Table of Contents

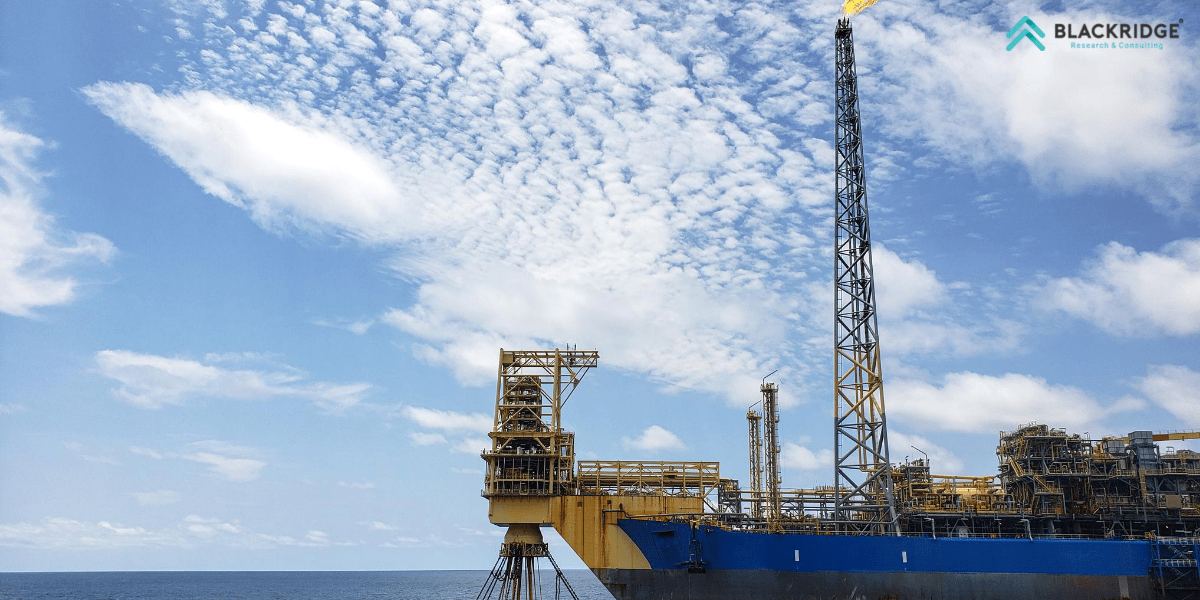

Offshore oil and gas production is infamous for its high costs, particularly in the upstream activities of exploration, drilling, and hydrocarbon extraction. In this complex process, FPSOs (Floating Production Storage and Offloading) emerge as pivotal solutions, especially in remote or challenging environments.

These floating vessels offer a cost-effective and flexible alternative, efficiently extracting hydrocarbons beneath the seabed. FPSOs streamline the production, storage, and offloading processes, by replacing expensive pipelines. Adaptability and redeployment of FPSOs make offshore operations more manageable and economically viable.

In this blog, we’ll explore how FPSO reduces upstream costs in the offshore industry, how much it costs, and the key factors influencing it. The FPSO charter and ownership methods will give a better understanding of the FPSO industry and its cost-effectiveness in the long run.

How much does an FPSO cost?

The cost of a purpose-built FPSO may exceed USD 800 million, especially if it can produce more than 250,000 barrels per day (BPD). On the other hand, the price of a conventional offshore oil platform might reach USD 650 million. Even though an FPSO has a higher initial cost, it ends up being more economical in the long term.

When additional costs like maintenance, well completion, and platform decommissioning are factored in, the price of a conventional offshore oil platform can increase.

Find Latest FPSO Projects Around the Globe Collect Your Free Leads Here!

The FPSO project cost comparison can be demonstrated using a project by Equinor, the operator of the Johan Sverdrup field in the North Sea. They opted for FPSOs over fixed platforms due to cost considerations. The estimated cost of the FPSO was around USD 4.2 billion, compared to the projected $7 billion for a fixed platform. This decision highlights the cost advantages of FPSOs.

FPSOs offer significant advantages for offshore crude oil and natural gas production, but they are complex undertakings with substantial costs. Here's a breakdown of key cost factors to consider in an FPSO project:

Capital Expenditure (CAPEX) of FPSO

FPSOs are considered long-term fixed assets, requiring significant capital expenditure for their initial investment. However, this investment typically yields results over an extended period, making FPSOs a sustainable choice for offshore operations.

Here we delve into how FPSO CAPEX varies according to the constructed facilities:

Hull: This can be a newly built or a converted ship hull. A newly built hull offers a longer lifespan but is more expensive. Conversion costs depend on the extent of modifications required.

Topsides: This encompasses all processing equipment for separation, treatment, storage, and offloading of oil, natural gas, and water. Complexity and capacity heavily influence cost.

Mooring System: The system used to keep the FPSO in position (spread-moored, turret-moored) impacts cost. Turret systems are generally more expensive due to increased complexity.

Risers: Large pipes connecting the FPSO to subsea wells. Material, length, and water depth all influence cost.

Engineering and Project Management: Detailed engineering design, procurement, and project management throughout the FPSO lifecycle incur significant costs.

Key Factors affecting FPSO cost

The operating cost and construction of an FPSO unit can vary significantly due to several key factors. Let’s explore each of these factors:

Production Capacity: Larger FPSOs with higher production capacities require more extensive facilities, equipment, and storage space. Consequently, their construction and installation costs tend to be higher.

Design Life: Longer design lives require more robust materials, corrosion-resistant coatings, and thorough maintenance planning. FPSOs designed for shorter periods like 10-15 years may prioritise cost savings over longevity, while those intended for extended service for 20-30 years demand higher initial investments.

Operating Environment: The expenses associated with running FPSOs are notably impacted by environmental factors like water depth and severe weather conditions, which require stronger hull designs, mooring systems, and safety measures.

Market Conditions and Supply Chain: Fluctuations in material prices, labour costs, and currency exchange rates impact overall expenses. For instance, the recent surge in steel prices and labour costs has affected FPSO bids in some regions.

The complexity of Topsides Facilities: Customised topsides tailored to specific field requirements may drive up costs compared to standardised designs. Complex processing systems, safety features, and accommodation spaces in topside modules contribute significantly to costs.

Regulatory Compliance and Safety Standards: Costs are also driven up by the implementation of safety features such as firefighting systems and escape routes, as well as environmental protection measures like oil spill response and waste management.

Read: Top 7 Upcoming Global FPSO Projects

FPSO Ownership vs Chartering

Choosing between FPSO rental (chartering) and ownership depends on your specific project needs and risk tolerance. The best approach depends on an evaluation of your specific project considering factors like project duration, reserves estimate, risk tolerance, and financial constraints. Let’s have a look at the different ownership and chartering methods of FPSOs.

FPSO Ownership

FPSOs cannot be purchased like traditional tankers. They are acquired through an Engineering, Procurement, Construction, and Installation (EPCI) contract. The contract is awarded to an FPSO construction contractor for a new building or conversion of a VLCC (Very Large Crude Carrier). The contractor then engages subcontractors for various phases, including hull construction, topsides, mooring systems, and integrated decks, with overall project responsibility.

The second option is that oil companies could award separate FPSO contracts to independent contractors for different project phases, with the contractors under the control of a single project manager. This method has a disadvantage as it doesn't provide a single entity for claiming damages in case of problems. Additionally, this method is not preferred by lenders who prefer a turnkey contract, which allows them to directly agree with the construction company and hold the company liable for any issues.

An alternative option for the oil corporation could be to award the FPSO contract to a construction consortium comprising independent contractors with shared joint and several liability. SBM offshore, CNOOC Ltd. Petroleo Brasileiro SA (Petrobras), Shell Plc., Exxon Mobil Corp and TotalEnergies SE are some of the global top FPSO companies.

FPSO Rental / Charter

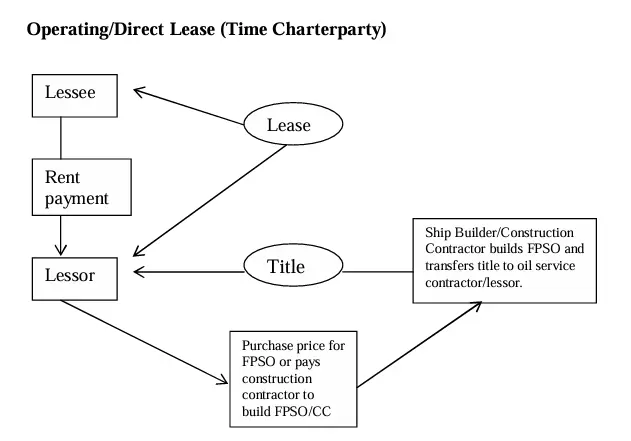

FPSOs can be chartered for a particular period for the production of hydrocarbons. The oil company enters into a lease or charter agreement for the FPSO, usually for the duration of the field's productive lifespan, in return for hire payments.

A lease agreement is typically cancellable and does not involve economic risks or rewards like early obsolescence or appreciation. A finance lease transfers ownership of property to the lessee at the end of the lease term, resembling a purchase contract. A finance lease is structured as outright ownership, with the intention that the leased equipment would ultimately belong to the lessee.

FPSOs on a lease-and-operate basis are more suitable for smaller to medium-sized fields with limited proven reserves, as they are less field-specific and can be re-used on multiple projects without significant conversion costs.

Long-term cost-effectiveness of FPSO

In the long run, FPSOs are more effective than fixed platforms. Here are the reasons:

Adaptability for Remote and Harsh Environments

Fixed platforms require extensive seabed surveys and complex construction processes, making them unsuitable for remote or challenging environments like deep waters or areas prone to severe weather.

FPSOs, on the other hand, are self-contained vessels. They can be moored in these locations without the need for permanent seabed structures, offering greater flexibility and potentially lower development costs.

Reduced Pipeline Infrastructure

Fixed platforms typically rely on a network of pipelines to transport extracted oil and gas to onshore processing facilities. Depending on the field's location, FPSOs can eliminate the need for extensive pipelines.

FPSOs have built-in storage capacity, allowing them to accumulate oil and gas until a shuttle tanker arrives for offloading. This can significantly reduce upfront investment costs compared to fixed platforms with lengthy pipelines.

Redeployment Advantage

Oil and gas reservoirs are finite resources. Once an FPSO has processed the bulk of the oil from one field, it boasts a significant advantage. Unlike fixed platforms that are permanent structures, FPSOs can be disconnected and redeployed to a new field after the initial reservoir is depleted.

This redeployment capability extends the FPSO's lifespan and allows operators to maximise their return on investment by utilising the unit across multiple projects.

Successful FPSO projects

The FPSO market has enjoyed strong growth over the last few years. The increasing demand for hydrocarbon energy, driven by expanding populations and a growing trend towards individual consumption, has been a key driver. This rising energy transition demands have created significant opportunities for FPSO projects to meet the needs of offshore oil and gas production.

Jubilee Field FPSO, Ghana

FPSO, named Kwame Nkrumah, began production in 2010 and has become a significant contributor to Ghana's oil and gas industry. It boasts a production capacity of 120,000 barrels of oil per day and 160 million cubic feet of gas per day.

Find Latest FPSO Projects Around the Globe Collect Your Free Leads Here!

The project's success lies in its efficient processing systems and utilisation of advanced subsea technology to maximise production rates while adhering to strict environmental and safety standards.

Lula Field FPSO, Brazil

The Lula Field FPSO, named Cidade de Itagua, stands as a testament to the capabilities of FPSOs in deep water environments. Located in the challenging Santos Basin, this FPSO tackles the technical complexities associated with ultra-deepwater production.

With a processing capacity of 150,000 barrels of oil per day and 6 million cubic metres of gas per day, the project demonstrates the adaptability and resilience of FPSOs in harsh offshore settings.

FPSOs are continuously evolving, with upcoming projects like the massive ONE GUYANA FPSO in Guyana pushing the boundaries of production capacity. These projects are successful due to their ability to optimise production in challenging environments, reduce development costs, and maintain high safety and environmental standards.

Conclusion

As technology advances and the demand for crude oil in offshore areas increases, FPSOs are expected to become increasingly significant in offshore oil and gas production. The depletion of onshore oil reserves in oil-producing countries, coupled with the limitations of fixed production platforms, has contributed to a growth rate of 6% in the adoption of FPSOs.

FPSOs reduce upstream project costs by offering a cost-effective and flexible alternative to traditional offshore platforms. Despite the initial higher cost of an FPSO, it proves to be more economical in the long term due to streamlined production, storage, and offloading processes. FPSOs offer advantages such as adaptability for remote and harsh environments, reduced pipeline infrastructure, and redeployment capability, making them more cost-effective in the long run compared to fixed platforms.

Looking for more than generic information on FPSO vessels around the Globe?

Subscribe to our Global FPSO & FSO (Oil & Gas) Projects and Tender Database to access reliable and high-quality insights on upcoming, in-progress, and completed floating offshore plant projects across the world or in your desired location.

Our user-friendly platform provides essential details, timely updates, key stakeholder contact information, and business opportunities tailored for engineering companies, industry professionals, investors, and government agencies.

Start a free demo to take your business to the next level!

![Top FPSO Companies in India [2025]](https://images.blackridgeresearch.com/zA7C1E09-z4Uj64Eb0zfkw/fef13aed-1db8-4a25-bf1c-ffc0ed743a00/public)

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.