Loading...

Market Research Reports

|Q4 2024

|Report ID: BR05307

|No. of Pages: 228

About this Report

The battery energy storage system (BESS) market is experiencing rapid growth, driven by the rising integration of renewable energy sources, whose intermittent nature necessitates reliable energy storage solutions. This growth is further supported by declining lithium ion battery costs and the expanding role of BESS in both utility-scale and behind-the-meter applications, including those serving electric vehicle infrastructure and onsite solar energy projects.

However, factors such as lack of adequate regulatory framework, double taxation or double charging of grid tariffs, and restrictions on market participation of BESS owners are some of the factors that are restricting the growth of the global battery energy storage system market.

Market Definition

A Battery Energy Storage System (BESS) is an electrochemical device that charges or collects excess energy from the power generation sources, such as solar panels, wind turbines, or the electric grid, and then discharges that energy at a later time providing a stable and reliable supply of power. Key technologies include lithium ion batteries, lead-acid batteries, and emerging flow batteries, each offering different energy density, storage capacity, and efficiency profiles.

BESS solutions are commonly used for:

Balancing supply and demand in the electricity grid

Storing renewable energy for use during periods with low generation, improving renewable energy integration

Providing backup power during blackouts or outages, supporting enhanced grid reliability

Supporting grid frequency and voltage regulation

By enabling efficient energy storage and discharge, BESS plays a crucial role in enhancing energy reliability, integrating renewables, and improving overall grid performance.

Market Dynamics

Drivers

Increasing renewable energy integration to the grid is one of the major factors driving the battery energy storage system market. As the share of variable renewable energy sources like wind and solar energy increases, batteries are essential for maintaining electricity security and grid stability. They provide short-term flexibility, shifting energy across seconds, minutes, or a few hours to balance electricity supply and demand. Large-scale BESS installations further enhance system reliability and offer critical benefits in terms of storage capacity and rapid response, supporting both urban and remote applications.

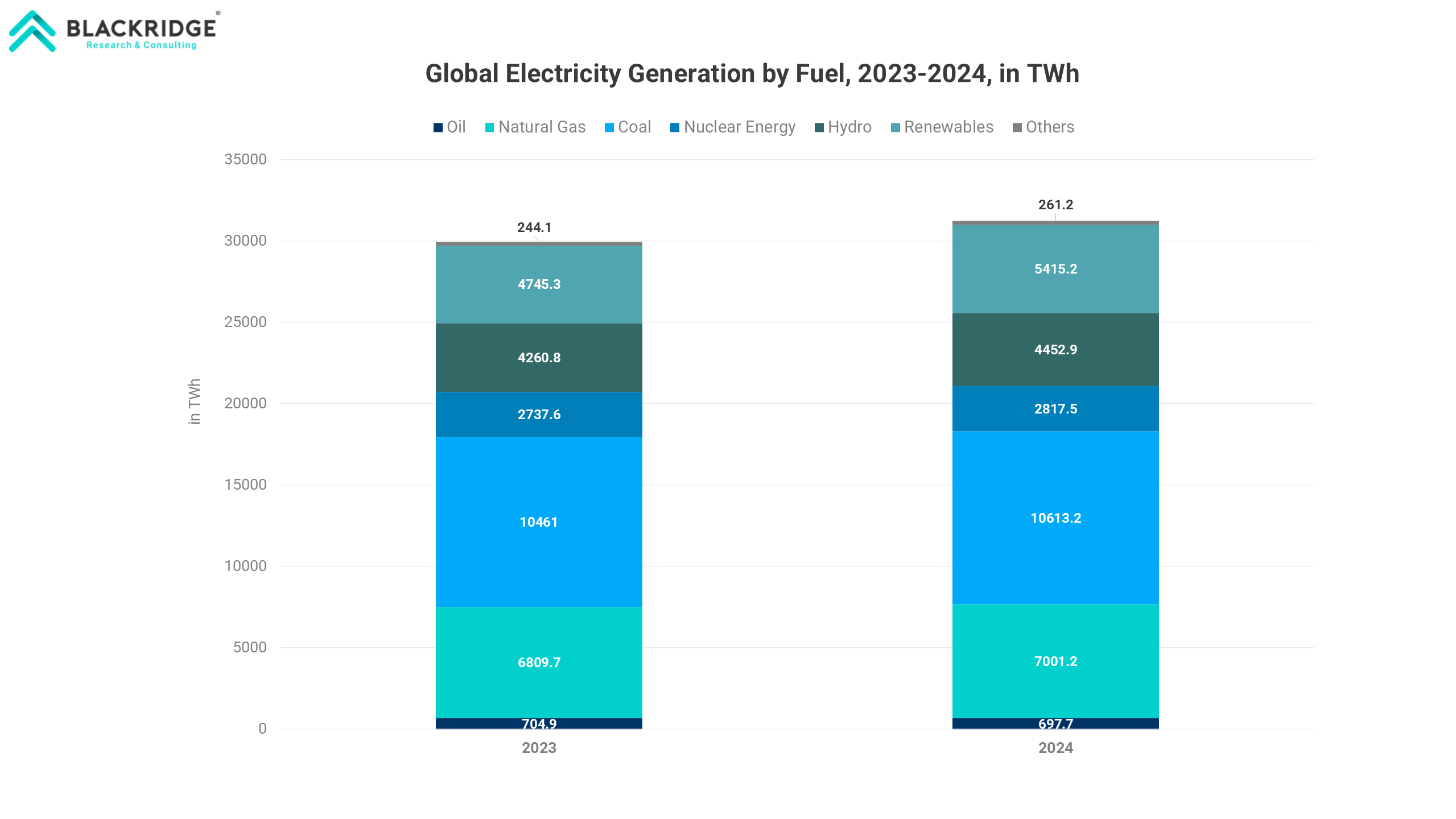

The contribution of renewable energy to global electricity production is steadily increasing, highlighting a clear trend toward greater renewable energy integration into the grid. In 2023, renewables accounted for approximately 15.8% of the world’s total electricity production. By 2024, this share had risen to about 17.3%, reflecting both higher absolute generation and a greater share of the overall electricity mix.

Renewable electricity generation grew from 4,745.3 TWh in 2023 to 5,415.2 TWh in 2024, an increase of roughly 14.1% year on year. This persistent rise in the contribution of renewables demonstrates the ongoing global shift toward cleaner energy sources. Such increasing integration of renewables, with their variable and intermittent nature, increases the need for reliable grid-support technologies like battery energy storage systems (BESS) to ensure grid stability and flexibility.

Restraints

Most countries currently lack sufficient regulatory frameworks for battery storage, impeding the development of viable business models in the energy storage market. Existing frameworks often fail to recognize the full value of the services batteries offer, including grid reliability and support for energy independence.

Battery storage systems are often restricted from fully participating in energy markets, including short-term electricity markets, capacity mechanisms, and balancing and congestion management markets. This limits their ability to provide diverse services and implement value stacking (the practice of combining multiple revenue streams from a single BESS) to improve profitability.

For instance, the Agency for the Cooperation of Energy Regulators in the European Union has highlighted that several member states still do not allow batteries to participate in short-term electricity markets or capacity mechanisms or to offer balancing and congestion management services. Additionally, local flexibility markets in these countries remain underdeveloped, which further discourages the adoption of behind-the-meter battery energy storage solutions.

A major challenge faced by storage operators in many regions is the issue of double taxation or double charging of grid tariffs. Due to the unique dual role of storage, functioning as both a producer (generation) and a consumer (load)—operators can be charged tariffs during both charging and discharging phases.

This creates a systemic disadvantage for storage compared to other technologies. In some cases, even if there is no injection tariff applied during discharge, storage systems may still be subject to withdrawal tariffs each time they charge, further impacting their competitiveness.

Furthermore, the complex and time-consuming regulatory processes for obtaining approvals and permits, along with the costs of grid upgrades to accommodate greater battery storage capacity, significantly delay or impede battery storage projects, further weighing on the profitability of developers.

Market Segmentation

By Region

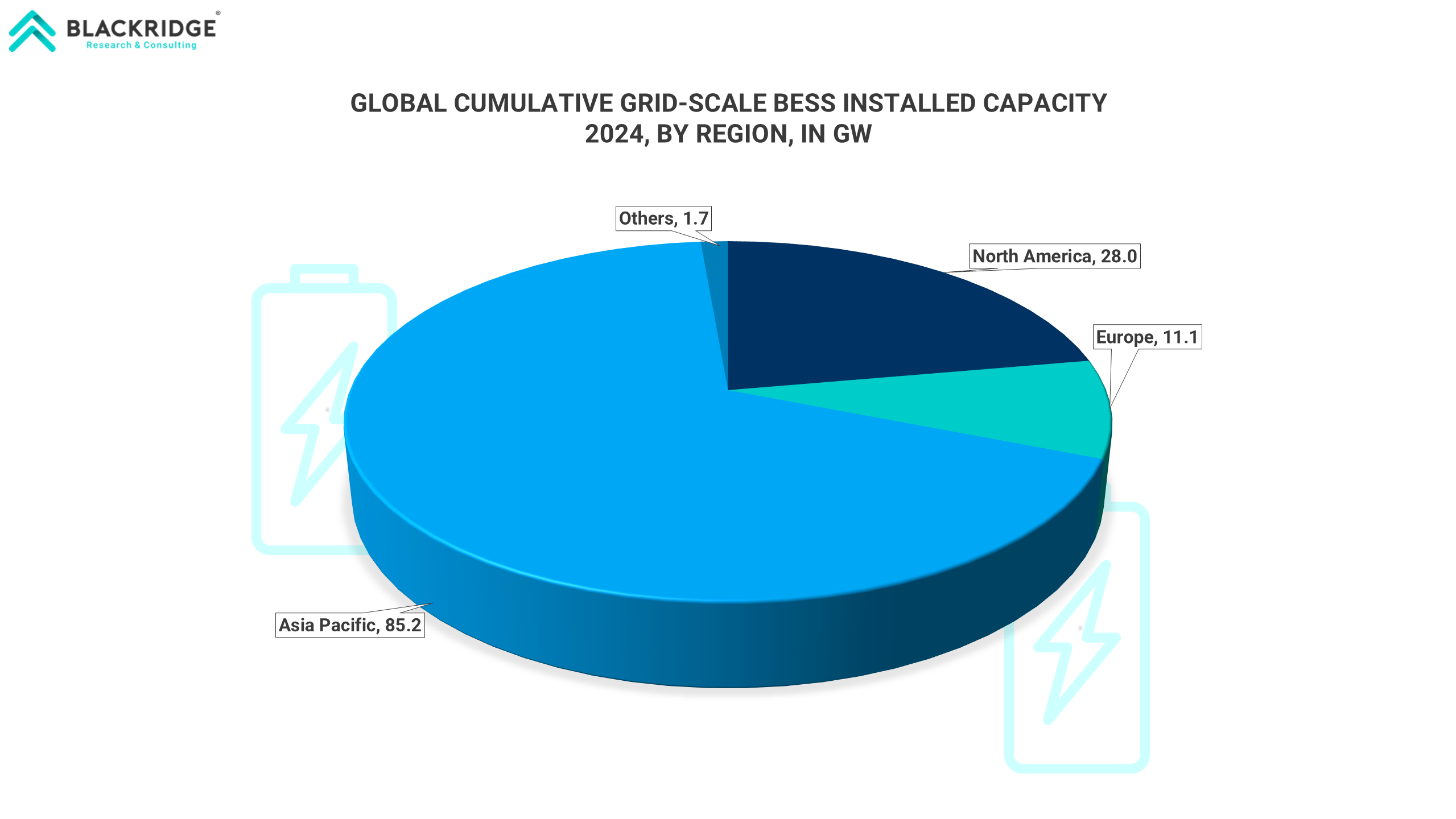

By the end of 2024, the Asia-Pacific region led the global battery energy storage system market with an installed capacity of approximately 85.2 GW. China accounted for the vast majority of this capacity, contributing 72.5 GW.

Much of China’s battery storage growth can be attributed to provincial regulations mandating that wind and solar energy projects be paired with energy storage solutions. This growth is further supported by the rising demand for flexibility in the power system as variable renewable energy sources make up an increasing share of generation. In addition, ongoing market reforms aimed at establishing and expanding electricity and ancillary service markets are providing further impetus for battery capacity expansion.

Following Asia-Pacific, North America recorded 28 GW of installed capacity, majorly due to the United States, which remains the second largest market for utility scale batteries. Owing to the state-level grid modernization, energy storage targets and the Inflation Reduction Act storage tax credit, many utilities are looking to battery storage to meet renewable energy goals, lower the emissions intensity and increase the energy efficiency of their electricity mix, and strengthen the reliability of the power supply.

While Europe ranked third with 11.1 GW, the major driver being the rising share of wind and solar PV, paired with onsite storage in some countries, is expected to support this growth, as is rising demand for secure capacity.

Market Opportunities

Major developing nations in the Asia-pacific region are planning to expand their battery energy storage installed capacity owing to the increasing renewable energy capacity in the power mix. For instance, India’s Battery Energy Storage System (BESS) sector is witnessing rapid growth, with approximately 12,500 megawatts (MW) of capacity under tender and an additional 3,300 MW in the pipeline or bid out.

Recent Developments

In July 2025, Lyten, a major chemicals manufacturer in the United States, announced the successful acquisition of Northvolt’s Dwa ESS operations in Gdansk, Poland, a 25,000 square meter (270,000 sq ft) battery energy storage systems (BESS) manufacturing and R&D facility.

The Chinese lithium-ion OEM Gotion High-Tech has launched manufacturing of its 5 MWh BESS units at its manufacturing facility in Göttingen, Germany, in July 2025.

Hithium, a major China based battery manufacturer, has opened a 10 GWh battery module and system factory in Texas in June 2025. The company will produce modules and complete battery energy storage systems (BESS) with a combined annual production capacity of 10 GWh at its 484,441-square-foot facility in Mesquite, Texas.

In May 2025, Fluence energy, a major ESS company in the United States, announced the start of manufacturing in its Goodyear, Arizona facility. The facility manufactures enclosures and battery management system (BMS) hardware for Fluence’s battery energy storage system (BESS) offerings.

Panasonic Corporation announced their exit from the solar PV and energy storage business in May 2025, citing business restructuring.

In February 2025, BYD Company Limited announced the signing of the world's largest BESS supply deal with a Saudi Electricity Company. The parties have inked contracts for a total of 12.5 GWh to be installed at five sites in Saudi Arabia.

The new report from Blackridge Research comprehensively analyses the battery energy storage systems market and provides deep insight into the current and future state of the industry.

The study examines the market dynamics, and regional trends influencing Global BESS Market demand and growth.

The report also addresses present and future market opportunities, market trends developments, and the impact of geopolitics on the Global BESS market, important commercial developments, trends, regions, and segments poised for fastest growth, the competitive landscape, and the market share of key players.

Further, the report will also provide Global BESS market size, demand forecast, and growth rates.

What Do We Cover in the Report?

Global BESS Market Drivers & Restraints

The study covers all the major underlying forces that help the market develop and grow and the factors that constrain growth.

The report includes a meticulous analysis of each factor, explaining the relevant, qualitative information with supporting data.

Each factor's respective impact in the near, medium, and long term will be covered using Harvey balls for visual communication of qualitative information and functions as a guide for you to analyze the degree of impact.

Global BESS Market Analysis

This report provides market overview, latest updates, important commercial developments and structural trends, and government policies and regulations.

Global BESS Market Size and Demand Forecast

The report provides Global BESS Market size and demand forecast until 2030, including year-on-year (YoY) growth rates and CAGR.

Global BESS Market Industry Analysis

The report examines the critical elements of Global BESS industry supply chain, its structure, and participants.

Using Porter's five forces framework, the report covers the assessment of the Global BESS industry's state of competition and profitability.

Global BESS Market Segmentation & Forecast

The report dissects the global BESS market into various segments based on battery type/battery technology, and the end-user sector.

A detailed summary of the current scenario, recent developments, and market outlook will be provided for each segment.

Further, market size and demand forecasts will be presented, along with various drivers and barriers for individual market segments.

Effective market segmentation enables you to identify emerging trends and opportunities for long-term growth. Contact us for "bespoke" market segmentation to better align the research report with your requirements.

Regional Market Analysis

The report covers detailed profiles of major countries across the world. Each country's analysis covers the current market scenario, market drivers, government policies and regulations, and market outlook.

In addition, market size, demand forecasts, and growth rates will be provided for all regions and emerging markets.

Following are the notable countries covered under each region.

North America: United States, Canada, Mexico, and the Rest of North America

Europe: Germany, France, the United Kingdom (UK), Russia, and the Rest of Europe

Asia-Pacific: China, India, Japan, South Korea, Australia, and the Rest of APAC

Rest of the world: Middle East, Brazil, South Africa, and other countries

Key Company Profiles

This report presents detailed profiles of Key companies in the global BESS market, such as Contemporary Amperex Technology Co. (CATL), LG Energy Solution, Samsung SDI, BYD Company Ltd., Fluence Energy, Schneider Electric SE, General Electric (GE) Vernova, etc. In general, each company profile includes - overview of the company, relevant products and services, a financial overview, and recent developments.

Competitive Landscape

The report provides a comprehensive list of notable companies in the global market, including mergers and acquisitions (M&As), joint ventures (JVs), partnerships, collaborations, and other business agreements.

The study also discusses the strategies adopted by leading players in the industry.

Executive Summary

Executive summary will be jam-packed with charts, infographics, and forecasts. This chapter summarizes the findings of the report crisply and clearly.

The report begins with an Executive Summary chapter and ends with Conclusions and Recommendations.

Get a free sample copy of the Global BESS Market report by clicking the "Download a Free Sample Now!" button at the top of the page.

Table of Contents

This report helps to

Who needs this report?

What's included

Why buy this report?

Want to know about Current Offers?

Analyst access from Blackridge Research

Free Report Customization

Further Information

Common Questions

Single User License

The Single User License will provide access to only one user.

Team License

The Team License will provide access only up to 7 users. This is great for a team.

Corporate License

This Premium package is ideal for large companies. By having Corporate license, any employee of your organization or its subsidiaries can access the report. You will also receive free industry update after six months and also a white label powerpoint presentation.

Related Content

What people are saying about us

Haven’t found what you’re looking for?

More than 70% of our clients seek customized reports. Reach us out to get yours today!