Table of Contents

Oil still makes up a significant share of the global energy mix. Big Oil is often used to describe large oil and gas companies in the world, including BP, Chevron, Eni, ExxonMobil, Shell, and TotalEnergies. These oil majors or supermajors operate upstream, midstream, and downstream of the oil and gas industry.

A dramatic fall in oil prices in the 1990s caused a flurry of M&A activity in the O&G industry. Over time, these giant corporations dominated the global petroleum industry with major control over worldwide gas and oil reserves.

Currently, Saudi Aramco is the largest oil company in the world, as per revenue generated in 2024. Keep reading to learn more about the leading oil industry companies globally.

Top 10 Largest Oil and Gas Companies in the World by 2024 Revenue

| Rank | Name | Founded Year | Country | Revenue 2024* (USD Billion) |

| 1 | Saudi Aramco | 1933 | Saudi Arabia | 488.98 |

| 2 | Sinopec | 2000 | China | 435.69 |

| 3 | PetroChina | 1999 | China | 417.87 |

| 4 | Exxon Mobil | 1999 | United States | 339.87 |

| 5 | Shell | 1907 | United Kingdom | 296.76 |

| 6 | TotalEnergies | 1924 | France | 203.26 |

| 7 | BP | 1909 | United Kingdom | 195.57 |

| 8 | Chevron | 1879 | United States | 194.01 |

| 9 | Phillips 66 | 1917 | United States | 147.73 |

| 10 | Marathon Petroleum | 1887 | United States | 141.98 |

Saudi Aramco

Saudi Aramco is the biggest oil and gas company in the world in terms of revenue and market cap. Officially known as the Saudi Arabian Oil Company or Aramco, the company is a majority state-owned petroleum and natural gas giant headquartered in Dhahran, Saudi Arabia. As of 2024, the Middle east company ranks as the fourth-largest company in the world by revenue. The company was founded through a concession agreement between Saudi Arabia and the Standard Oil Company of California (SOCAL) in 1933.

The world number one oil company Aramco, manages over 270 billion barrels of proven crude oil reserves which is the second largest in the world. Also, the company produces over 11 million barrels of oil per day significantly contributing to Saudi Arabia’s economy.

Find Upcoming Oil and Gas Projects Around the World Collect Your Free Leads Here!

Aramco also set up some of the world's largest oil refineries, including Jazan Refinery and terminal projects (JRTP), Jeddah Refiner, Ras Tanura Refinery, The Saudi Aramco Jubail Refinery Co. (SASREF), Jubail, Riyadh Refinery and Yanbu Refinery. In June 2024, Aramco awarded engineering, procurement, and construction (EPC) contracts worth USD 7.7 billion for a major expansion of its Fadhili Gas Plant in the Eastern Province of Saudi Arabia.

Saudi Aramco is looking forward to increasing its capability with 110 projects between 2024 and 2026. This includes 67 upcoming projects in oil, gas, and petrochemicals, 20 in pipeline construction, and 23 infrastructure projects in Saudi Arabia.

China Petroleum and Chemical Corporation - Sinopec

Sinopec or China Petroleum and Chemical Corporation is one of the world leading oil and gas companies publicly listed in Hong Kong (2000) and Shanghai (2001). Sinopec Corp. stands as one of China’s largest integrated energy and chemical companies operating across exploration, production, refining, marketing, and chemicals.

Sinopec’s global ventures include joint projects in Russia, Angola, Kazakhstan, and Colombia. In 2023, Sinopec achieved remarkable production figures, producing 251.63 million barrels of crude oil and 1,337.82 billion cubic feet of natural gas. The Chinese oil and gas giant’s refining segment processed an impressive 257.52 million tonnes of crude oil in 2023, producing 156 million tonnes of refined oil products.

Sinopec integrates innovation into its strategy with four State Key Laboratories, six National Energy R&D Centers, and numerous other research facilities, incubating technological advancement. In June 2024, Petronas signed a Memorandum of Understanding (MoU) with Sinopec to promote sustainable expansion in commodity and specialized chemicals, crude oil, liquefied natural gas (LNG) trading, lubricants, and digital solutions.

PetroChina

PetroChina Company Limited is one of the largest oil and gas companies in the world established on November 5, 1999. Company formed as part of the restructuring of China National Petroleum Corporation (CNPC) has become a leader in the global oil and gas industry. PetroChina has operations covering exploration, production, refining, and petrochemical manufacturing.

As of December 31, 2023, PetroChina reported 18.6 billion barrels of oil equivalent in reserves, placing itself as one of the biggest oil companies. Crude oil and condensate reserves for the company are 6.375 billion barrels and natural gas is 73,371.7 billion cubic feet.

PetroChina, one of the biggest oil companies, is listed on multiple stock exchanges, including its debut on the New York Stock Exchange (NYSE), Hong Kong Stock Exchange, and Shanghai Stock Exchange in 2000 and 2007, respectively. Though its ADSs were delisted from the NYSE in 2022, PetroChina continues to maintain its strong presence in international oil and gas markets.

ExxonMobil

Founded in 1882 in New Jersey, ExxonMobil Corporation has grown into one of the largest publicly traded petroleum and petrochemical enterprises in the world. The company operates across most countries, leading in the exploration, production, refining, and distribution of oil, gas, and petroleum products with globally recognized brands like Exxon, Esso, and Mobil.

ExxonMobil achieved crude oil production of 3.7 million oil-equivalent barrels per day in 2023. The company also achieved record outputs in the Permian Basin and Guyana, reinforcing its position among the top oil and gas companies in the world. Also, the US oil and gas giant achieved a refining output of 4.1 million barrels per day in late 2023.

Read: Top 10 Oil and Gas Companies in Saudi Arabia

Exxonmobil Global Operations

Here are some of the largest oil and gas markets of Exxonmobil:

- U.S. Operations: ExxonMobil is the largest U.S. refiner, marketer of petroleum products, and a leader in global oil and gas production and exploration.

- Guyana: ExxonMobil began operations in Guyana in 2008, achieving oil production in 2019 through Liza Phase 1.

- Indonesia: ExxonMobil's Banyu Urip oil field in East Java produces over 200,000 barrels per day, contributing 25% of Indonesia's national crude oil production.

- Papua New Guinea: The PNG LNG project produces 8.3 million tonnes of LNG annually.

- Qatar: ExxonMobil partners with Qatar Petroleum to develop the North Field, operate LNG infrastructure, support domestic gas projects, and contribute to Qatar National Vision 2030.

Shell

Shell plc is a British multinational oil and gas company and a core member of ‘Big Oil’ headquartered in London. The company was established in 1907 through the merger of Royal Dutch Petroleum Company and The "Shell" Transport and Trading Company forming Royal Dutch Shell. The largest investor-owned oil and gas companies in the world now operate in more than 70 countries and employ approximately 103,000 people globally.

Shell is primarily listed on the London Stock Exchange (LSE) and has secondary listings on Euronext Amsterdam and the New York Stock Exchange. Shell’s key business divisions include Integrated Gas and Upstream, where the company explores and extracts crude oil, natural gas, and natural gas liquids. The Downstream, Renewables, and Energy Solutions (R&ES) division serves over 1 million business customers, delivering chemicals, petroleum products, and renewable energy solutions.

In 2024 December, Shell and Norway’s Equinor announced plans to combine their British offshore oil and gas assets to create a jointly owned energy company. The joint venture will be established in Aberdeen, Scotland and will become the U.K. North Sea’s largest independent oil producer. The company is expected to produce more than 140,000 barrels of oil equivalent per day in 2025, as per Shell.

TotalEnergies

TotalEnergies SE is one of the seven supermajor oil companies founded in 1924. The European multinational energy and petroleum company operates across the entire oil and gas value chain, including crude oil and natural gas production, exploration, refining, power generation, transportation, and global petroleum product marketing. Additionally, TotalEnergies is a leading manufacturer of chemicals and a top company in international crude oil and product trading.

Since January 2023, TotalEnergies has been structured around five key business segments: Exploration & Production, Integrated LNG, Integrated Power, Refining & Chemicals, and Marketing & Services. The company reported 2.0 million barrels of oil equivalent per day (Mboe/d) of hydrocarbon production in 2023. TotalEnergies is the 3rd largest LNG company in the world, selling 44.3 million tonnes (Mt) of LNG, including 15.2 Mt from equity production.

Toatenergies also holds a dominant position as the first U.S. LNG exporter and the first European regasification provider. Operating in approximately 120 countries, TotalEnergies employs over 100,000 people. In December 2024, France's largest oil and gas company announced that it had expanded its gas portfolio with more assets by wrapping up the acquisition of stakes OMV and Sapura Upstream.

BP Plc

BP p.l.c., previously known as The British Petroleum Company and BP Amoco, is a leading British multinational oil and gas corporation headquartered in London. BP is one of the world’s "supermajor" energy companies covering exploration, production, refining, distribution, marketing, power generation, and trading in the global oil and gas sector.

BP provides energy solutions such as fuel for transportation, heating, lighting, and essential petrochemical products to over 80 countries around the world. In 2022, BP achieved an upstream production of 2.3 million barrels of oil equivalent per day (mboe/d) and maintained a diversified liquefied natural gas (LNG) portfolio of 23 million tonnes per annum (Mtpa).

BP’s Major Oil And Gas Projects

| Project Name | Location | Project Type |

| Azeri Central East (ACE) | Azerbaijan | Conventional Oil |

| Argos Southwest Extension | US Gulf of Mexico | Deepwater Oil |

| Atlantis Drill Center 1 Expansion | US Gulf of Mexico | Deepwater Oil |

| Coconut | Trinidad | LNG |

| Cypre | Trinidad | LNG |

| GTA Phase 1 | Mauritania & Senegal | LNG |

| Kaskida | US Gulf of Mexico | Deepwater Oil |

| Mento | Trinidad | LNG |

| Murlach | North Sea | Conventional Oil |

| Raven Infills | Egypt | Gas |

| Atlantis Major Facility Expansion | US Gulf of Mexico | Deepwater Oil |

| Browse | Australia | LNG |

| Clair Ridge Expansion | North Sea | Conventional Oil |

| Ginger | Trinidad | LNG |

| GTA Phase 2 | Mauritania & Senegal | LNG |

| Shah Deniz Compression | Azerbaijan | Gas |

| Tangguh Ubadari Compression and Capture | Indonesia | LNG |

| Tiber | US Gulf of Mexico | Deepwater Oil |

In November 2024, BP and its partners approved a USD 7 billion expansion of the Tangguh liquefied natural gas (LNG) project in Indonesia. BP will hold a 40% stake in the upcoming natural gas project.

Find Upcoming Oil and Gas Projects Around the World Collect Your Free Leads Here!

Chevron

Chevron Corporation is a leading American multinational energy company and one of the largest oil and gas corporations globally. Headquartered in San Ramon, California, Chevron operates in over 180 countries, focusing on hydrocarbon exploration, production, refining, transportation, marketing, chemicals manufacturing, and power generation.

Chevron's roots trace back to the 1906 merger of Pacific Oil Company and Standard Oil Company of Iowa, and it remains a key descendant of Standard Oil. Over the decades, the company’s major acquisitions included Gulf Oil in 1984, Texaco in 2001, and Unocal in 2005.

In 2023, Chevron's upstream operations produced 3.1 million oil-equivalent barrels per day. The company added approximately 980 million barrels of net oil-equivalent proved reserves, representing 86% of its annual production. Chevron’s acquisition of PDC Energy enhanced its portfolio with 275,000 net acres in Colorado’s DJ Basin and 25,000 net acres in the Permian Basin. Notably, Permian Basin production reached a record 783,000 barrels of oil equivalent per day, a 10% increase over 2022, with plans to achieve 1 million barrels per day by 2025.

In the Gulf of Mexico, Chevron achieved its first oil at the Mad Dog 2 project and completed the installation of the floating production unit for the Anchor Field. At its El Segundo Refinery, the company successfully converted a diesel hydrotreater to process 100% renewable feedstocks alongside traditional inputs. Also, Chevron Corporation has unveiled its third Future Energy Fund with a commitment of USD 500 million in the second quarter of this year.

Phillips 66

Phillips 66 is one of the top 10 oil and gas companies in the world, headquartered in Westchase, Houston, Texas. The American multinational energy company traces its origin back to 1927 when the Phillips Petroleum Company introduced the "Phillips 66" trademark. The company, in its current form, emerged in 2012 after ConocoPhillips spun off its refining, chemical, and retail operations into Phillips 66. It began trading on the New York Stock Exchange (NYSE) on May 1, 2012, under the ticker PSX.

Phillips 66 specializes in the processing, transportation, storage, and marketing of fuels and related products, operating through four primary segments: Midstream, Chemicals, Refining, and Marketing & Specialties.

- The Midstream segment focuses on crude oil and refined product transportation, terminals, and processing. They also focus on the storage, processing, and marketing of natural gas, natural gas liquids (NGLs), and liquefied petroleum gas (LPG).

- The Chemicals segment produces and markets petrochemicals that support various industries through its joint ventures.

- The Refining segment processes crude oil into fuels and products, while the Marketing & Specialties segment handles the retail and commercial distribution of these refined products.

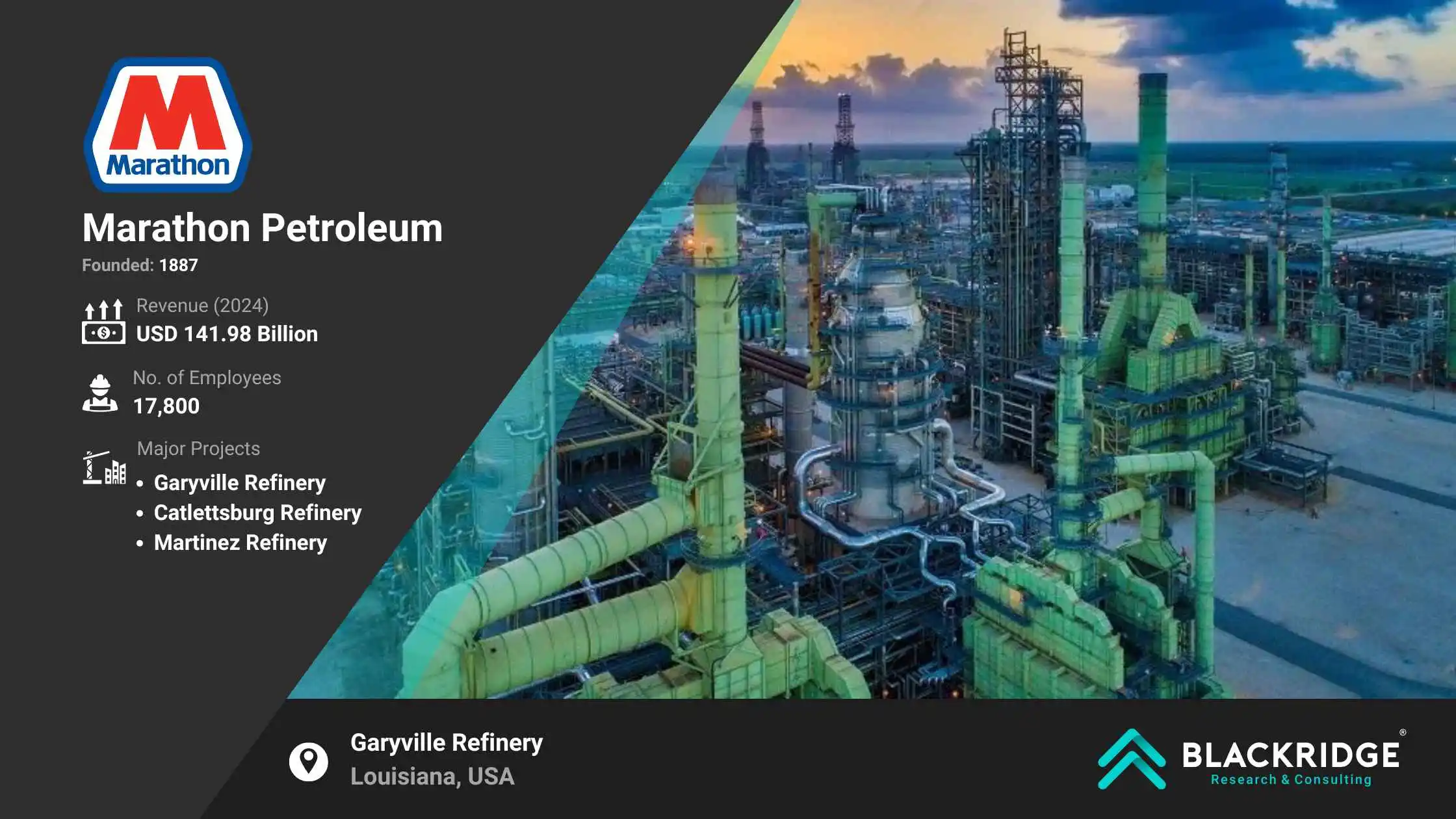

Marathon Petroleum

Marathon Petroleum Corporation (MPC) is one of the largest oil producers in America, headquartered in Findlay, Ohio. Originally a subsidiary of Marathon Oil, the company became an independent entity following a corporate spin-off in 2011. One of the largest oil and gas supply companies traces its roots back to 1887. MPC evolved from The Ohio Oil Company, which was established in Lima, Ohio, and later acquired by the Standard Oil Trust in 1889.

MPC operates the largest refining system in the United States, with a total crude oil refining capacity of 3 million barrels per calendar day across 13 refineries. These facilities are strategically connected through an extensive network of pipelines, terminals, and barges to optimize operational efficiency.

The company’s Midstream segment is managed through MPLX LP, a sponsored master limited partnership. MPLX focuses on the gathering, processing, storage, and distribution of crude oil, refined products (including renewable diesel), and natural gas. It also handles the transportation, fractionation, and marketing of natural gas liquids (NGLs), utilizing a broad infrastructure of pipelines, terminals, towboats, and barges.

Oil and Gas Industry in the World: 2025 Outlook

The global oil and gas industry faced tremendous changes driven by geopolitical tensions, changing trade routes, and the energy transition in 2024. Sanctions on Russia and attacks in the Red Sea corridor have disrupted trade flows. In time Asia, particularly China and India, emerged as the primary demand center.

The United States, the biggest oil industry in the world, is currently producing an annual average of 13.2 million b/d. Meanwhile, the Atlantic Basin experiences an oversupply, leading to a structural eastward shift in oil trade. Oil demand growth is slowing due to adoption of electric vehicles (EV), clean energy technologies, and efficiency policies, with demand expected to plateau by 2030.

Looking for Global Oil and Gas Market Report? Download Free Sample Now!

Supply growth is expected to outpace demand over the medium term, led by non-OPEC+ producers, particularly in the United States and other American regions. By 2030, global oil production and supply capacity will reach 113.8 mb/d, significantly exceeding the forecasted demand of 105.4 mb/d. Key developments include:

- Saudi Arabia focusing on natural gas liquids (NGLs) and condensates instead of crude oil expansion.

- NGLs and condensates drive 45% of new supply capacity, fueled by their role in petrochemical production.

- A significant spare capacity cushion is emerging as supply continues to rise.

Oil prices in 2024 remained stable, with Brent crude trading between USD 74–90 per barrel, marking one of the most stable years in decades. Industry resilience was further reflected in strong financial returns, with USD 213 billion in dividends and USD 136 billion in share buybacks. The balance of rising production, geopolitical challenges, and energy transition will shape the global oil and gas market through 2025 and beyond.

Conclusion

The oil and gas industry has witnessed several ups and downs since the beginning of the modern oil era, including fluctuating oil prices and tremendous pressure to cut down on exploration and drilling activities to reduce fossil fuel production. Some of the top 10 independent oil and gas companies such as Chevron, ExxonMobil, and BP also contributed to that uncertainty.

Globally, the countries with the most oil reserves include Venezuela, Saudi Arabia, Canada, Iran, Iraq, Kuwait, the United Arab Emirates, Russia, and Libya. On the other hand, there are thousands of fossil fuel companies around the world involved in the exploration, production, and distribution of oil and gas and related products. Among the industry players, the top 10 global oil and gas companies have made a mark for themselves in the highly volatile oil market and generated billions of dollars in revenue, with operations spanning one or more upstream, midstream, and downstream segments.

Explore the Global Oil and Gas Market Trends with Blackridge Research

The Global Oil and Gas Market Report by Blackridge Research & Consulting offers a comprehensive analysis of the current market landscape, growth drivers, and emerging opportunities. This report provides valuable insights into key regional markets, competitive dynamics, and forecasts, making it an essential resource for stakeholders in the oil and gas industry.

Key Highlights of the Report:

- Market Analysis & Forecasts: Detailed insights into market trends, segmentation, and growth projections.

- Regional Insights: In-depth analysis of Asia-Pacific, Europe, North America, and other regions.

- Competitive Landscape: Profiles of leading companies and strategies driving the market.

- Industry Drivers & Restraints: Examination of factors influencing growth and challenges.

- Recent Developments: Overview of the latest innovations, investments, and market activities.

Gain access to critical insights and stay ahead in the competitive oil and gas market. For customized solutions and exclusive offers, contact our expert research team.

*2024 revenue is calculated as per latest data available (sum of 2023 Q4, 2024 Q1,Q2 and Q3 revenue)

Leave a Comment

We love hearing from our readers and value your feedback. If you have any questions or comments about our content, feel free to leave a comment below.

We read every comment and do our best to respond to them all.