Table of Contents

Semiconductors are materials that are essential for both everyday consumer gadgets, such as smartphones and computers, and more complicated, specialized products for civilian and military use. Over a hundred billion semiconductors are used every day. They have promoted the integration of electronic systems for the last 30 to 40 years.

The global semiconductor business ranks as the fourth largest worldwide, following oil production, automotive, and oil refining and distribution. In 2021, about 1.1 trillion semiconductors were sold, and the industry is estimated to earn annual revenues between 500 and 600 billion US dollars. The DCMS predicted an approximate yearly real-term growth rate of 7% in demand within the semiconductor sector from 2021 to 2031. The global compound semiconductor market was valued at approximately USD 91 billion in 2020. Now, let us study the semiconductor industry in the UK in detail.

Overview of the Semiconductor Industry in The UK

The UK is a prominent player in the semiconductor business, contributing significantly to the national economy, with domestic semiconductor firms representing 2% of worldwide revenues and generating revenue of about USD 12.10 billion in 2022 and USD 13.12 Billion in 2024. The market is predicted to grow at a CAGR of 6.70% in the forecast period of 2025-2034. It is expected that it will reach a value of USD 25.09 Billion by 2034. Arm is the preeminent semiconductor manufacturer in the UK, contributing 25% of revenue and 20% of employment among the firms examined in the study.

Around 5% of the UK population resides in Wales; it generates 30% of revenue in this sector. Scotland contributes 24% of revenue while comprising approximately 8% of the UK population. Specialized semiconductor firms directly employ 15,000 individuals and may facilitate an additional 86,000 jobs in the UK. These firms have obtained USD 2.14 billion in grants and fundraising efforts till now. Approximately 70% of overall fundraising has been achieved by only five companies. Moreover, over 75% of total fundraising has been obtained by growth-stage semiconductor startups.

History of The Semiconductor Industry in The UK

The UK's semiconductor industry has evolved throughout the years with various important events and strategic initiatives. The timeline representing the history of the semiconductor industry in the UK is given below in the form of a table.

YEAR | DEVELOPMENT |

|---|---|

1956 | Ferranti pioneered European semiconductor manufacturing by producing the first silicon diode |

1957 | Mullard opened a semiconductor plant in Southampton, focusing on germanium alloy transistors |

1960s | Scotland's "Silicon Glen" emerge as a semiconductor hub, with companies like Hughes Aircraft establishing facilities in Glenrothes |

1978 | The UK government founded Inmos to advance microelectronics, leading to the development of the transputer microprocessor |

1980s | Brought further growth, with Plessey producing early integrated circuits and Ferranti developing uncommitted logic arrays used in home computers |

2023 | The UK government unveiled a National Semiconductor Strategy, pledging up to USD 1.26 billion over the next decade to bolster the domestic semiconductor sector. This strategy aims to enhance research and development, design, and compound semiconductor capabilities, ensuring the UK's competitive edge in the global market |

Key Players in the semiconductor industry of The UK

Some of the top players in the UK semiconductor industry are given below:

Arm Holdings

Based in the UK, Arm designs, develops, and licenses high-performance, cost-effective, and energy-efficient CPU devices and associated technologies. Arm's energy-efficient CPUs have facilitated advanced computing in over 99% of global cell phones. As of 2022, it has a total of more than 250 billion chips, powering devices ranging from minuscule sensors to the most powerful supercomputers. Arm was founded in 1990 and was publicly traded on the London Stock Exchange from 1998. In 2016, it was acquired by SoftBank Group.

Arm offers four lines of CPUs/processors, including Neoverse, Cortex-A, Cortex-R and Cortex M. It also has two GPU lines like Mali and more recent Immortalis (with hardware-based ray tracing). Additionally, it provides Ethos neural processing units (NPUs), Corelink/CoreSight System/SoC IP, and TrustZone Security IP.

Pragmatic Semiconductor

Pragmatic Semiconductor is located in Cambridge, England, with a manufacturing facility at the National Centre for Printable Electronics in Sedgefield. It was founded in 2010. It is a global leader in ultra-low-cost flexible electronics, facilitating the potential for trillions of "smart objects" capable of sensing and communicating with their surroundings. The innovative technology platform facilitates the creation of integrated circuits smaller than a human hair, which may be seamlessly implanted in various surfaces, hence integrating interactivity into several commonplace objects.

PragmatIC designs and produces cutting-edge, flexible integrated circuits (FlexICs) that are thin, durable, and more economical than conventional silicon-based devices.

Dynex Semiconductor

Dynex Semiconductor designs and manufactures high and low power semiconductor devices, as well as power assembly products and services for traction, power and renewable energy, industrial, and electric vehicle applications. It was established in 1956. Dynex has undergone transformations through mergers and ownership changes. The former names include AEI, Marconi, and GEC Plessey. The factory in Lincoln encompasses extensive silicon production, assembly and testing, sales, design, and development capabilities. They make a variety of power products, such as IGBTs, GTOs, and thyristors of varying types.

Vector Photonics

Vector Photonics is known for producing PCSEL-based, III-V semiconductor lasers, which represent major advances in laser creation and production in the past 30 years. The company originated as a spin-out from the University of Glasgow, recognized as one of the UK's and the world's hubs of leadership in Optics and Photonics. PCSELs, or Photonic Crystal Surface-Emitting Lasers, are characterized by their low cost, robustness, broad wavelength range, and high power. This unique combination of key features provides them with a significant advantage over other semiconductor laser technologies currently in use.

Initiatives of The UK Government to Bolster Semiconductor Industry

The UK government's National Semiconductor Strategy, supported by USD 94.65 billion in funding, seeks to improve research and development, infrastructure, and international collaboration during the next two decades.

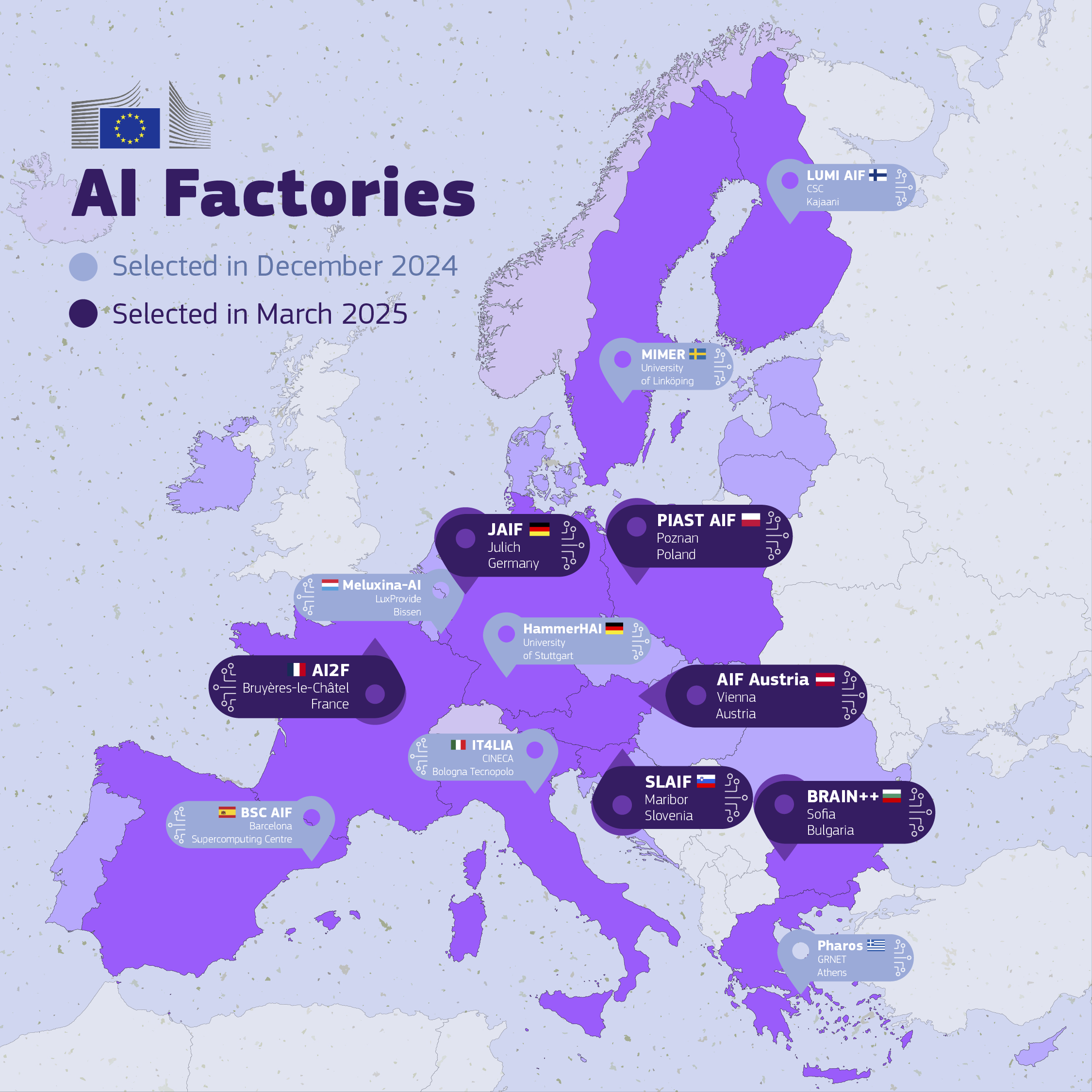

Planned AI Factories in Europe. Source:digital-strategy.ec.europa.eu

Recently, the EuroHPC Joint Undertaking (EuroHPC JU) has chosen six further proposals to create AI Factories within the EU, deploying the vast amount of supercomputers. The objective of this facility is to support AI startups, expand small and medium enterprises, and educate the forthcoming generation of reliable, high-performance AI models. The plants will be constructed in Austria, Bulgaria, France, Germany, Poland, and Slovenia. The proposed budget for these new projects is USD 528.76 million.

In the coming years, the UK is going to develop major sectors in future semiconductor technologies by using its strengths in research and development, design, IP, and compound semiconductors. The strategy for advancing the semiconductor industry includes the following;

Grow Domestic Sector

The UK will build on their strengths in design, compound semiconductors, and research and development to retain and expand their vital position in this sector. This will ensure that the domestic semiconductor sector contributes to the prosperity of the UK. It is poised to drive growth and support their ambitions in quantum, net zero, and AI. Strengthening the domestic sector will yield positive effects on the capacity to engage internationally across various issues.

Skills and talent

The UK is addressing the fundamental challenge that an appropriate number of individuals do not possess the necessary technical abilities and qualifications to meet the demands of industry. A holistic approach across the entire skills pipeline, which includes STEM education, apprenticeships, industry-led learning, and talent attraction, is essential to address the increasing demands of the sector.

Safeguarding Supply Chain

The UK must ensure, to the best of its ability, that a reliable supply of semiconductors is safeguarded, covering both individual components and final products. This is essential to the economy of the UK and is becoming increasingly urgent because of potential global supply disruptions. Considering the complexities of the global supply chain, it is clear that there are no straightforward solutions. The proposal is to engage in collaborative efforts with industry and international partners.

Protection Against Security Threats

The UK must guarantee that its response is in line with the increasing national security threats in the industry. This involves preventing hostile forces from developing defense or technology capacities that threaten national security, in addition to managing the cybersecurity of constantly interconnected equipment.

Challenges in the UK semiconductor Industry

It is essential to deal with the primary obstacles that limit the UK's capacity to establish a competitive semiconductor sector. The challenges include the following:

Skill Shortages

The UK faces a significant skills shortage and retention challenges caused by a scarcity of competent staff in the semiconductor industry. 29% of the employees are hired from abroad. The sector requires a wide range of specialized skills. This deficiency restricts the capacity of organizations, particularly smaller enterprises, to innovate and expand. Moreover, comparatively lower incomes and rising living expenses in the UK decrease its appeal to international talent, hence intensifying the issue.

Resource Allocation Problem

There is presently an imbalance between capital for scaling up and research and development investment in the UK to promote next-generation compound semiconductor and packaging advancements, with the majority of funding directed towards R&D. The risk is that, without enhanced support, users would seek production and design services elsewhere to facilitate a seamless transition to manufacturing.

Inadequate Facilities

The UK semiconductor sector has a shortage of sufficient silicon processing capabilities. To expand, coordination with overseas high-volume production foundries is essential. This necessitates the use of appropriate procedures and materials. The absence of uniformity between prototyping facilities and mass production results in complications, expenses, and time constraints. Furthermore, the accessibility of academic or commercial institutions is hindered by the inadequate visibility of the current infrastructure in the UK.

Key Trends in UK Semiconductor Industry

The primary trends influencing the growth of the United Kingdom semiconductor market include increasing research and development activities, the deployment of 5G technology, the expansion of the automotive sector, and a growing number of data centers.

5G Network

A number of UK areas are obtaining access to 5G networks, as operators nationwide accelerate 5G deployments, thereby enhancing the application of semiconductors in base stations and wireless network equipment.

Rising Demand for Automobiles

Semiconductors are essential for batteries and powertrains, as well as essential parts in the operating system of most modern vehicles. Furthermore, as the quantity of electric vehicle orders continues to rise due to the integration of semi-autonomous capabilities, the demand for semiconductors is anticipated to grow.

Growth in Data Centers

The UK is considered an important sector for data centres, which includes commercial operators that offer data centre services to third parties (data centre colocation) and in-house data centres that facilitate corporate IT tasks and customer services for banks, shops, and universities. The nation possesses more than 250 functional colocation data centers located in cities including London, Manchester, Slough, Birmingham, and Wales.

Conclusion

The United Kingdom has the potential to emerge as a significant semiconductor hub in the coming decades. The UK now contributes minimally to the global semiconductor market. With changes and improvements, it possesses the ability to make substantial contributions in the future. The government must enhance its focus on the semiconductor industry and implement necessary reforms.

In recent years, the UK government has acknowledged the significance of investing in semiconductor research and development, resulting in an increase in funding and support for emerging technologies. This has led to the creation of new semiconductor manufacturing plants and research centers, thereby reinforcing the UK's status as an essential player in the global semiconductor market.

Frequently Asked Questions (FAQ’s)

Here are some frequently asked questions;

Which is the most advanced semiconductor in the world?

TSMC's 3nm process is their highest level of semiconductor technology, delivering optimal power, performance, and area (PPA), and constitutes a full-node advancement from the 5nm generation.

How big is the semiconductor industry in the UK?

The Uk semiconductor industry achieved USD 13.12 Billion in 2024. The market is predicted to grow at a CAGR of 6.70% in the forecast period of 2025-2034. It is expected that it will reach a value of USD 25.09 Billion by 2034.

Which is the largest semiconductor company in the UK?

Arm Holding is the largest semiconductor company in the United Kingdom. It was found in 1990.

Connect with decision-makers of semiconductor fabrication plant projects in the UK for business opportunities.

Subscribe to the upcoming and ongoing Semiconductor Fabrication projects and tenders database in the UK to access reliable and high-quality insights on forthcoming, in-progress, and completed Semiconductor Fabrication plant projects across Germany.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Start a free demo to learn about the latest Semiconductor fabrication projects in the UK and take your business to the next level!

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.