Table of Contents

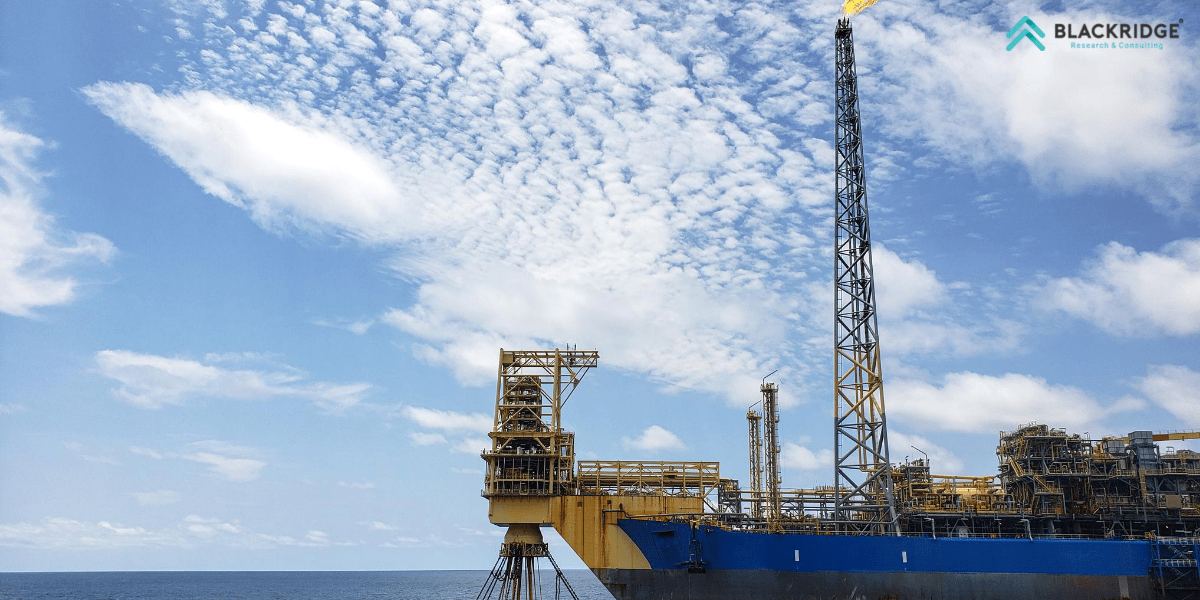

The demand for Floating Production Storage and Offloading (FPSO) units is on the rise driven by more investments and increased production in the offshore oil and gas industry. Unlike traditional seabed pipelines, modern FPSOs offer a cost-effective solution with reduced maintenance costs over time, making them an increasingly attractive option for companies operating in this sector.

The steady growth of the crude oil and gas industry has been reflected in these upcoming FPSO projects around the world which are expected to start operations this year. The inclusion of fpso development from various regions from South America to Senegal, Norway, and the US demonstrates the global reach of FPSO technology.

Here we explore the new fpso projects in 2025 that shape the future of the offshore oil and gas industry.

Top 7 upcoming FPSO projects in the World 2025

Sl No | Name | Operator | Capacity | Country |

1 | Mero-3 FPSO | Petrobras | 180,000 barrels per day | Brazil |

2 | BM-C-33 FPSO | Petrobras/ | 220,000 barrels per day | Brazil |

3 | Liuhua 29-1 FPSO | CNOOC | 60,000 barrels per day | China |

4 | MAD Dog 2 FPSO | BP | 140,000 barrels per day | US Gulf of Mexico |

5 | Johan Castberg FPSO | Equinor | 95,000 barrels per day | Norway |

6 | P-71 FPSO | Petrobras | 150,000 barrels per day and 6 million cubic meters of gas per day | Brazil |

7 | One Guyana FPSO | ExxonMobil | 220,000 barrels per day | Guyana |

Mero-3 FPSO (Brazil)

The Brazilian oil field, divided into four areas, namely Mero 1, Mero 2, Mero 3, and Mero 4 is being developed in four phases. Four FPSO units will produce and process oil from each area, each with a capacity of 180,000 barrels a day and 12 million cubic meters a day. The project will use Petrobras' HISEP technology.

The Mero field which is located 180 km offshore Brazil Rio de Janeiro, is owned by the Libra consortium, led by Petrobras. The first oil was drilled in April 2022, marking the field's commercial viability. Earlier in 2023 Sepetiba FPSO sailed to Mero Field offshore Brazil from BOMESC shipyard in China increasing the crude oil production.

40+ reviews

Find FPSO Projects and Tender Leads around the Globe

Gain exclusive access to our industry-leading database of FPSO project opportunities with detailed project timelines and stakeholder information.

Collect Your Free Leads Here!

No credit cardUp-to-date coverage

Joined by 750+ industry professionals last month

The Mero-3 project, a third phase of the Mero development, is set to commence production in 2024 at the FPSO Marechal Duque de Caxias, located in the southern part of the Mero oil field. The development plan includes connecting 15 wells, including eight oil producers and seven water and gas injectors, using subsea infrastructure.

BM-C-33 FPSO (Brazil)

BM-C-33 is a gas and condensate field in Brazil's Campos Basin, operated by Equinor with a 35% interest. The block was acquired in 2005 and is being developed in a phased manner. The final investment decision was made in May 2023, with production expected in 2028. The field is expected to generate around USD 9 bn in investment.

The BM-C-33 field will be developed by connecting production wells to a floating production, storage, and offloading unit (FPSO), with crude offloaded via shuttle tankers and transported to the international export market via ship-to-ship transfers.

The FPSO vessel, under construction by MODEC, is set to be 200 km off Rio de Janeiro's coast. This FPSO project is built using MODEC's new double hull design, capable of producing 220,000 barrels per day and 565 million standard cubic feet of associated gas daily.

Liuhua 29-1 FPSO (China)

The field is owned by Cenovus Energy and China National Offshore Oil Corporation. CNOOC Ltd. has started production from the Liuhua 29-1 gas field in the eastern South China Sea. A new subsea wellhead has been built, with seven development wells planned. The field will fully utilize existing facilities from Liuhua 34-2 and Liwan 3-1. CNOOC holds a 25% working interest in Liuhua 29-1.

The production capacity is 60,000 barrels per day where peak production was reached in 2023 for the conventional gas field Liuhua 29-1, which recovered 14.26% of its total recoverable reserves. According to economic projections, production will go on until the field reaches its economic limit in 2070.

MAD Dog 2 FPSO (US Gulf of Mexico)

Mad Dog Phase 2 is a new extension of the existing Mad Dog offshore oil and gas field, located in the Green Canyon area of the Gulf of Mexico. The field operated by BP was discovered in 1998 and started FPSO operation in 2005.

Woodside Energy and Union Oil Company of California hold 23.9% and 15.6% interest respectively with BP having a share of 60.5%. The Mad Dog area holds over five billion barrels of oil equivalent, with a production capacity of 140,000 barrels a day.

The Mad Dog Phase 2 development aims to drill 14 production wells and eight water injectors from five drill centers. These wells are connected to the Argos floating production unit (FPU), a digitally advanced platform operated by BP in the Gulf of Mexico. The platform weighs 60,000 tonnes and has a waterflood injection capacity of over 140,000 barrels per day.

Johan Castberg FPSO (Norway)

The Johan Castberg project operated by Equinor consists of three oil fields in the Barents Sea, Norway. The fields, located at depths of 360m to 390m, hold 400 to 650 million barrels of proven oil reserves.

Construction began in November 2018, and the first oil is expected to flow in Q4 2024. The project, estimated to cost Norwegian Krone 49bn ($8.01bn), will generate 4,800 jobs and have a production capacity of 190,000 barrels of oil equivalent per day.

Johan Castberg plans to install an FPSO with a pipeline to shore and an onshore oil terminal at Veidnes, Finnmark. The subsea system will include 30 wells, umbilicals, and flowlines. The 1,900t vessel will accommodate 140 workers and drill 18 production wells. Oil will be transported via a 280 km pipeline to the onshore storage facility.

P-71 FPSO, Brazil

In October 2020, Petrobras and the Itapu field development consortium agreed for Petrobras to acquire the FPSO P-71 for $353 million. The Itapu offshore oil field was given the FPSO following the transfer of rights surplus auction, but it was originally intended to be used at the Tupi field, which is situated in the BM-S-11 block in the Santos Basin.

Itapu, previously known as Florim, is operated by Petróleo Brasileiro and acquired through a rights auction in 2019. Petrobras holds 100% of exploration and production rights in the field surplus volume.

At the Jurong Shipyard in the state of Espirito Santo in southeast Brazil, the FPSO construction is nearing completion. The 316-meter-long and 54-meter-wide FPSO can produce six million standard cubic meters of natural gas and 150,000 barrels of oil per day. The floating storage platform is enough for 160 persons and can hold 1.6 million barrels of oil.

One Guyana FPSO

SBM Offshore is set to deliver the highest-producing floating production storage and offloading (FPSO) vessel, 'ONE GUYANA', to Guyana. The vessel, designed to produce 220,000 barrels of crude per day, is set to enter drydock at Singapore's Keppel Shipyard.

The high production levels reflect ExxonMobil's policy to maximize crude output, aligning with Guyana's depletion policy. SBM Offshore has delivered 20 FPSOs for deepwater and ultra-deepwater projects, with four of them destined for ultra-deep projects.

ONE GUYANA is set to be delivered to Guyana for its first oil in 2025, boosting the country's output to 600,000 b/d. SBM Offshore has already delivered Liza Destiny and Unity, producing 380,000 b/d offshore Guyana. ExxonMobil plans to increase production offshore Guyana to above 1.2 million b/d by 2027, with Hess (30%) and CNOOC (25%) as partners.

FPSO as a Cost-Effective Solution for Offshore Operations

The procurement of FPSOs can be done through a new build, conversion of an existing vessel, or redeployment of an existing unit. Operators often rely on third-party contractors for these services. Contractor-owned FPSOs offer cost advantages over operator-owned FPSOs or fixed platforms, allowing economies of scale and optimizing fleet utilization.

Leasing allows operators to access and deploy FPSOs with minimal upfront capital investments. With increasing offshore activities, outsourcing FPSO-related activities to contractors allows operators to focus on areas where they can create the most value. The Contractor-owned FPSO is expected to dominate the market during the forecasted period.

Conclusion

With Ambitious advancements in technology and surging global energy demands, the FPSO market is experiencing significant growth, with a projected market value of USD 19 billion by 2029. This exploration of seven upcoming FPSO projects from diverse regions like Brazil, China, Norway, and the US showcases the remarkable advancements and expanding applications of this technology.

Notably, these projects highlight the increasing scale and complexity of FPSOs, with some designed for challenging environments and high production capacities. As the industry continues to evolve, these projects pave the way for a future where FPSOs play an even more prominent role in shaping the global oil and gas sector. Brazil and Guyana are expected to significantly influence the global FPSO market, with a surge in demand in recent years.

Looking for more than generic information on FPSO vessels around the Globe?

Subscribe to our Global FPSO & FSO (Oil & Gas) Projects and Tender Database to access reliable and high-quality insights on upcoming, in-progress, and completed floating offshore plant projects across the world or in your desired location.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Start a free demo to take your business to the next level!

![Top FPSO Companies in India [2025]](https://images.blackridgeresearch.com/zA7C1E09-z4Uj64Eb0zfkw/fef13aed-1db8-4a25-bf1c-ffc0ed743a00/public)

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.