billion) over a five-year period, spanning from FY 2024-25 to FY 2029-30.

Opportunities

Green Hydrogen Production: The transition to green hydrogen, produced using renewable energy sources, is a major opportunity. Governments and industries are investing heavily in green hydrogen projects to reduce carbon emissions. Electrolyzers play a pivotal role in this shift.

Renewable Energy Integration: Electrolyzers can store excess renewable energy and convert it into hydrogen, providing grid stability and energy storage solutions. As renewable energy adoption continues, this integration becomes more crucial.

Transportation Sector: The rise of hydrogen fuel cell vehicles (FCVs) and the expansion of hydrogen refueling infrastructure create opportunities for electrolyzer manufacturers. FCVs are gaining traction, especially in heavy-duty transport.

Industrial Applications: Industries like chemicals, refining, and steel manufacturing are exploring hydrogen as a cleaner alternative to reduce emissions. Electrolyzers can supply hydrogen for these processes.

Government Initiatives: Various governments worldwide are providing incentives, subsidies, and funding for green hydrogen and electrolyzer projects. Manufacturers can benefit from these support mechanisms.

The new report from Blackridge Research on the Global Electrolyzer Market comprehensively analyzes the electrolyzer market and provides deep insight into the current and future state of the industry.

The market research report examines the drivers, restraints, and key market trends influencing global electrolyzer market demand and growth.

The report also addresses present and future market opportunities, market dynamics, and the impact of geo-politics on the global hydrogen electrolyzer market, as well as important commercial developments, trends, regions, and segments poised for the fastest growth, competitive landscape, and electrolyzer market share of key players.

Further, the report will also provide global electrolyzer market size, demand forecast, and growth rates.

What do we Cover in the Report?

Global Electrolyzer Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain growth.

The report includes a meticulous analysis of each factor, explaining the relevant, qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and will function as a guide for you to analyze the degree of impact.

Global Electrolyzer Market Analysis

This report discusses an overview of the market, the latest updates, important commercial developments and structural trends, and government policies and regulations.

This section provides an assessment of the geo-politics impact on global electrolyzers market demand.

Global Electrolyzers Market Size and Demand Forecast

The report provides global market size and demand forecasts until 2030, including year-on-year (YoY) growth rates and CAGR.

Global Electrolyzer Market Analysis

The report examines the critical elements of the global electrolyzer industry supply chain, its structure, and the participants.

Using Porter's five forces framework, the report covers an assessment of the global electrolyzer industry's state of competition and profitability.

Global Electrolyzer Market Segmentation & Forecast

The report dissects the global electrolyzer market into segments based on product type. A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies & regulations, and market outlook.

In addition, market size, demand forecast, and market growth rates will be provided for all regions.

Following are the notable countries covered under each region.

North America - United States, Canada, Mexico, and the Rest of North America

Europe - Germany, France, United Kingdom (UK), Russia, and the Rest of Europe

Asia-Pacific - China, India, Japan, South Korea, Australia, and the Rest of APAC

Rest of the World – South America, the Middle East, and Africa

Key Company Profiles

This report presents detailed profiles of key companies in the global electrolyzer industry, such as Nel ASA, Plug Power Inc., ITM Power plc, Cummins Inc., Siemens Energy AG, McPhy Energy SA, etc.

Generally, each company profile includes a company overview, relevant products and services, a financial performance, recent developments, and company's business strategy.

Competitive Landscape

The report provides a comprehensive list of notable companies in the market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

The executive summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an executive summary chapter and ends with conclusions and recommendations.

Get a free sample copy of the global electrolyzer market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Also, check out our latest regional reports on:

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Loading testimonials...

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!