Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 229

About this Report

Blackridge Research foresees rapid growth in global Electric Vehicle (EV) sales during the forecast period. The global EV market share has been growing at an impressive pace owing to factors such as favorable initiatives by the governments across the world to promote EV adoption, long-term economic advantages offered by electric vehicles, improving affordability, expanding charging infrastructure, etc.

However, the concentration of the battery supply chain in certain geographies and the high upfront cost of EVs are some of the major restraints to the market growth.

Electric Vehicle (EV) Market Definition

The electric vehicle (EV) market comprises all road transport vehicles that are powered, fully or partially, by electric propulsion systems drawing energy from onboard rechargeable batteries or fuel cells instead of, or in addition to, conventional internal combustion engines.

It includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs), as well as emerging categories such as fuel cell electric vehicles (FCEVs).

The market spans multiple segments, such as passenger cars, commercial vehicles (light, medium, and heavy-duty), and two- and three-wheelers, with applications in both private and public transport.

Market Dynamics

Market Drivers

Governments worldwide are actively supporting the adoption of electric vehicles (EVs) through a mix of financial incentives and regulatory measures. Direct incentives such as purchase subsidies, tax credits, and exemptions from registration or purchase taxes have played a crucial role in boosting sales.

For instance, in April 2024, China launched a trade-in scheme offering CNY 20,000 (USD 2,750) to consumers replacing older vehicles with new EVs. The country also extended its 10% purchase tax exemption for New Energy Vehicles (NEVs) until the end of 2027.

Similarly, in the United States, revisions to the Clean Vehicle Tax Credit in early 2024 enabled buyers to claim an immediate discount of up to USD 7,500 at the point of purchase. In Latin America, government measures such as tax exemptions, reduced registration fees, and relaxed traffic restrictions have also provided momentum for EV adoption.

Beyond financial incentives, governments are increasingly relying on regulatory frameworks and long-term policies to accelerate electrification. These include emissions standards, manufacturing mandates, and infrastructure development targets.

For example, the United Kingdom’s Vehicle Emissions Trading Scheme requires 22% of new registrations in 2024 to be Battery Electric Vehicles (BEVs) or Fuel Cell Electric Vehicles (FCEVs), rising to 28% in 2025.

In the United States, California’s Advanced Clean Cars II (ACC-II) regulation—adopted by 11 other states and Washington, D.C.—mandates a steadily increasing share of EV and FCEV sales, with the ultimate goal of achieving 100% by 2035.

Together, these financial incentives and regulatory commitments are driving the global shift toward electric mobility.

Market Restraints

High upfront vehicle price remains a major restraint on global EV adoption because batteries still add thousands of dollars to bill-of-materials, pushing retail prices above comparable ICE models in many markets despite falling pack costs and incentives.

Even as battery pack prices fell roughly 20% in 2024 to about USD 115/kWh, many EVs remain priced at a premium outside China, delaying mass-market penetration until broader price parity is achieved across segments and regions.

Battery packs account for a large share of EV cost, historically around one-third of vehicle production cost, so even modest per‑kWh differences translate into multi‑thousand‑dollar retail premiums versus ICE in most segments.

Market Segment Analysis

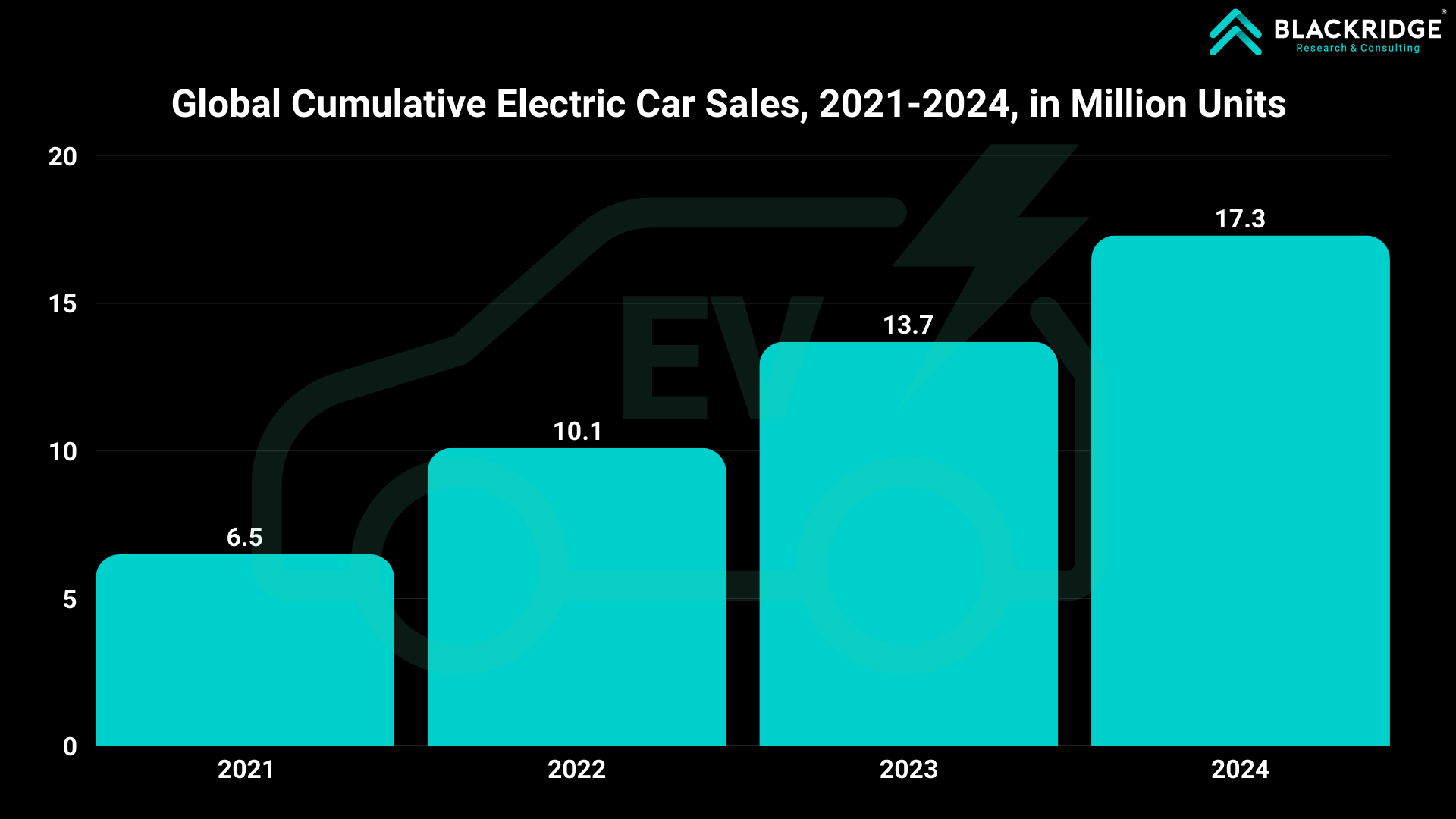

The global electric vehicle (EV) market is currently dominated by the passenger vehicle segment, which continues to dominate sales and drive the overall momentum of electrification. In 2024, electric passenger car sales surged, making them the largest and fastest-growing segment.

This is driven primarily by the strong electric car sales in China, where nearly half of all car sales are electric, combined with supportive policies, falling battery prices, and a growing variety of affordable models. Electric cars also account for the majority of EV battery demand.

Following electric cars, two- and three-wheelers (2/3Ws) represent another important segment, particularly in emerging markets such as China, India, and Southeast Asia. They are the most electrified by fleet share globally, offering an affordable entry point into clean mobility.

With removable or swappable batteries, 2/3Ws require less charging infrastructure, making them especially popular for commercial applications like deliveries and ride services. Although their sales growth has slowed in some regions, they remain a critical contributor to EV adoption worldwide, especially in Asia-pacific.

Light commercial vehicles (LCVs) form the next segment, gaining traction in urban logistics and last-mile delivery. Growth has been particularly strong in China, supported by incentives and operational savings, while Europe and the United States are gradually expanding adoption through policy support and fleet electrification by major companies such as United Parcel Service, Inc., DHL, etc.

Electric buses also play a significant role in the transition to cleaner transport. China leads this segment, but deployment is rising in Europe, India, and Latin America as battery prices decline and governments implement innovative financing models. Most electric buses are battery-electric, reflecting technological advances and the rollout of depot charging infrastructure.

Finally, electric trucks represent the smallest but fastest-emerging segment. Growth has been strongest in China, with Europe and North America also beginning to scale adoption.

While high upfront costs and infrastructure needs remain barriers, improvements in total cost of ownership, coupled with the development of megawatt EV charging and battery-swapping solutions, are gradually positioning electric trucks as a viable option for specific applications such as regional haul and logistics.

Regional Market Analysis

Asia-Pacific

The Asia-Pacific region dominates the global EV market across nearly all vehicle categories, driven primarily by China. China has become the world’s EV hub, producing more than two-thirds of global electric cars and representing the largest share of electric buses and trucks.

The nation's strong EV sales momentum due to affordability, strong government incentives, and domestic manufacturing capacity is driving rapid adoption.

Other countries in the region, including India, Japan, and those in Southeast Asia, are also emerging as key players, particularly in segments like electric two- and three-wheelers.

India, for example, leads globally in electric three-wheeler adoption, while Southeast Asia is gaining traction with battery-swapping models to improve affordability and convenience. Overall, Asia-Pacific accounts for the majority of global EV sales and battery demand, maintaining its position as the epicenter of electric mobility.

Europe

Europe remains a significant region in the global EV market, particularly for electric cars and buses. Despite maintaining a strong sales share – around one-fifth of total car sales in 2024 – growth has slowed due to reduced subsidies and affordability challenges. Norway continues to set benchmarks with near-total electrification, while the UK and Germany are pushing adoption through regulatory targets and emissions schemes.

Electric buses are another bright spot, with European cities rapidly electrifying their public transport fleets. However, challenges remain in the light commercial vehicle and truck segments, where adoption is steady but slower compared to Asia. Even so, upcoming EU CO₂ standards and regulatory targets are expected to sustain Europe’s role as a global leader in clean transport policy and innovation.

North America

North America, primarily driven by the United States, shows steady but slower progress compared to China and Europe. Electric car sales in the US continue to grow, supported by federal incentives, though policy uncertainties such as changes to the Clean Vehicle Tax Credit create some volatility. The region is also seeing rising adoption of electric light commercial vehicles, led by fleet operators and companies like Rivian.

School buses are the leading category within electric buses, supported by federal funding programs, while the truck segment is still in its early stages, constrained by high costs and electric vehicle charging infrastructure gaps.

Rest of the World

Regions outside Asia, Europe, and North America – primarily Latin America, Africa, and parts of the Middle East – are experiencing rapid but uneven EV adoption. Latin America is seeing strong growth in electric car sales, led by Brazil, where Chinese imports are helping make EVs more affordable.

Africa, while starting from a small base, is beginning to see momentum in both cars and two- and three-wheelers, aided by policies such as import restrictions on fossil-fuel vehicles and local assembly initiatives. Electric buses are also gaining traction in Latin America, particularly in Mexico, where nearly 8% of bus sales are already electric.

Though small in overall volume, these regions represent important growth frontiers for global EV adoption, particularly as affordable Chinese models expand access to emerging markets.

Recent Market Trends and Developments

In September 2025, QuantumScape, a leading solid-state battery developer, together with its partner PowerCo (Volkswagen Group’s battery subsidiary), successfully carried out the first live demonstration of its solid-state lithium-metal batteries in a real vehicle. The energy-dense cells were used to power a Ducati motorcycle, marking a significant milestone in the commercialization of next-generation battery technology.

In August 2025, Hyundai Motor Company and General Motors announced a strategic partnership to co-develop four vehicles tailored for the Central and South American markets. The line-up will include a compact SUV, a passenger car, a pickup, and a mid-size pickup, all designed with the flexibility to operate on either internal combustion or hybrid powertrains. In addition, the two automakers will jointly develop an electric commercial van specifically for the North American market.

In April 2025, Aramco and BYD signed a Joint Development Agreement to collaborate on new energy vehicle technologies, signaling oil–auto tech convergence around efficiency, powertrains, and materials to advance new energy vehicle performance and cost.

Smart Charging and V2G Integration are gaining popularity, aided by mandates (e.g., UK, EU AFIR), enabling flexible charging and demand-side flexibility for grids. Vehicle-to-Grid (V2G) solutions are advancing, with over 30 bi-directional-capable EV models available and various demonstration projects underway globally, aiming for grid flexibility and revenue generation.

Increasing installations of fast and ultra-fast chargers: The number of ultra-fast chargers (150 kW and above) grew by over 50% in 2024, and their prices fell by 20% between 2022 and 2024.

The gradual phase-out of subsidies is reducing the share of government spending in the EV market, signaling a shift toward greater market-driven growth and competitiveness as consumer demand and private investment take on a larger role. However, government mandates are also playing a major role in promoting EV adoption in some regions.

Further Details Available in the Report

The new report from Blackridge Research on the Global Electric Vehicle Market provides comprehensive qualitative and quantitative analyses along with a deep insight into the current and future of the market.

What do we cover in the report?

Electric Vehicle Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain the growth.

The report includes a meticulous analysis of each factor, explaining the relevant qualitative information with supporting data.

Each factor's respective impact in the near, medium and long term will be covered using Harvey balls for visual communication of qualitative information and will functions as a guide for you to analyze the degree of impact.

Electric Vehicle Market Analysis

This report discusses the overview of the market, latest updates, important commercial developments and structural trends, and government policies and regulations.

This section also provides an assessment of geopolitics' impact on electric vehicles Market demand.

Electric Vehicle Market Size and Demand Forecast

The report provides the Global Electric Vehicle Market size and demand forecast until 2027, including year-on-year (YoY) growth rates and CAGR.

Electric Vehicle Market Industry Analysis

The report examines the critical elements of the Electric Vehicle industry supply chain, its structure, and the participants.

Using Porter's five forces framework, the report covers the assessment of the Electric Vehicle industry's state of competition and profitability.

Electric Vehicle Market Segmentation & Forecast

The report dissects the Global Electric Vehicles Market into various segments based on vehicle type (passenger vehicles, and commercial vehicles), by propulsion type (BEVs, PHEVs, FCEVs). A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for a "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies & regulations, and market outlook.

In addition, market size, demand forecast, and growth rates will be provided for all regions. Following are the notable countries covered under each region.

North America - United States, Canada, Mexico, and Rest of North America

Europe - Germany, France, United Kingdom (UK), and the Rest of Europe

Asia-Pacific - China, India, Japan, South Korea, Australia, Rest of APAC

Rest of the world - Saudi Arabia, Brazil, Nigeria, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of Key companies in the Electric Vehicle industry such as Tesla Inc., General Motors, and Hyundai Motor Group. In general, each company profile includes an overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

The Executive Summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Analysis of the impact of geopolitics on the electric vehicle market is an integral part of the report, which helps companies navigate a rapidly changing market landscape.

Get a free sample copy of the the Global Electric Vehicle Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Also check our latest report on the Global Electric Two-Wheelers Market to discover key market insights and trends in the industry, along with an in-depth analysis of the market's growth drivers and challenges. Stay ahead of the competition and make informed decisions with our comprehensive and up-to-date research. Order your copy now!

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!